Market Overview

Have a look ...World Tube & Pipe Market: Factors influencing the current situation

Dr. Gunther Voswinckel – Update as per August 2025

Welcome to ITA’s and VOSCO´s regular presentation of the main worldwide economic factors influencing the tube and pipe industry.

The conflict with Israel in the Middle East appears to be calming down. Concerns about an oil and gas shortage in this region are diminishing. The new US government has declared that it will continue to expand US oil and gas production. As a result, oil and gas prices fall. Continued demand for oil and gas, its distribution, new cars, machinery and building construction, especially in GDP growth regions, as well as new emerging market segments such as CCUS (Carbon Capture and Storage) and hydrogen pipelines will maintain demand for tubular products and require larger quantities of alloyed tubes. In general, there is sufficient production capacity to meet the growing demand for tubes in all market segments. However, the trend towards customer-centred production will continue to influence the landscape for tube manufacturers. Raw material prices for the steel and pipe industry appear to have stabilised. However, the markets are nervous and there is the potential for further volatility.

A further challenge could arise if political measures to prevent climate change are not introduced in a balanced manner, which could lead to a relocation of energy-intensive industries to regions with lower energy costs. However, as the balance between supply and demand in the pipe industry has largely been restored, price volatility has calmed down.

The transition to environmentally friendly pipe production with low carbon footprint pipes has become an increasingly important task for the industry. Pipe manufacturers are converting their production facilities from gas to electricity. Geopolitical and logistical risk considerations as well as current and future energy costs are increasingly taking centre stage.

Regions such as the USA, India, Turkey, the Middle East and China are benefiting from lower energy costs. Political interventions and regulations are increasingly influencing the industry's strategies and measures. Due to the dynamic nature of current developments, it is becoming increasingly difficult for the industry to react appropriately. Some manufacturers are losing confidence in their ability to compete on the global market with their cost levels and are even reducing their involvement in Europe as a result. Some countries/regions are therefore looking for suitable political countermeasures to compensate for their cost disadvantages.

All sources of supply are being critically scrutinised, and one can only hope and warn that international trade will not suffer too much as a result.

However, disruptive times also always create new opportunities for economic success. New markets such as Carbon Capture Utilisation and Storage (CCUS), new pipelines and networks for hydrogen transport, electromobility and productivity improvements at production sites as well as improved customer service as part of the transformation to more environmentally friendly plants offer opportunities that need to be exploited.

Many technology providers have already responded to this and expanded their product portfolio to include green and digital solutions.

As stated before, the availability of economical energy is a decisive factor for the industry. Geopolitical turbulences and political regulations have changed the regional balance with increasing challenges for the industry in regions with higher energy cost. The industrial landscape of the energy intensive industry is already taking consequences, which will change the entire industrial landscape if appropriate countermeasures are not taken. The new US government, although the US already having favourable energy costs, has announced to take actions to further reduce energy cost. These announcements have already shown consequences for the electrical energy as well as oil and gas prices.

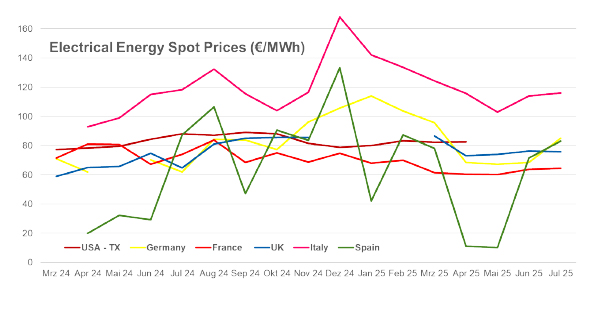

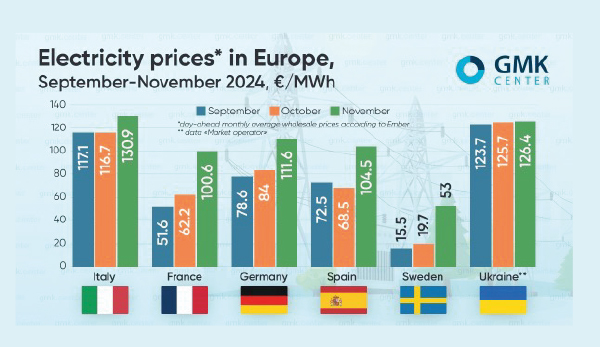

The prices for electrical energy, after turbulent periods, are very volatile and reported at levels of about 40-140 €/MWh (figure 1). In Europe the span of the average prices in January 2025 is huge between 40 – 140 €/MWh. This corresponds not only to a huge price increase in the last 20 years but also results in major economical uncertainties for the energy intensive industry! Economical production planning becomes increasingly difficult in such regions with high and volatile energy cost. Since the energy intensive industry is mostly the initial process step in the industrial production chain, this uncertainty endangers also many downstream industries with significant contribution to national GDP´s and employment rates.

Some countries with larger nuclear energy sources, like e.g. France (ab, 70 €/MWh), or other base-load energy sources at reasonable cost, still have cost advantages. Considering for example US-Texas with an electrical energy cost level of about 70-80 €/MWh is about 30% lower than most European cost levels. It will even become more unbalanced if some more European punitive regulations or network costs become effective. As stated before the new US government announces further energy cost reductions. Countries like Saudi Arabia are even offering electrical energy at 40 €/MWh or less! This widening cost gap is increasingly forcing companies to relocate their production facilities to countries with more attractive energy cost levels.

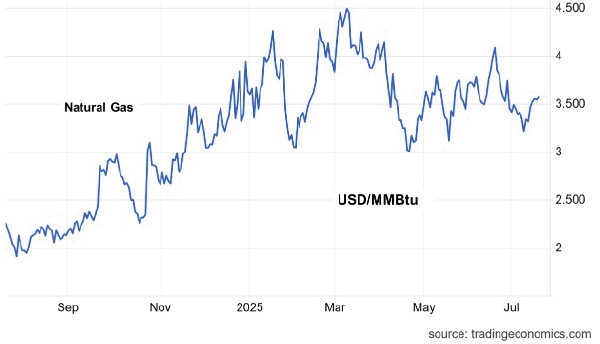

Cost of natural gas, one of the most important energy sources, had a sharp downturn in 2025 from about 4,3 to 3 USD/MMBtu (figure 2). This may also be seen in light of the announcements of the new US government stating, “Drill Baby Drill”. Experts expect an enlargement of the gas supply causing the erosion of the gas prices.

Regions such as Europe anyhow nowadays depending largely on LNG (Liquified Natural Gas) are faced by far more expensive prices than normal natural gas.

LNG consumers are confronted with cost levels of about 14 USD/MMBtu which is about 470% higher than normal natural gas (figure 3). The present Chart does not show the envisaged price downturn in January 2025 as seen for natural gas. These remarkable additional costs for LNG are applicable to such regions without sufficient natural gas supply. Due to this price disadvantage LNG can only be a short-term solution to ensure the gas supply in Europe. In longer terms natural gas supply via pipelines shall be considered.

In Europe, Italy has built a natural gas pipeline from Algeria to Italy via Tunesia which was inaugurated in 2010 with a capacity of 7 billion m³ per annum (figure 4). An extension of the Trans-Mediterranean pipeline delivers Algerian gas to Slovenia. It may be considered to enlarge the capacity.

Greece is planning to build a pipeline to connect eastern Mediterranean resources with Greece further into Italy and other European regions (figure 4). Other projects are under experts discussion to supply natural gas to Europe via pipelines at reasonable cost levels. So far the political institutions in Europe are reluctant to consider such cost saving measures.

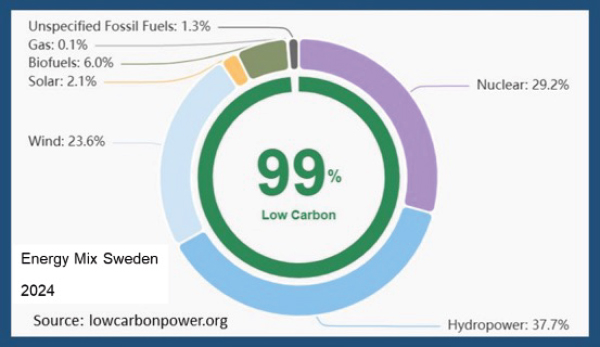

The long-term strategy to shift towards green hydrogen to replace fossil energy sources such as natural gas, are also questioned by specialists. Hydrogen production via electrolysis in an industrial scale requires not only masses of clean water, but also a lot of electrical energy. About 55 MW electrical energy per ton of Hydrogen must be considered. Furthermore, the chemical process, the electrolysis, requires permanent electrical energy 24 hours over 7 days per week with limited power network variations. The lifetime of the electrolyse stacks is significantly reduced in case of larger power supply volatility. Therefore, green hydrogen production seems only feasible in regions with steady electrical power supply from sun, wind, water or nuclear sources. In most parts of Europe such constant power supply at reasonable cost is still hardly to be realized by the green energy sources. Norway, Sweden are possible regions for economical hydrogen production. Some specialists e.g. from OECD therefore consider producing hydrogen in regions with steady and reasonable electrical supply such as some places in Middle East or Africa. Economically transportable goods shall than be produced near the electrical source and then further processed in the industrial centres like Europe or northern Asia. DRI could so become an ideal import product which could then be further processed in electrical steel plants to a wide range of specifications. Such value chains as proposed by OECD specialists would secure most technological knowledge and employment levels for the traditional metallurgical plants. Unfortunately, such ideas are still not supported by most European politicians.

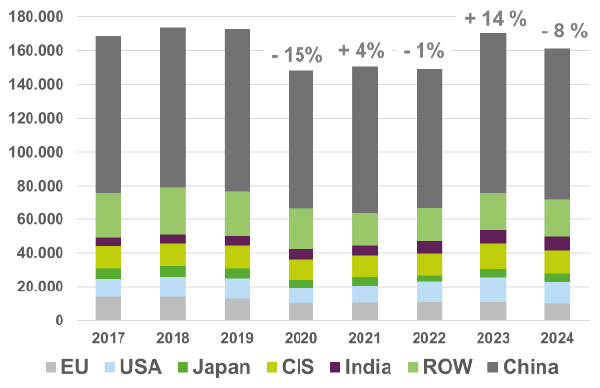

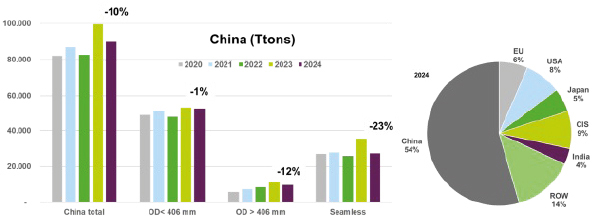

The total world tube and pipe production in first 6 months 2024 was 82,2 million tons. After the record year 2023 the market calmed down a bit again. If this production volume 2024 is extrapolated to full year, we report a world tube production cut of - 4% (figure 5).

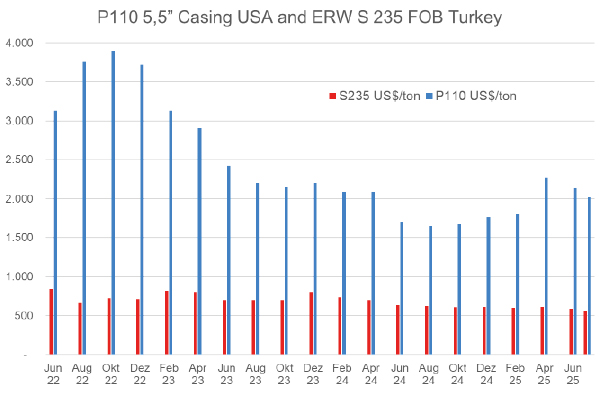

Figure 6, shows the price development for two representative tube grades since June 2022:

- P110 OCTG O.D. 5,5” alloyed casing pipe.

- S235 non alloyed structural pipe.

The OCTG pipe price for P110, after its hight in October 2022 (ab. 3.900 USD/ton) experienced a price decline of ab. 58% until August 2024 (ab. 1.650 USD/ton) - however, since then, it seems the price has stabilized at a level of about 1.800 USD/ton.

The structural pipe S235 although on a much lower price niveau, characterized by much less volatility almost maintained its price level at ab. 600 USD/ton.

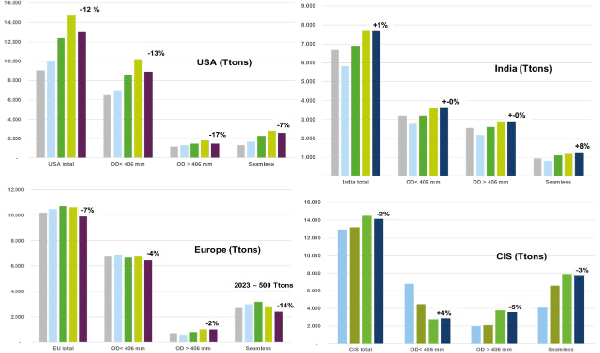

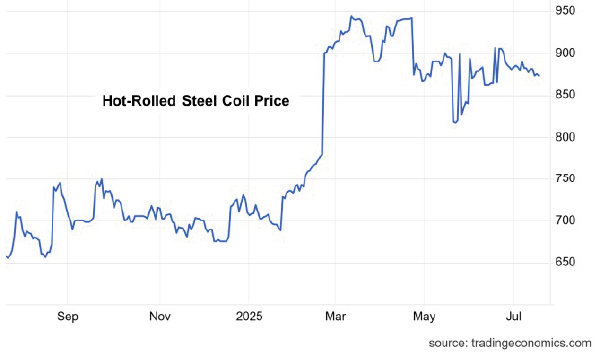

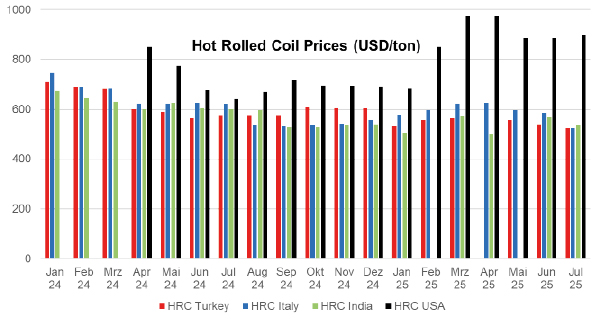

Tube and Pipe manufacturers buy hot-rolled coils, round billets, or plates as input material for their production lines. 72 % of the total world pipe production, i.e. in 2024 about 116 million tons/year, are welded tubes and pipes. Welded tube producers are therefore highly dependent on attractive hot rolled coil prices and large OD (> 406 mm diameter) pipeline producers, on plate prices. Average prices for hot-rolled coils in the US came down from January 2024 (ab. 1130 USD/ton) to February 2025 (ab. 740 USD/ton) (Figure 7). Some Countries, such as Turkey (640 USD/ton) or India (590 USD/ton) trade even lower.

Comparing the price difference between HRC and finished structural tubes and pipes type S 235 on Turkish basis, it becomes obvious how small the margins for tube producers of such products are. There are even time periods, with negative margins.

Furthermore, tube producers suffer from shortages in the availability of special tube material specifications. Special alloyed HRC as applied e.g. at OCTG tubes and pipes, are traded at significant higher prices.

Billet prices, applied for seamless tubes are traded for an average of around 525 USD/ton.

In 2024/2025 almost all prices for tubular pre-materials were calming down. Anyhow it remains challenging to predict the pre-material price developments.

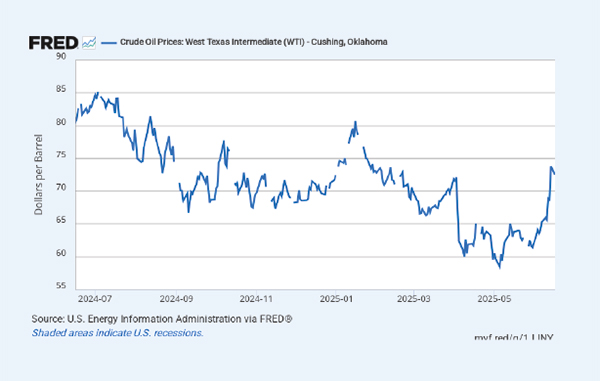

The major driver of the tube and pipe industry is the oil and gas market representing about 51% of the world tube and pipe production. The consumption of OCTG tubes directly relates with the oil price (figure 8, see also previous tube market reviews). OPEC+ during the past years have unsuccessfully tried to keep the oil price at a minimum level of 90 USD/Bbl. by voluntary supply cuts of 2 million barrel/day. These cuts have only recently been prolonged until mid-2025 to stabilize the oil price. Anyhow the oil price WTI eroded in 2024 from April (87 USD/Bbl.) to December (67 USD/Bbl.). Announcements of the new US president were immediately reflected in oil price. Announcements to punish oil producing countries with additional oil embargos raised the oil price in January 2025 from 69 to 82 USD/Bbl. Following announcements to increase the US oil production “Pump Baby Pump” and the ceasefire in middle east let the oil price calm down again to 74 USD/Bbl. It must be observed how the new US president Trump´s announcements will affect the oil price in the coming months.

The oil price volatility anyhow ticks higher with more geopolitical risks simmering.

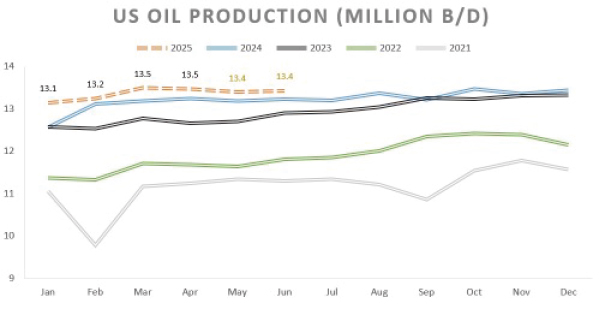

The USA to soften the inflation and to sacrifice the crude oil demand enlarged its crude oil production almost linear from 12 Mio. Bbl./day in August 2022 to

13,3 Mio. Bbl./day in February 2024 (+ 11%) by increasing the number of drilling rigs and their productivity (Figure 9). Since the election of the new US president, the production will even be further enlarged.

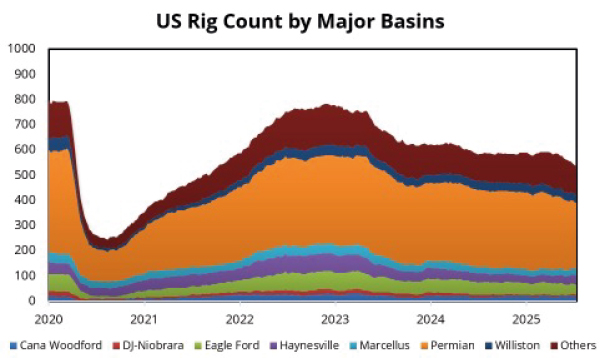

The number of US drilling rigs was enlarged to about 800 by December 2022 (Figure 10). In 2023 due to improved productivity and declining oil prices, the number of rigs was reduced until February 2025 to 584 rigs. Of these 584 rigs, 480 are dedicated for the extraction of oil and 100 for gas. The US oil exports have reached a remarkable new all-time high with about 5,5 million Bbl./day representing about 41,6% of the total world crude oil production.

Efforts to reduce dependence on fossil energy sources can hardly be successful in the short term and can only contribute in medium term. For our pipe industry, however, this means that crude oil prices can be expected for 2025 at around 70-80 USD/Bbl. unless the geopolitical situation does get out of control.

The need to secure the world energy supply will keep the demand for tubular products high. Another driving factor is the record high global LNG production. Katar, USA and Australia have record high LNG production. Consequently, the demand for OCTG products remain high. The LNG supplies ease the energy supply crisis especially in Europe to compensate the stopped Russian pipeline gas supplies, unfortunately at much higher cost.

Another interesting driver for the tube industry is related to the longevity of the tubular products applied in the oil and gas industry. Harsh environment and high concentrations of H2S and CO2 as well as challenging geological conditions demand for advanced materials. In the past mostly corrosion inhibitors were the main solution hereto. Now increasing demand for pipes made of CRA and clad materials are taking centre stage. These high-tech products are a great opportunity for pipe producers to create unique selling points.

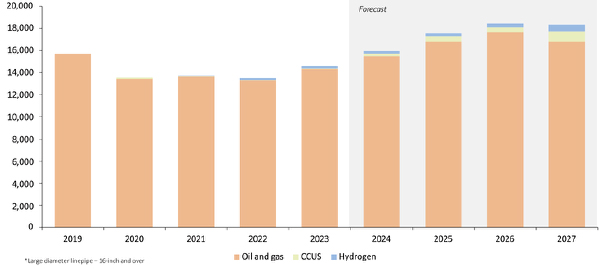

Despite the current delays, the need for new pipeline projects remains high (figure 11). Geopolitical changes and economical needs require enormous investments in the distribution networks for oil and gas.

Carbon Capture Utilisation and Storage (CCUS) is another upcoming interesting market. CCUS is an important emission reduction technology, that can be applied across the energy system. CCUS involves the major steps: the separation of CO2 from other gases produced in large scale industrial process facilities, such as coal- or natural gas fired power plants, steel mills, cement plants and refineries. The captured CO2 is compressed and transported via pipelines. CO2 is injected into deep underground rock formations, usually at depth of 1.000 m or more. Due to the reactivity of CO2, higher alloyed tube materials are required to prevent excessive corrosion.

CCUS will require new pipelines to allow the scalability of such technology. Pipelines can be expanded and interconnected to create CO2 networks that link multiple sources of emissions to centralized storage locations. This network approach reduces costs by sharing infrastructure across industries, making CCUS more viable and attractive for widespread adoption. By leveraging existing pipeline technologies and developing new infrastructure for CO2 transport, we can accelerate the deployment of CCUS projects and contribute to global emissions reduction goals. Despite the benefits, there are challenges. High upfront costs, public acceptance, and regulatory approval are significant hurdles to building new CO2 pipelines. Additionally, as more CCUS projects come online, it’s crucial to ensure that pipelines can meet the growing demand for CO2 transport, which requires strategic planning and investment in infrastructure. The technological acceptance of such technologies seems to raise not only in the US and Middle East but also elsewhere in the world.

Hydrogen pipelines will also create further additional markets for alloyed steel tubes.

The automotive market, accounting for about 15% of the global tube and pipe market and the mechanical engineering market accounting for 9% are offering interesting opportunities. (see also our previous report in ITAtube Journal from Dec. 2024)

The construction market, which accounts for around 5% of the global pipe market,represents another opportunity for pipe manufacturers with growth potential.

The Construction Market is forecasted to grow at a rate of CAGR of 5.9% from 2025 to 2030. The sector is involved in a wide range of projects, including residential, commercial, industrial, civil engineering and institutional construction, with multiple stakeholders such as architects, engineers, contractors, suppliers, developers, investors and government agencies involved in the process. Construction activity in the US and Northeast Asia picked up, driving global construction output growth. With high interest rates, new investment in residential construction fell sharply. The infrastructure, energy & utilities and industrial sectors will remain the main drivers of construction output.

The penetration of structural tubes in the building and construction market has been uneven throughout the world. In North America and parts of Asia, pipe products are widely used in building construction. In Europe, on the other hand, standard concrete or open steel structures are still dominantly used. The tube industry must continue to promote the benefits of tubular applications and demonstrate the architectural prospects. Tubular profiles are an ideal choice when visible structures are desired due to their versatile shapes and closed cross-sections combined with smooth sides. The best mechanical properties and the ability to bridge large spans are further highlights of tubular profiles. In addition to round structural tubes, rectangular profiles dominate in architecture.

Such profiles are usually cold-rolled and formed in so-called “Turk’s heads”. In this process, attention must be paid to the metallurgical properties of the edges. Generally, unalloyed steel is used, but alloyed steels with their improved material properties should also be considered. In terms of carbon footprint, pipe profiles are of great advantage as the steel used can be produced from metal scab in electric arc furnaces powered by green electricity.

There is room for additional production capacity for structural tubes, particularly in India, to keep up with the market trend.