Market Overview

Have a look ...World Tube & Pipe Market: Factors influencing the current situation

Dr. Gunther Voswinckel – Update as per may 2023

Welcome to ITA’s and VOSCO´s regular presentation of the main worldwide economic factors influencing the tube and pipe industry.

The corona pandemic is under control. The supply chains were mostly restored. The Russian invasion into the Ukraine in 2022 and its consequences are major challenges for the industry. Increasing tension between the US and China officials create threatening clouds for free international trade. Political interventions and regulations are increasingly influencing industrial strategies and actions.

The transition to environmentally friendly and carbon reduced production became a central mission of the industry. The consequences on the cost increases are unevenly distributed across the world. Europe, which was highly dependent on competitive Russian gas and oil supplies, is challenged now by persistently high energy prices and high industrial producer costs. Regions such as the USA, India, Turkey and China are benefiting from lower energy and industrial producer cost. In addition, high inflation and its countermeasures threaten our industry and present it with unexpected challenges difficult to calculate. The high level of public debt caused by the expensive measures taken to overcome the various crisis in recent years give rise to fears that the central banks’ effectiveness in combating inflation will be limited and that little improvement can therefore be expected in the short term.

As always in such disruptive times, we see crisis winners who maximise their profits - but also crisis losers who have to fear for their existence. Due to the dynamics of these developments, it is usually very difficult for the crisis losers to react appropriately. As a result, some regions are looking for suitable political countermeasures to compensate for their cost disadvantages.

Whereas previously only quality, delivery time and costs were decisive, now geopolitical and logistical risk considerations as well as current and future energy costs are increasingly taking centre stage. All sources of supply are being critically scrutinised, and one can only hope and warn that international trade will not suffer too much as a result. In particular, the regional differences in energy prices will have an impact on the current landscape of the energy-intensive steel and tube industry.

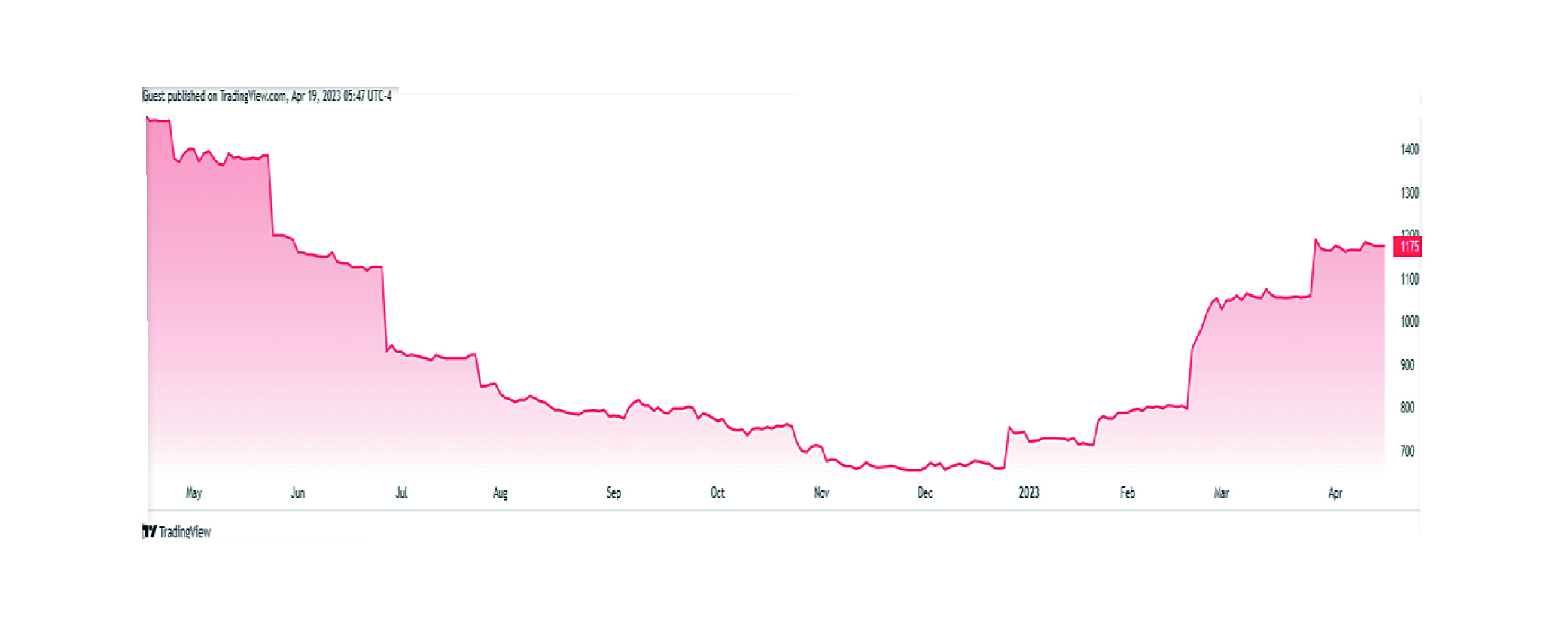

More than 70 % of total world pipe production, i.e. about 110 million tonnes, are welded pipes. Welded pipes are highly dependent on hot-rolled coil prices and large OD pipes, on plate prices. Average prices for hot-rolled coils declined from June 2022, from around USD 1500, to a minimum of USD 650 in December 2022. Since then, the prices went up again to USD 1300 this March 2023. Today, end of April 2023, the price for hot-rolled coil averages to about USD 1100. This price volatility poses major challenges to our tube industry. Although tube prices are still high, the demand for tubes calmed down with similar effects on prices. The high price for hot-rolled coils therefore leads to an erosion of margins for welded tubes. It remains quite difficult to forecast prices for hot-rolled coils. Prices for unalloyed commodity pipes in Europe are currently around 800 USD/tonne, resulting in a value added of only about 200 USD/tonne at most. OCTG pipes, having much higher material requirement, are traded at prices of about 3,000 USD/tonne in the USA. The need to replace the Russian oil and gas supplies let to increased exploration and production of other oil and gas producing countries, such as the USA. This resulted in increased demand for tubular products. Further opportunities are expected as new pipeline networks need to be built to follow oil and gas logistics as the war in Russia has made some of the existing pipeline system obsolete. Transporting oil and gas by pipelines is by far cheaper and more environmentally friendly than transporting LNG by ship. Conversion to environmentally friendly production as well as improved infrastructure in terms of pipe mills, finishing lines, digitalisation and applied quality assurance systems also play an important role. Increasing importance is attached to agile management strategies in terms of customer benefits, process and product quality improvement as well as purchasing processes using “Industry 4.0” measures.

With a view to the return to normality, it can be seen, that plant manufacturers and technology suppliers are increasingly finding interesting business opportunities in these new market segments. Some technology suppliers have already reacted and expanded their product portfolio to environmentally friendly and digital solutions.

The International Tube Association has organised several well-attended webinars in 2020, 2021 and 2022 to maintain the exchange within our industry. The positive response to these events is a sign of the impressive optimism in our tube industry.

This year, May 11th and 12th 2023, the ITA organizes an international hybrid conference in Düsseldorf under the title “Opportunities for the Tube Industry in turbulent times” offering an excellent platform to discuss sustainable solutions for the tube and pipe industry. The plant tour on 12th of May to the Benteler Dinslaken plant under the title “Sustainable Tube Production in a high-cost environment” is an interesting practical example hereto. The conference is a great opportunity to meet and exchange with tube producers as well as technology suppliers of the tube and pipe industry.

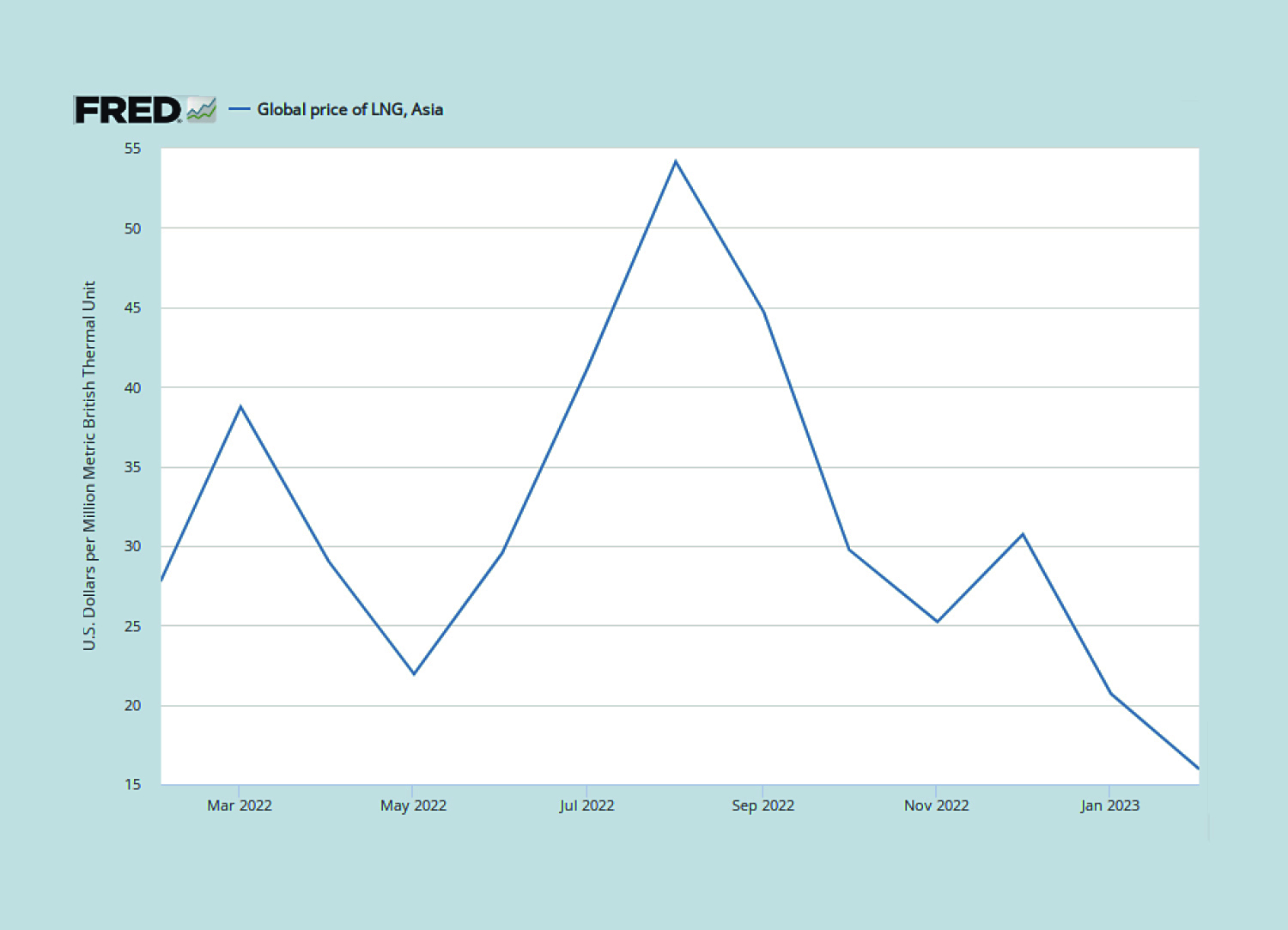

The energy cost pressure on our industry is relieving. The price of gas peaked at around 9,8 USD/MMBtu at the end of August 2022, since than the price went down to the pre-Ukraine war levels of about 2.3 USD by April 2023, meaning a price reduction of about 75% (Figure 1). Our European industry nowadays depends to a great extent on imported LNG. Despite significant price reductions since August 2022, the present price of LNG of about 15 USD (Figure 2) is still about 7 times more expensive than natural gas. Therefore, the European energy intensive industry is confronted by a significant cost disadvantage. Similar effect can be reported from the electrical energy price, which in Europe is about 3-times higher than before the Ukraine war. As long as no cheaper energy supply sources become available, this disadvantage remain as a major thread for the European energy intensive steel and tubular industry.

Pipe manufacturers buy hot-rolled coils, round billets, or plates as input material for their production lines.

More than 70 % of the total world pipe production, i.e. about 110 million tonnes/year, are welded tubes and pipes. Welded tube producers are highly dependent on attractive hot rolled coil prices and OD pipe producers, on plate prices. Average prices for hot-rolled coils came down from early 2022 (ab. 1400 USD/ton) to December 2022 (ab. 700 USD/ton). Since then, the HRC prices strengthened again to prices of about 1200 USD/ton. Furthermore, tube producers suffer from shortages in the availability of special tube material specifications.

Steel plates were trading at an average of around1,000 USD/ton in November 2022, now in April 2023 low grade plates are traded at about 770 USD/ton.

Billet prices, used for seamless tubes are traded for an average of around 570 USD/ton. Since the year end 2022 almost all prices for tubular pre-materials became more expensive. It remains a challenge to predict the pre-material prices.

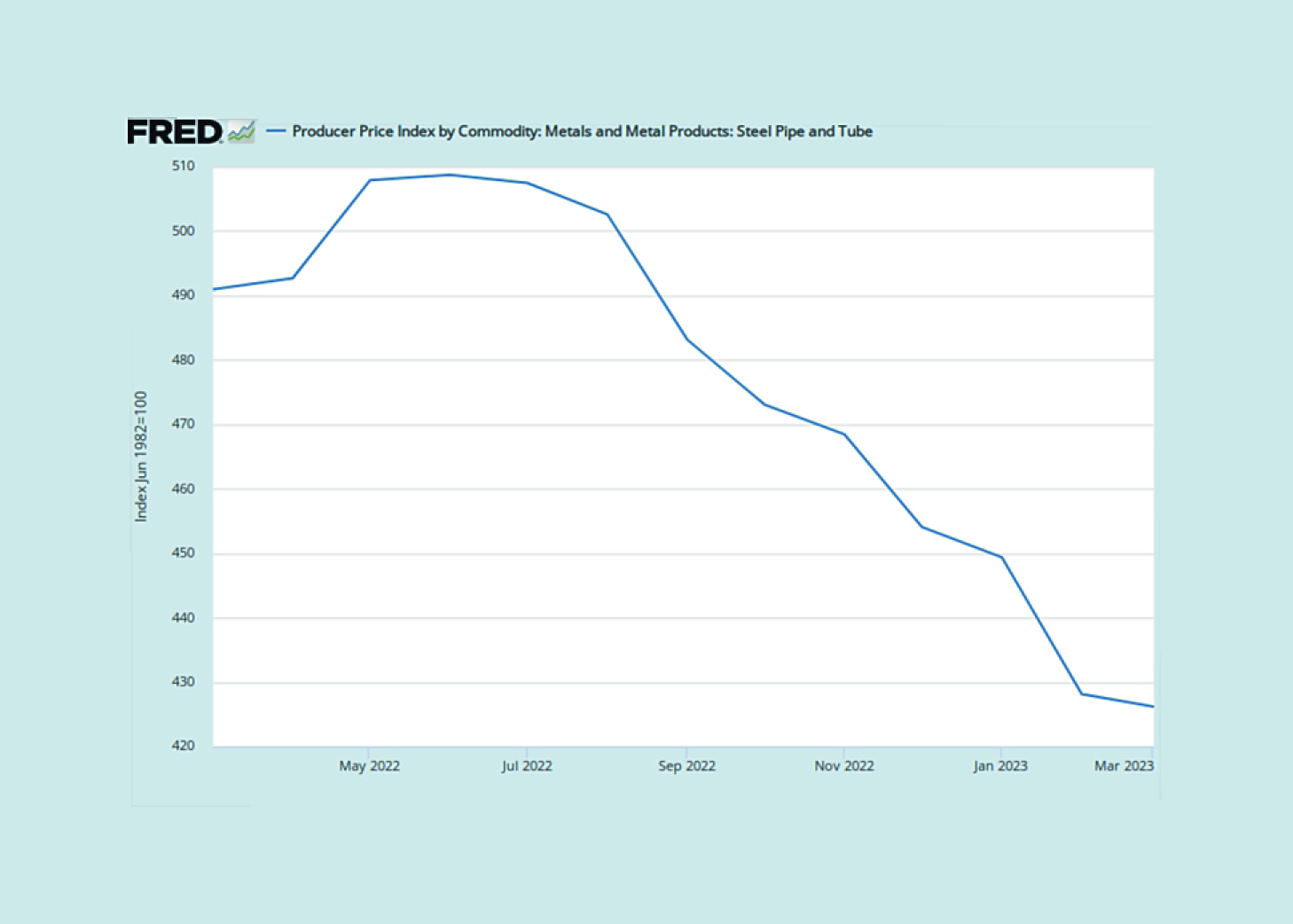

After the pipe price rally until mid-2022 (prices went up by 50%), now since then, the prices for tubular products weakened by about 13% (Figure 4).

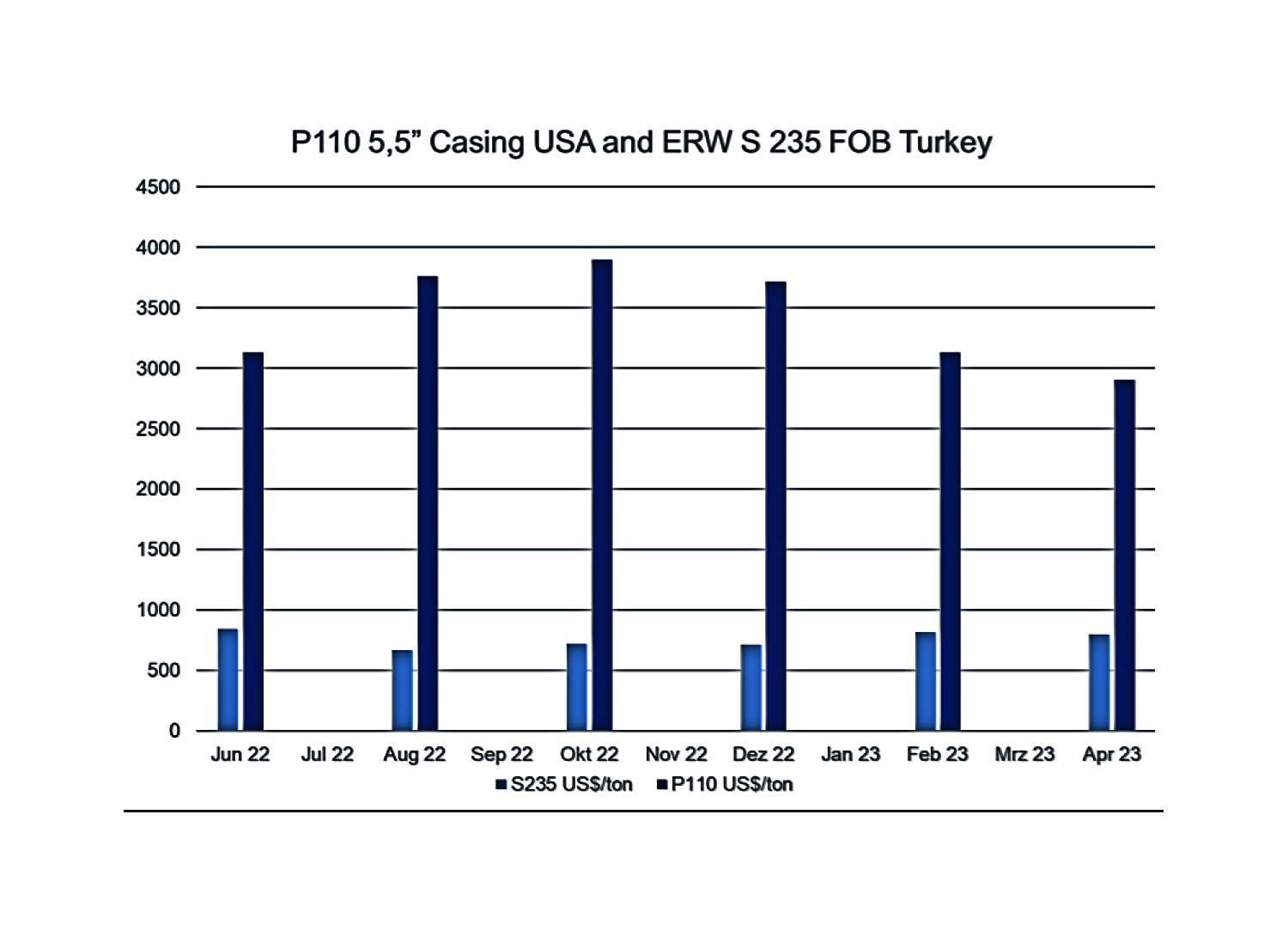

Even the booming US demand was reporting fading pipe prices. Until the beginning of October 2022, pipe prices in the US were still holding at high levels, but in November fears were being voiced from many regions that demand for pipes is weakening, which had an immediate impact on prices. The decline in pipe demand and its negative impact on prices is now faster than the decline in prices for the input materials hot-rolled coils, plates and round billets. This challenges some pipe producers since they face margin losses. As a representative example Figure 5, shows the price development for two representative tube types since June 2022:

- P110 OCTG O.D. 5,5” alloyed casing pipes

- S235 non alloyed structural pipe.

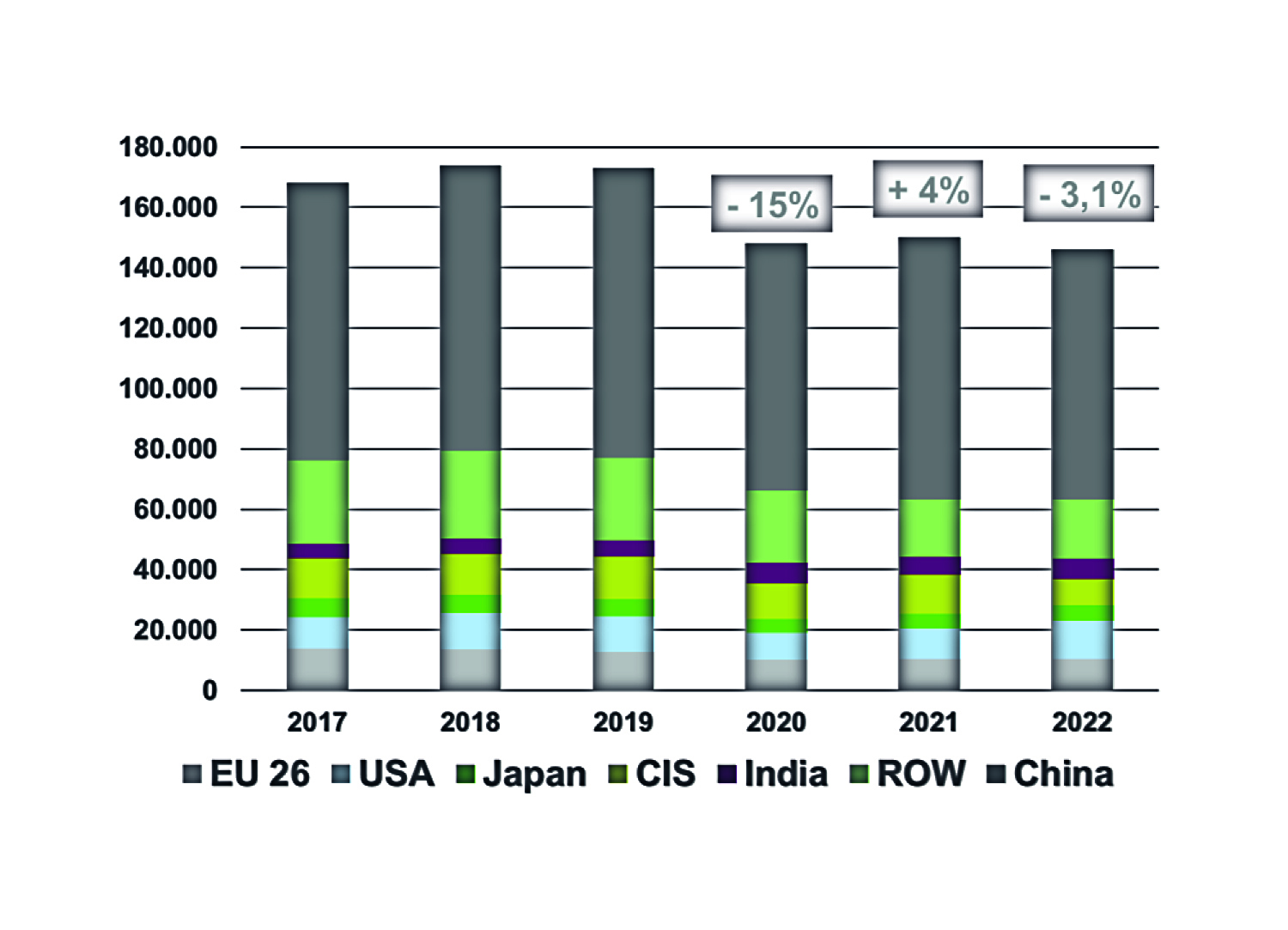

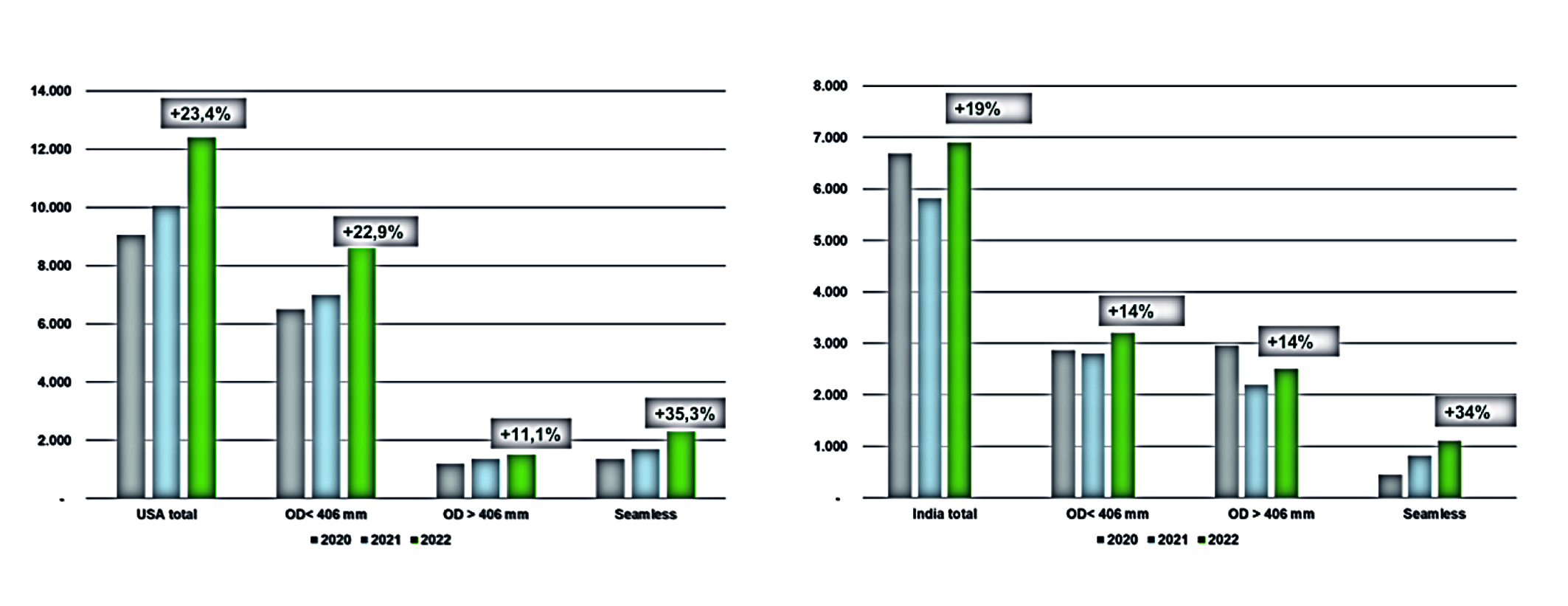

The OCTG pipe price for P110, after its hight in October 2022 (ab. 3.900 USD/ton) suffered a price decline of ab. 25% until April 2023 (ab. 2.900 USD/ton). The structural pipe S235 although on a much lower price level almost maintained its price value at ab. 800 USD/ton. The world tube and pipe production after a slight recovery in 2021 of +5%, was shrinking by -3,1% in 2022. Anyhow substantial regional differences are reported. Whereas CIS (-32,6%) and China (-4,8%) suffer from less production of tube and pipes, the USA (+23,4%) and India (+18,6%) report major growth of production, driven by a strong OCTG and construction market (Figure 7 and 8).

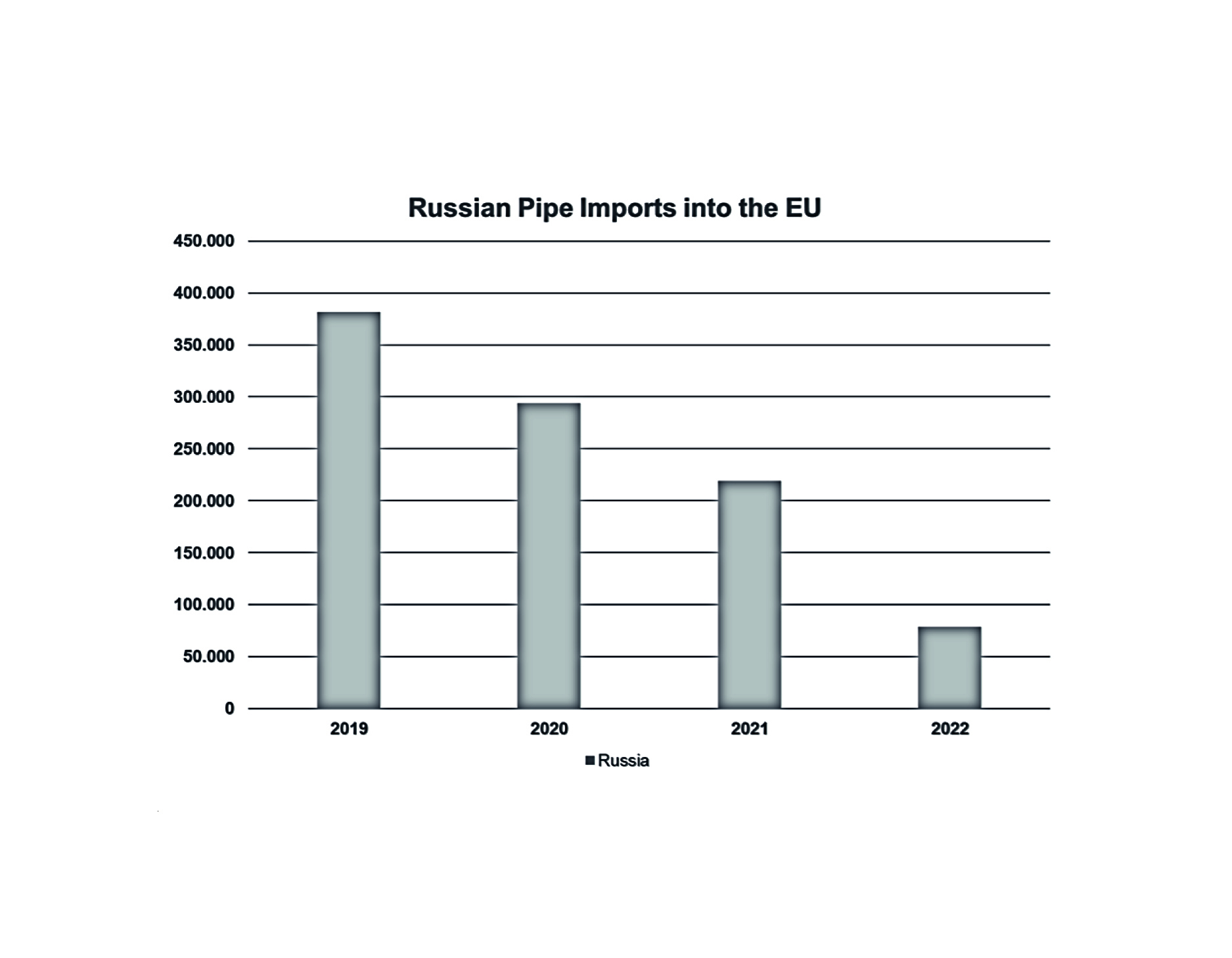

If we look at the European pipe market, before the Russian invasion, about 14% of pipe imports into the EU have been served by Russia. These volumes need to be supplied by other tube and pipe producers. Russian shipments to the EU in 2022 compared to 2020 have been decreased by 75% on-year to 78 million tonnes, ESTA reports (Figure 9).

Therefore, major structural supply modifications were introduced since the Russian invasion into the Ukraine. European, Chinese and Indian suppliers filled most of the gap. This end of the year 2023, Vallourec will shut down major European production, whose capacities need to be replaced as well.

For international trade most of the supply chain bottlenecks disappeared and the freight rates normalized. Inflation seems to have passed its maximum and shall further decline until 2024. The affords of the central banks, especially these of the US FED, has stopped the galloping inflation and reversed the trend. Due to the high indebtedness of the central banks, however, it must be feared that the target inflation of 2% will not be reached for some time yet.

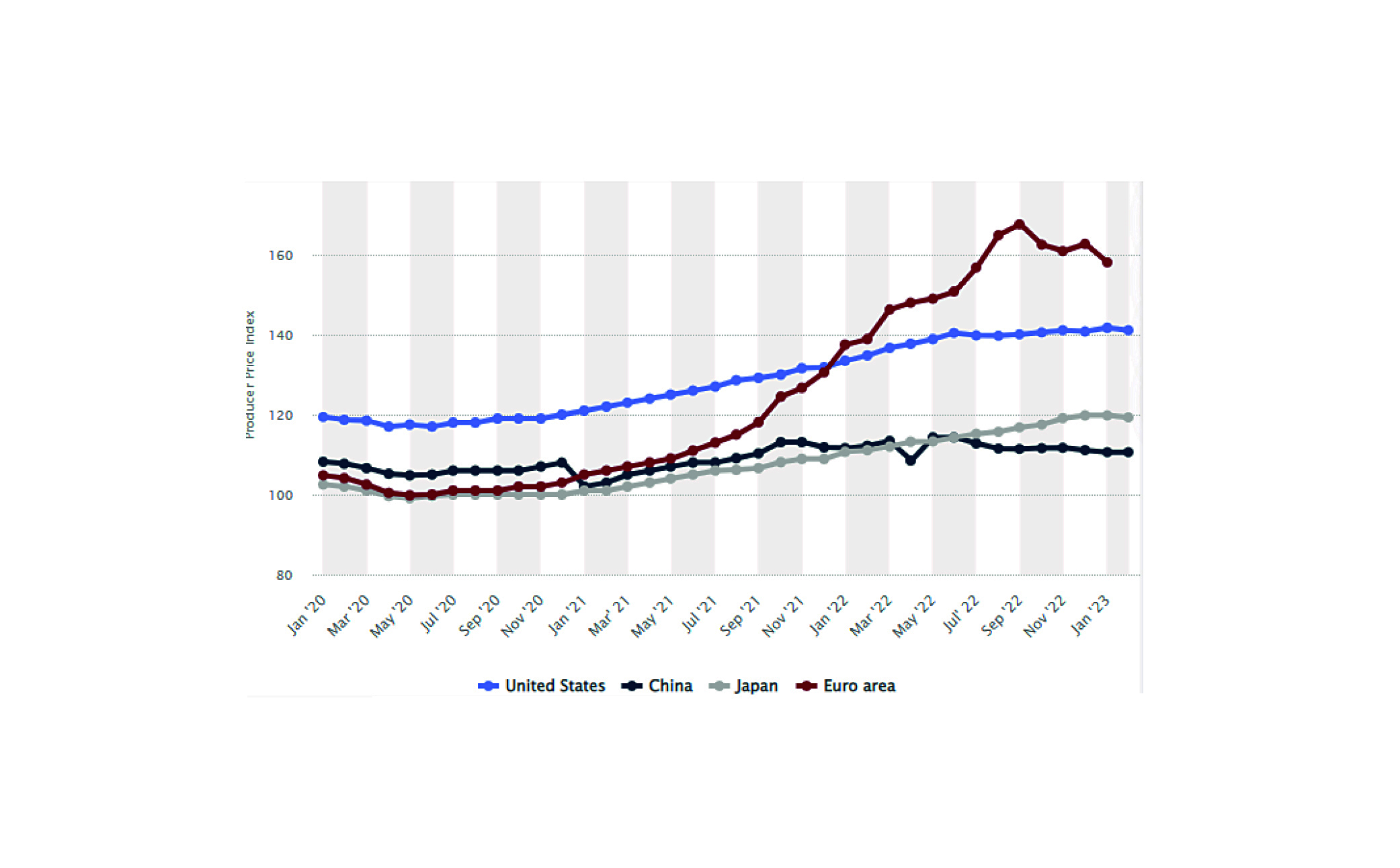

Besides the inflation rate, the producer price index is another important parameter for the economical efficiency, as it reflects the costs of the manufacturing industry. As Figure 10 shows, these costs vary greatly from region to region. Europe brings up the rear due to the sharp rise in energy costs. The USA has compared to Europe a significant advantage of more than 16% due to cheaper local energy. China’s cost situation is particularly advantageous with an advantage versus Europe of about 48% and the US of about 32%. Japan as well has an advantageous situation. Unless Europe finds again sustainable reasonable energy supplies, this cost disadvantage can hardly be bridged in a short time. The major driver of the tube and pipe industry is the OCTG market representing about 51% of the world tube and pipe production. The consumption of OCTG tubes directly relates with the oil price (see previous tube market reviews).

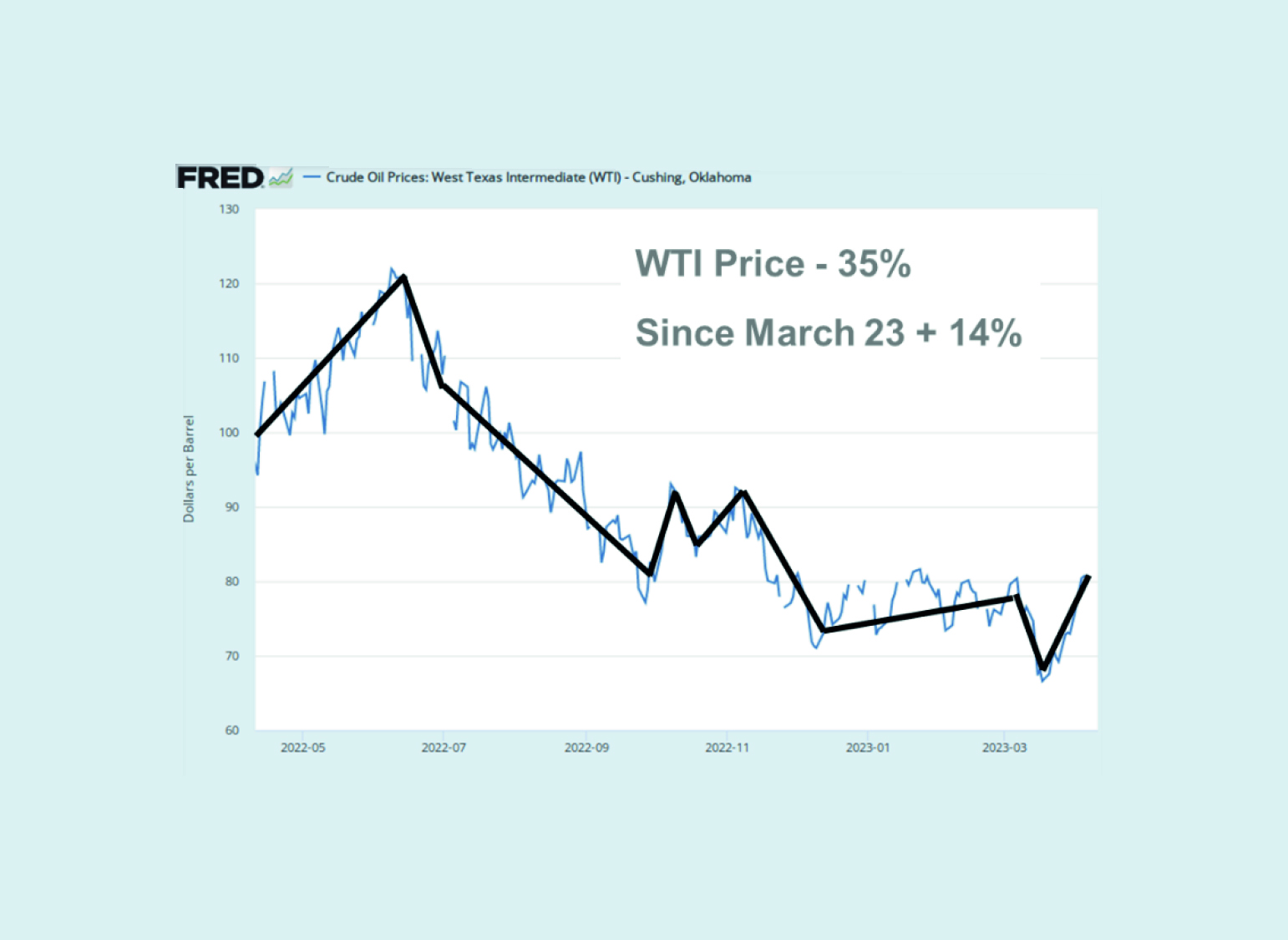

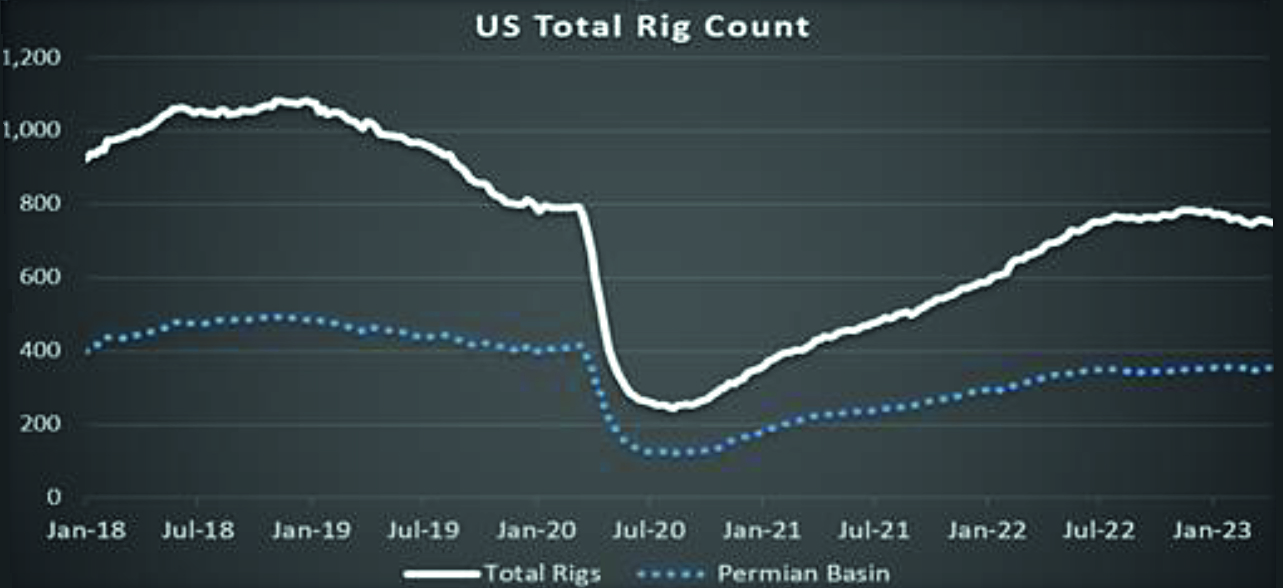

The geopolitical sanctions against Russia in 2022 created a massive contraction of Russian oil production causing speculative price increases until mid-2022 (Figure 11). To sacrifice the supply shortage and to limit the inflationary consequences of the energy supply gap exploration companies initiated massive drilling activities. OPEC-plus boomed its crude oil production in only 2 months starting in February 2022 from 37 Mio. Bbl./day to 38 Mio Bbl./day. The USA to soften the inflation and to sacrifice the crude oil demand enlarged its crude oil production almost linear from 11 Mio. Bbl./day in February 2022 to 12,4 Mio. Bbl./day in February 2023 (+13%) by increasing the number of drilling rigs. The number of drilling rigs was enlarged from 531 in May 2021 to about 800 end of November 2022 (Figure 12).

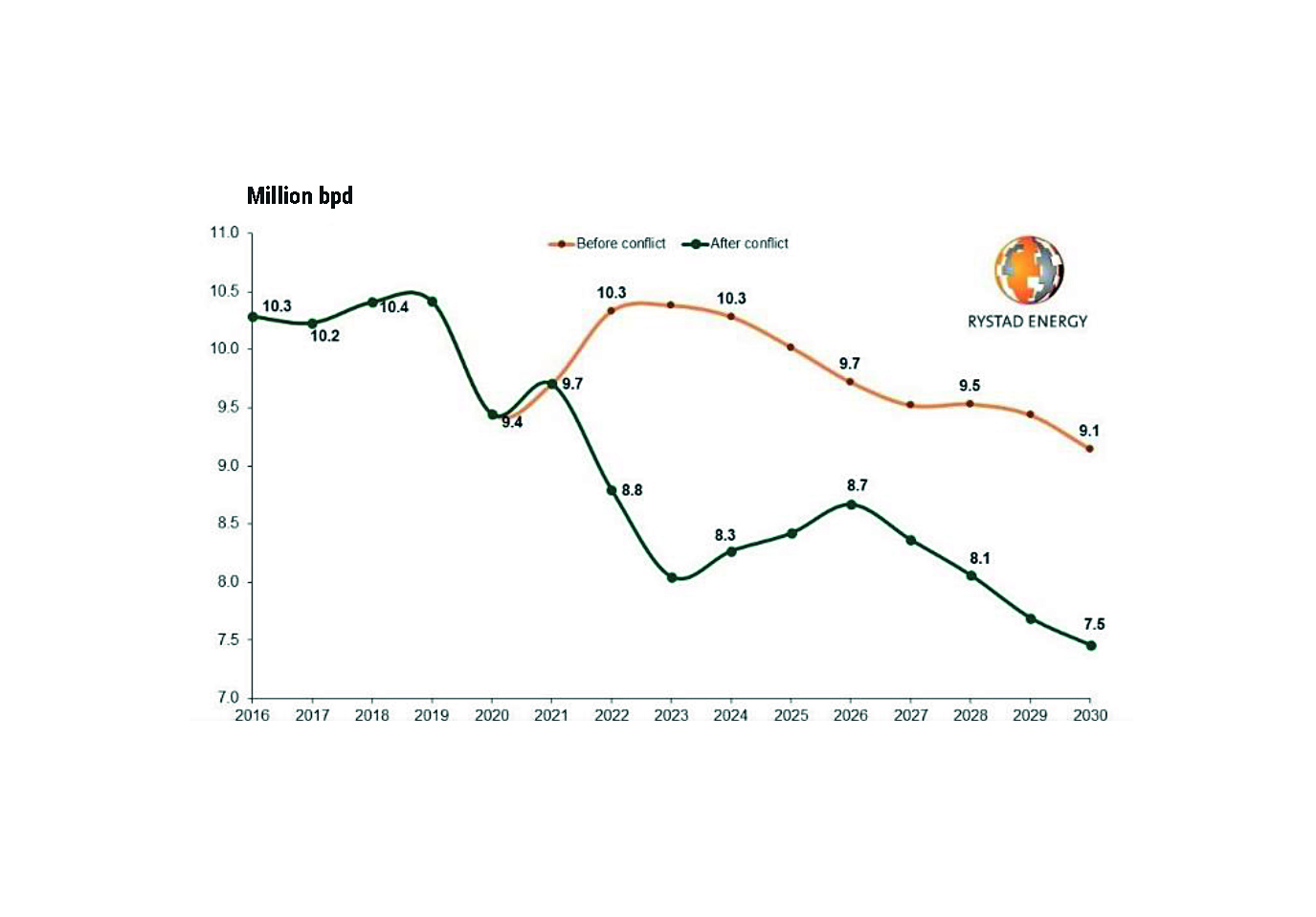

Of these 800 rigs, 637 are dedicated for the extraction of oil and 163 for gas. The growth pattern has slightly calmed down, anyhow demand stays on high level. The oil producing countries should compensate the anticipated reduced Russian Oil production in a range of 1-2 Mio. Bbl./day (Figure 13). Since June 2022 anyhow, the market calmed down and the oil price stabilized since September 2022 at a price span of about 75 to 85 USD/Bbl. Only this month the price weakened again.

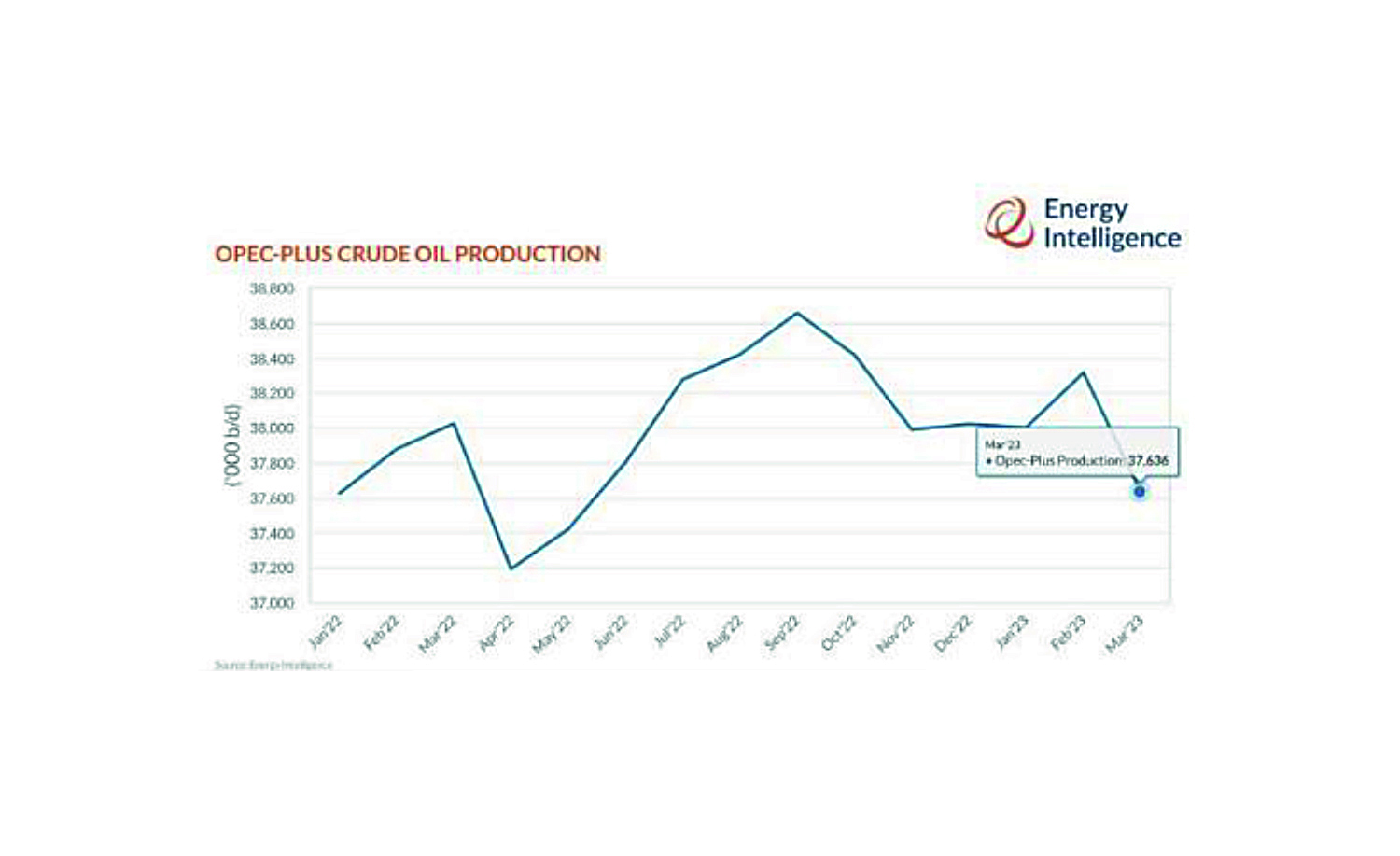

Although OPEC-Plus controls only less than 50% of the total world oil production volume, the oil price is greatly triggered by the OPEC-Plus oil production volumes. In September 2022 OPEC-Plus reduced its production volumes (from 38,7 to 38 Mio. Bbl./day) (Figure 14), with the consequence that the oil price stabilized. Anyhow when in January 2023 the production volume was enlarged to 38,3 Mio. Bbl./day, the oil price weakened immediately. Now in March 2023 the OPEC-Plus, mainly Saudi Arabia, decided, due to further weakening oil prices below 70 USD/Bbl., to reduce its oil production by about 0,7 Mio. Bbl./day to a total of 37,6 Mio. Bbl./day. So far, the effect of this last reduction of production volume did not show the expected strengthening of the oil price. This reducing of the crude oil production is heavily criticised by the US and EU officials, as they fear that inflation and industrial growth will be negatively affected by raising oil prices. The energy industry is booming, Aramco, the world’s largest producer of fossil fuels, has become the world’s most valuable company in 2022. Exxon Mobile even extends its footprint in gas exploration planning to acquire the largest US based shale gas producer. Shell intends to widen its footprint in oil and gas as well. Anyhow currently, there is no evidence that the international oil and gas producers are increasing supply to capture market prices.

Efforts to reduce dependence on fossil fuels can hardly be successful in the short term and can only contribute to decoupling in the medium term. For our pipe industry, however, this means that high energy prices can be expected in the future as well - prices around 80-90 USD/Bbl. are most probable. The investments to secure the energy supply will keep the demand and prices for tubular products high.

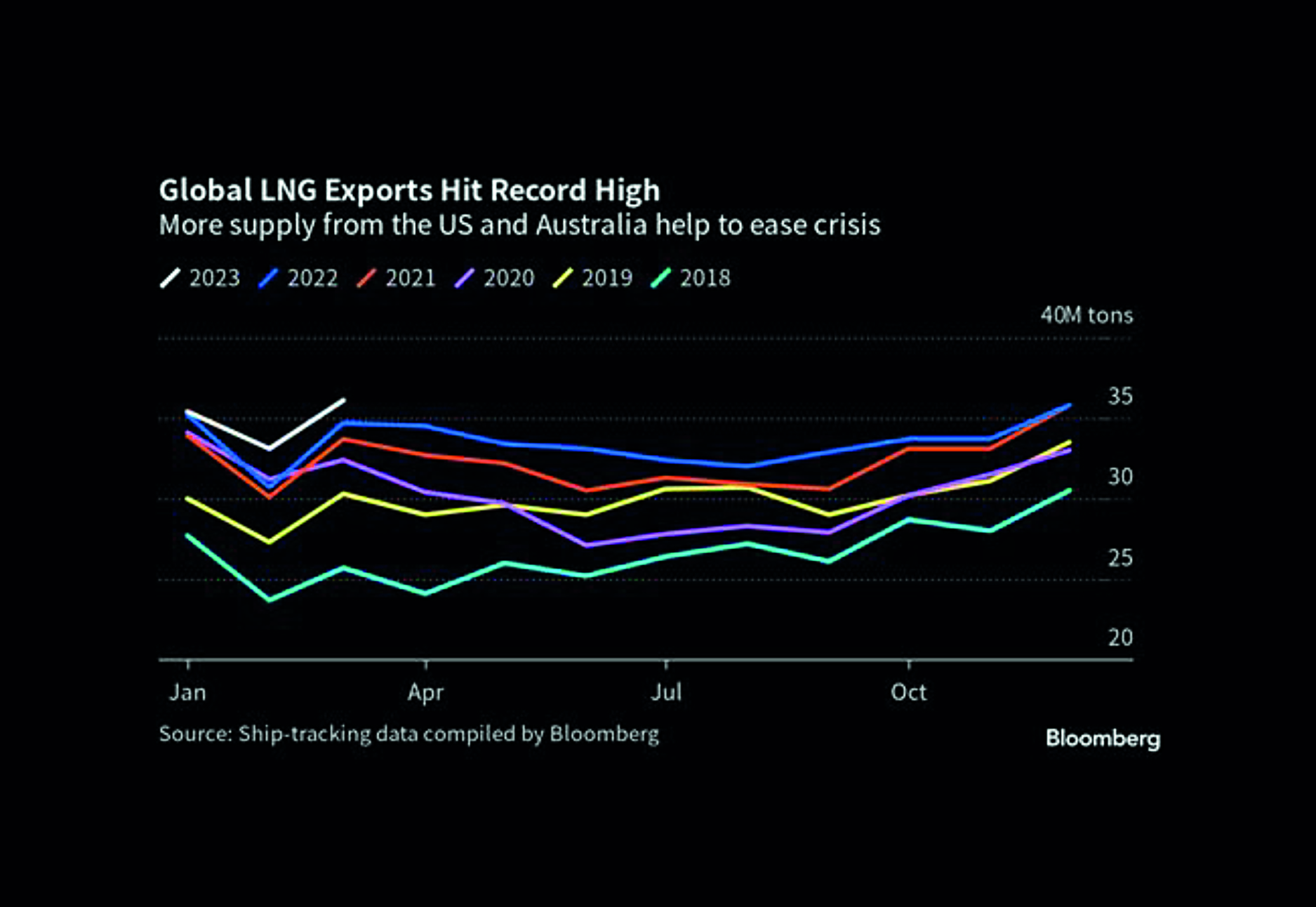

Another driving factor is the record high global LNG export rate. Figure 15 shows for the US and Australia how record high LNG production became. Consequently the demand for OCTG products remain high and it eases the energy crisis especially in Europe to compensate the stopped Russian pipeline gas supplies.

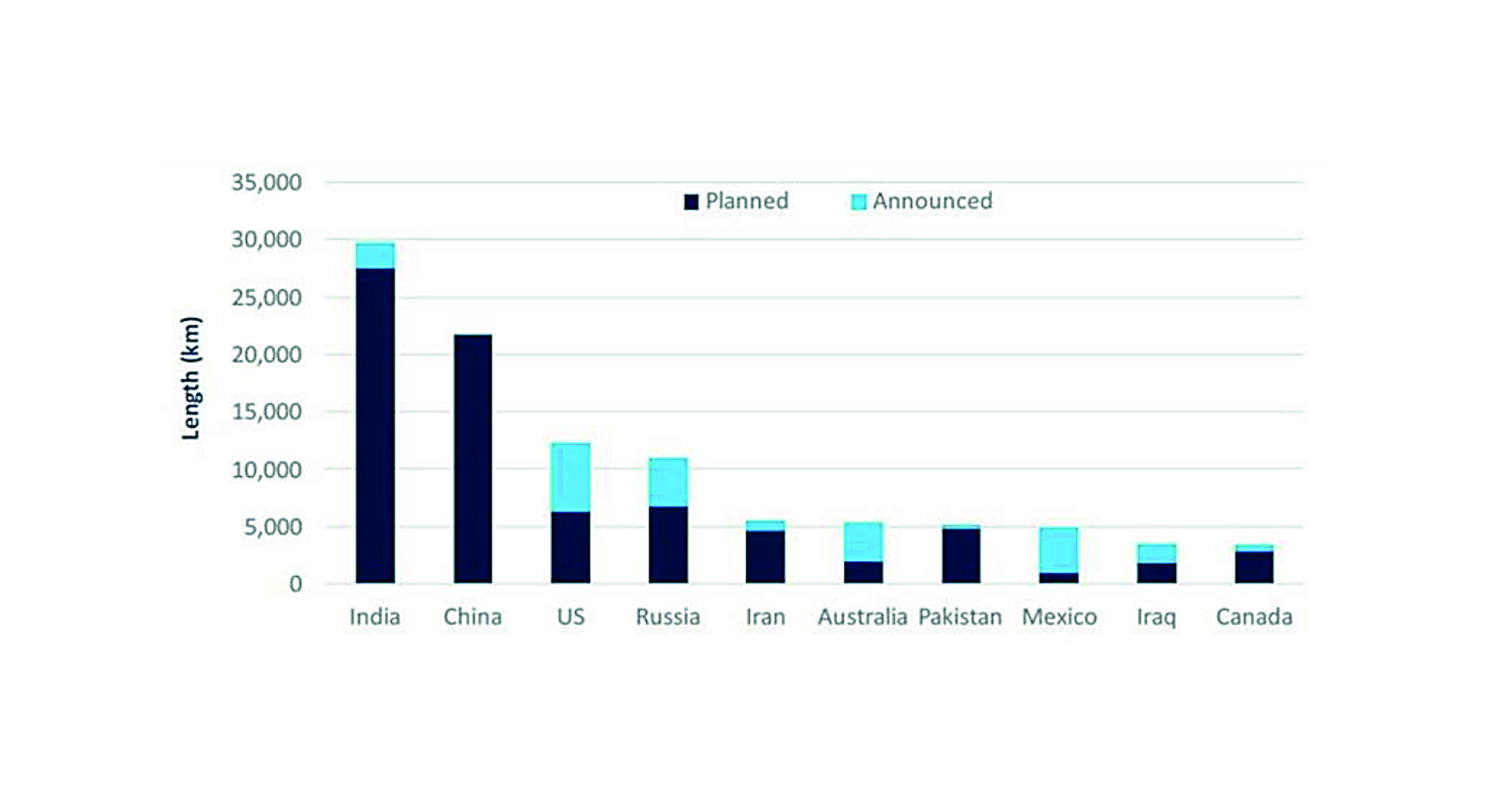

In addition to exploration activities, the need to build new pipeline routes has also increased since the ban on Russian pipelines to Europe and the strategy towards hydrogen to replace natural gas. In the wake of the attacks on the Northstream pipelines, which released very large quantities of methane as an environmental load, it can be expected that the safety standards for pipelines will become even more demanding. This development offers the manufacturers of large-diameter pipes > 406 mm OD opportunities for interesting business. Globally a large quantity of pipelines is planned or announced to be built in the coming years up to 2027 (Figure 16).

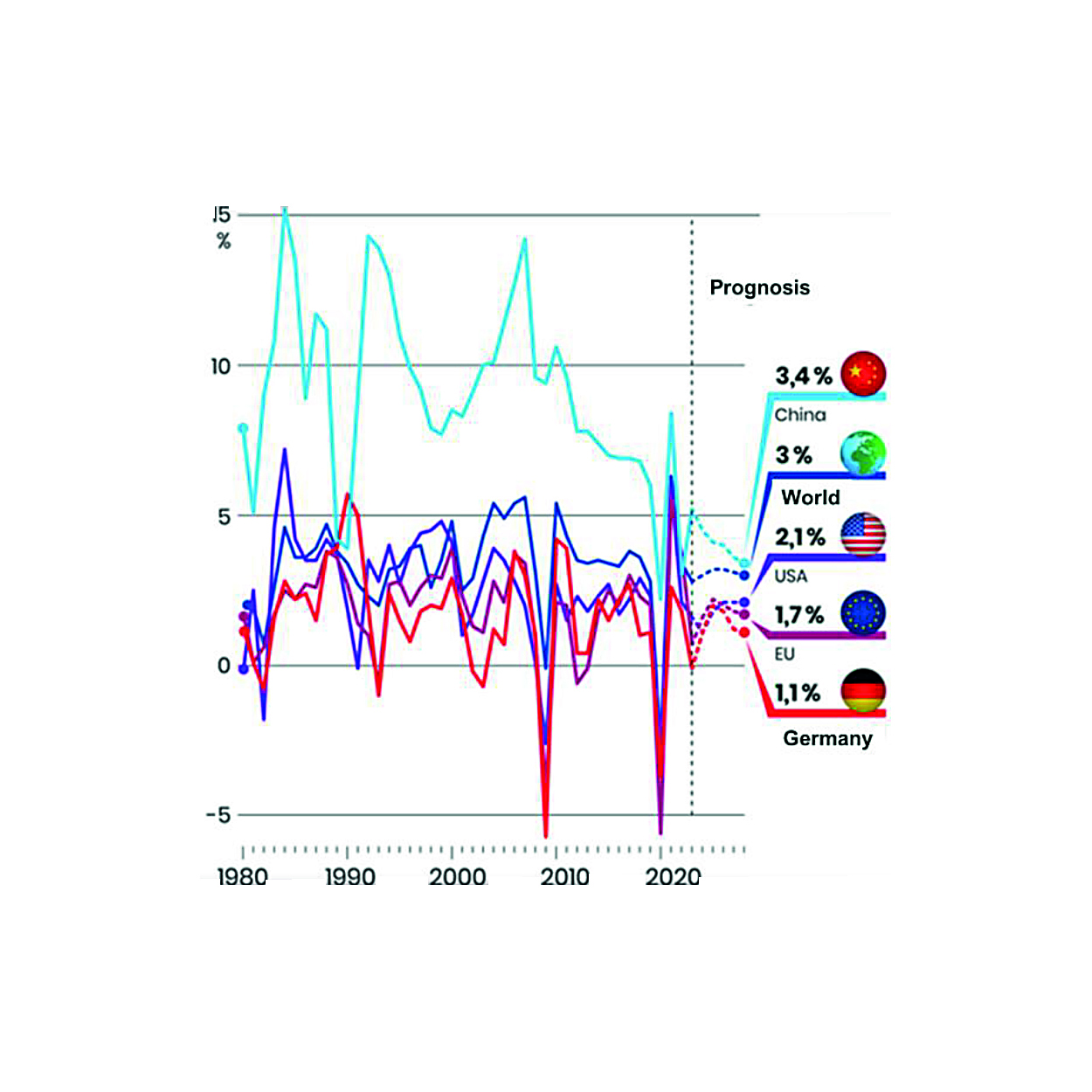

In this context it is remarkable that most of the contractors building the worldwide pipeline projects are headquartered in China or India. The global construction market with about 5% of the global tube market presents another opportunity for pipe manufacturers with growth potential. The market penetration is quite unevenly distributed in the world and the growth pattern is greatly dependent on the regional GDP growth (Figure 17).

North America and parts of Asia are widely using tubular products for structural buildings. Europe on the other hand still designs mostly with standard concrete or steel structures. A recent study published by Global Construction Perspective and Oxford Economics, entitled “Global Construction 2030”, forecasts an 85% growth in global construction output to 15.5 trillion by 2030, with three countries, China, USA and India, leading the way and accounting for 57% of global growth alone. Europe, on the other hand, will reduce its pace of investment. There is room for additional production capacity for structural tubes, especially in India, to follow the market trend. The tube industry needs to further promote the benefits of tube applications and showcase the architectural perspectives (Figure 18).

Tubular profiles are an ideal choice when visible structures are desired due to their varied shapes and closed cross-sections combined with smooth sides. Best mechanical properties and the possibility to bridge large spans are further highlights of tube profiles. Besides round shaped structural tubes, rectangular profiles are dominating architectural applications. Such profiles are normally cold rolled and formed in so-called turks-heads. In this process great attention must be given to the metallurgical properties of the edges. Normally unalloyed steel is applied, anyhow alloyed steels with its improved material properties should also be considered.

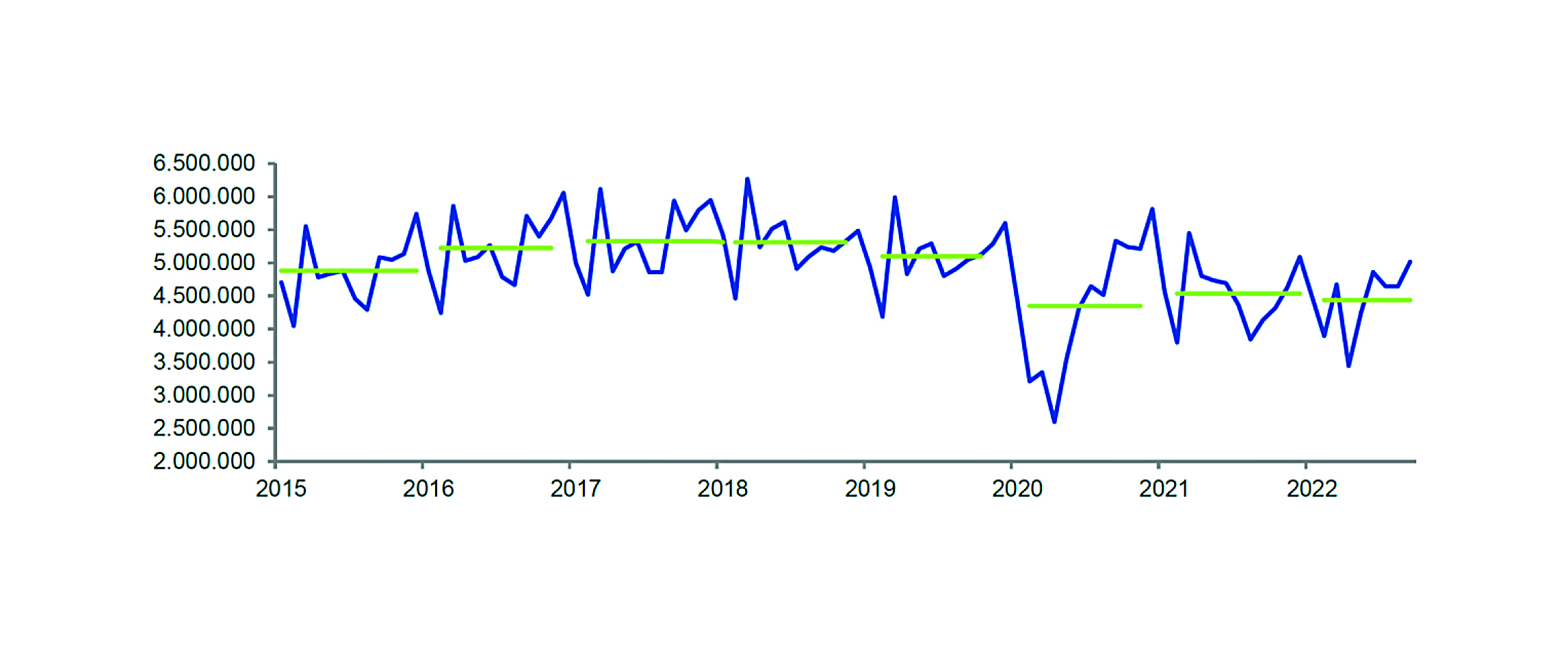

The automotive market representing about 15% of the global tube market is a quite steady and reliable market. The car registration level in 2020, which fell due to the Corona crisis, could only be slightly increased to around 77.2 million light vehicles worldwide in 2021 and 2022 due to various challenges in the supply chain (Figure 19). According to IHS, the recovery process will take longer in the volume markets of Europe and North America. Future growth will take place primarily in Asia, especially in China. However, China could increasingly become a sales problem for the western automotive industry due to the American decoupling tendencies and strengthening local car industry in China.However, the tendency to further reduce the weight of vehicles supports the trend towards the use of tubular products. The transition towards electromobility may also support the application of tubular components since the additional weight of the batteries need to be compensated to the extend possible. The automotive industry offers a lot of attractive tubular applications.

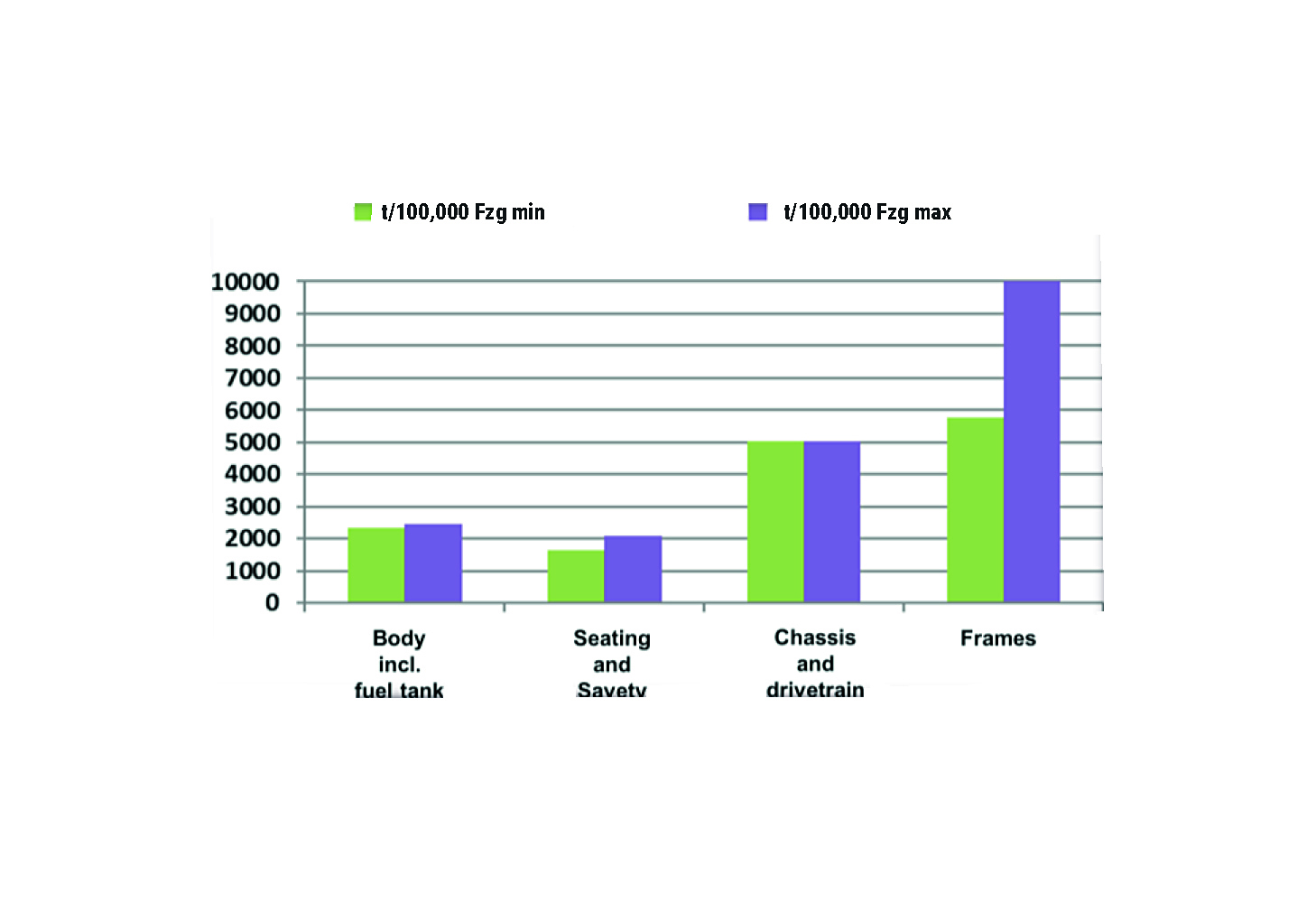

The greatest potential for the use of tubular products (Figure 20) is seen in vehicle frames, followed by chassis and powertrains. Tube manufacturers shall endeavour to enter new vehicle series with larger volumes to further expand their presence in the light vehicle industry.

Overall, the automotive industry is challenged by the transition towards electromobility and how to keep on serving such markets where electromobility cannot be introduced due to restrictions regarding availability of electrical energy. Therefore, automotive producers will need to follow all drive technologies to prevent losing large market potentials. Environmentally friendly combustion technologies will still have its position. Political institutions such as in Europe on the other hand, set time limits to ban combustion technologies. In this field of tension, the automotive industry including its suppliers of tubular products need to find appropriate business approaches.

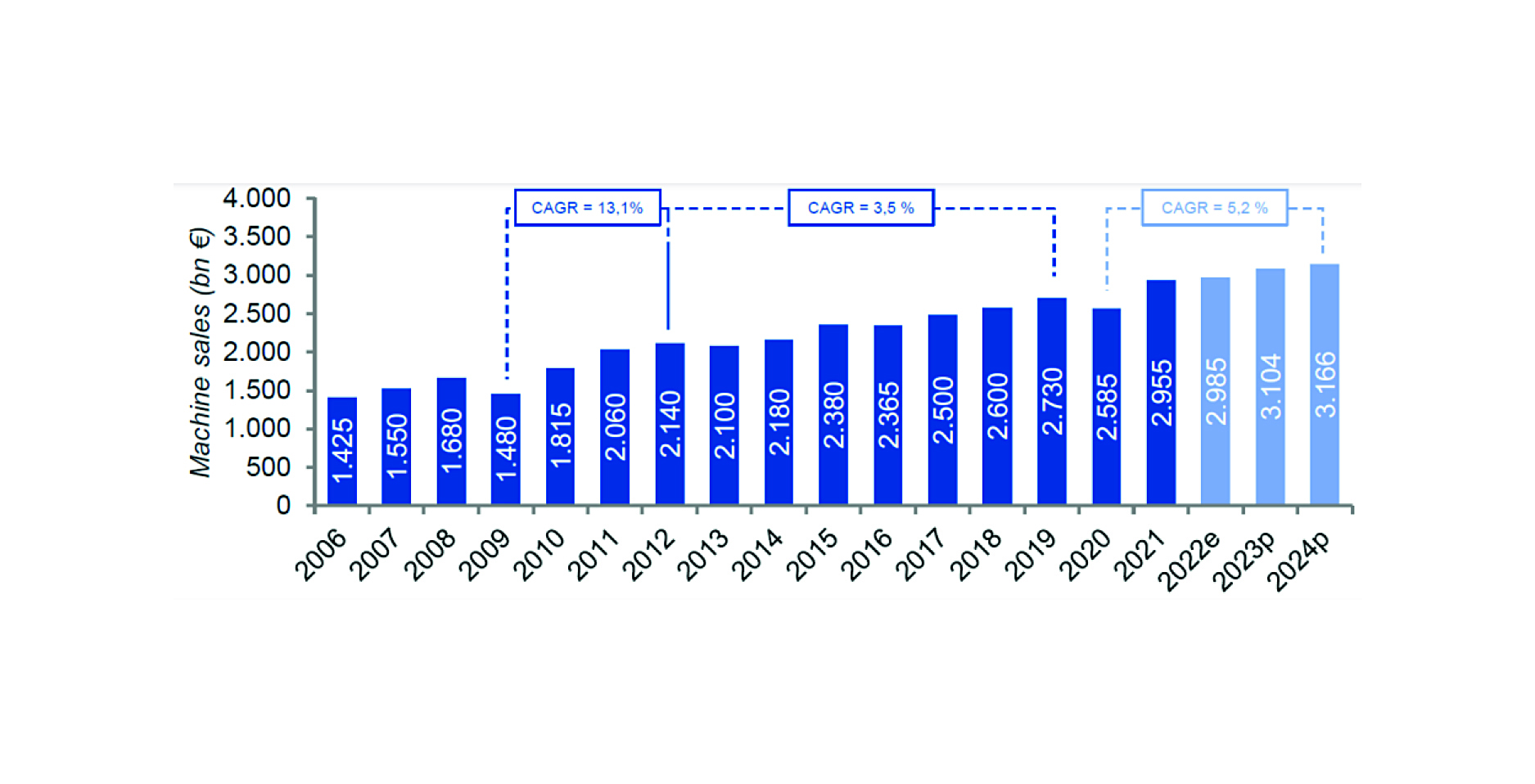

The mechanical engineering market segment, which accounts for around 9% of world pipe production, has developed well in line with global GDP in recent years (Figure 21). During the financial- and corona crisis, the market was characterised by higher volatility with sharper declines and quick recoveries. In 2022, the current further recovery was slowed down by geopolitical circumstances. Asia, and China in particular, although increasingly reaching self-sufficiency are still the largest markets for machinery purchases. It remains noteworthy that the Chinese industry has taken the global lead in machinery sales since the Corona crisis.

Here, the decoupling intentions of the USA must be observed since this may become a game changer for the worldwide mechanical engineering industry. The USA and Europe continue to be significant sales regions as well. This market segment certainly has the greatest variety of tube products. Cylinder-, ball bearing- and turned part tubes, to name just a few prominent representatives of this market segment, certainly show good prospects for tube producers.

Most pipe and steel producers were able to report strongly improved economic figures in 2022 in the wake of the price increases. However, for European pipe producers, the persistently higher energy cost and the additional CO2 levies agreed to be imposed by the European Community represent major challenges. Confidence in being able to compete on the world market in the future with these additional costs is dwindling among some tube producers. Some tube producers even reduce their engagement in Europe as a consequence hereto.

In general, there is enough production capacity to serve even the increased demand for tubes and pipes for all market segments. Raw material prices for the steel as well as the tube and pipe industry would seem to have peaked early 2023. Still markets are nervous with potential for further volatility.

Further challenge may be imposed, if political measures to prevent climate change are not introduced in a balanced way, with possible consequences being the migration of high energy consuming industries to lower-cost regions. Nonetheless, if the balance of supply and demand within the tubes and pipes industry is restored, price volatility can be expected to calm down.

Tube plant infrastructure with respect to tube mills and finishing lines as well as applied quality assurance systems also plays a significant role. The transition towards environmentally friendly tube production to produce carbon reduced tubes and pipes became increasingly a major task for the industry. Tube and pipe producers who have used the corona pandemic to improve their productivity, flexibility and customer service, like introducing “Industry 4.0” measures, will benefit from such measures.

With an eye to the return to something like normal, it should be noted that plant builders and technology suppliers alike find interesting business opportunities in this new and innovative market segment. Some technology suppliers have already reacted and enhanced their product portfolio with the addition of environmentally friendly and digital solutions.

The ITA organizes this May 11th and 12th an international hybrid conference in Düsseldorf under the title “Opportunities for the Tube Industry in Turbulent Times” offering an excellent platform to discuss sustainable solutions for the tube and pipe industry. The tour on 12th of May to the Benteler Dinslaken plant under the title “Sustainable Tube Production in a High-Cost Environment” is an interesting practical example hereto. The conference is a great opportunity to meet and exchange with tube producers as well as technology suppliers to the tube and pipe industry.

The corona pandemic is under control. The supply chains were mostly restored. The Russian invasion into the Ukraine in 2022 and its consequences are major challenges for the industry. Increasing tension between the US and China officials create threatening clouds for free international trade. Political interventions and regulations are increasingly influencing industrial strategies and actions.

The transition to environmentally friendly and carbon reduced production became a central mission of the industry. The consequences on the cost increases are unevenly distributed across the world. Europe, which was highly dependent on competitive Russian gas and oil supplies, is challenged now by persistently high energy prices and high industrial producer costs. Regions such as the USA, India, Turkey and China are benefiting from lower energy and industrial producer cost. In addition, high inflation and its countermeasures threaten our industry and present it with unexpected challenges difficult to calculate. The high level of public debt caused by the expensive measures taken to overcome the various crisis in recent years give rise to fears that the central banks’ effectiveness in combating inflation will be limited and that little improvement can therefore be expected in the short term.

As always in such disruptive times, we see crisis winners who maximise their profits - but also crisis losers who have to fear for their existence. Due to the dynamics of these developments, it is usually very difficult for the crisis losers to react appropriately. As a result, some regions are looking for suitable political countermeasures to compensate for their cost disadvantages.

Whereas previously only quality, delivery time and costs were decisive, now geopolitical and logistical risk considerations as well as current and future energy costs are increasingly taking centre stage. All sources of supply are being critically scrutinised, and one can only hope and warn that international trade will not suffer too much as a result. In particular, the regional differences in energy prices will have an impact on the current landscape of the energy-intensive steel and tube industry.

More than 70 % of total world pipe production, i.e. about 110 million tonnes, are welded pipes. Welded pipes are highly dependent on hot-rolled coil prices and large OD pipes, on plate prices. Average prices for hot-rolled coils declined from June 2022, from around USD 1500, to a minimum of USD 650 in December 2022. Since then, the prices went up again to USD 1300 this March 2023. Today, end of April 2023, the price for hot-rolled coil averages to about USD 1100. This price volatility poses major challenges to our tube industry. Although tube prices are still high, the demand for tubes calmed down with similar effects on prices. The high price for hot-rolled coils therefore leads to an erosion of margins for welded tubes. It remains quite difficult to forecast prices for hot-rolled coils. Prices for unalloyed commodity pipes in Europe are currently around 800 USD/tonne, resulting in a value added of only about 200 USD/tonne at most. OCTG pipes, having much higher material requirement, are traded at prices of about 3,000 USD/tonne in the USA. The need to replace the Russian oil and gas supplies let to increased exploration and production of other oil and gas producing countries, such as the USA. This resulted in increased demand for tubular products. Further opportunities are expected as new pipeline networks need to be built to follow oil and gas logistics as the war in Russia has made some of the existing pipeline system obsolete. Transporting oil and gas by pipelines is by far cheaper and more environmentally friendly than transporting LNG by ship. Conversion to environmentally friendly production as well as improved infrastructure in terms of pipe mills, finishing lines, digitalisation and applied quality assurance systems also play an important role. Increasing importance is attached to agile management strategies in terms of customer benefits, process and product quality improvement as well as purchasing processes using “Industry 4.0” measures.

With a view to the return to normality, it can be seen, that plant manufacturers and technology suppliers are increasingly finding interesting business opportunities in these new market segments. Some technology suppliers have already reacted and expanded their product portfolio to environmentally friendly and digital solutions.

The International Tube Association has organised several well-attended webinars in 2020, 2021 and 2022 to maintain the exchange within our industry. The positive response to these events is a sign of the impressive optimism in our tube industry.

This year, May 11th and 12th 2023, the ITA organizes an international hybrid conference in Düsseldorf under the title “Opportunities for the Tube Industry in turbulent times” offering an excellent platform to discuss sustainable solutions for the tube and pipe industry. The plant tour on 12th of May to the Benteler Dinslaken plant under the title “Sustainable Tube Production in a high-cost environment” is an interesting practical example hereto. The conference is a great opportunity to meet and exchange with tube producers as well as technology suppliers of the tube and pipe industry.

The energy cost pressure on our industry is relieving. The price of gas peaked at around 9,8 USD/MMBtu at the end of August 2022, since than the price went down to the pre-Ukraine war levels of about 2.3 USD by April 2023, meaning a price reduction of about 75% (Figure 1). Our European industry nowadays depends to a great extent on imported LNG. Despite significant price reductions since August 2022, the present price of LNG of about 15 USD (Figure 2) is still about 7 times more expensive than natural gas. Therefore, the European energy intensive industry is confronted by a significant cost disadvantage. Similar effect can be reported from the electrical energy price, which in Europe is about 3-times higher than before the Ukraine war. As long as no cheaper energy supply sources become available, this disadvantage remain as a major thread for the European energy intensive steel and tubular industry.

Pipe manufacturers buy hot-rolled coils, round billets, or plates as input material for their production lines.

More than 70 % of the total world pipe production, i.e. about 110 million tonnes/year, are welded tubes and pipes. Welded tube producers are highly dependent on attractive hot rolled coil prices and OD pipe producers, on plate prices. Average prices for hot-rolled coils came down from early 2022 (ab. 1400 USD/ton) to December 2022 (ab. 700 USD/ton). Since then, the HRC prices strengthened again to prices of about 1200 USD/ton. Furthermore, tube producers suffer from shortages in the availability of special tube material specifications.

Steel plates were trading at an average of around1,000 USD/ton in November 2022, now in April 2023 low grade plates are traded at about 770 USD/ton.

Billet prices, used for seamless tubes are traded for an average of around 570 USD/ton. Since the year end 2022 almost all prices for tubular pre-materials became more expensive. It remains a challenge to predict the pre-material prices.

After the pipe price rally until mid-2022 (prices went up by 50%), now since then, the prices for tubular products weakened by about 13% (Figure 4).

Even the booming US demand was reporting fading pipe prices. Until the beginning of October 2022, pipe prices in the US were still holding at high levels, but in November fears were being voiced from many regions that demand for pipes is weakening, which had an immediate impact on prices. The decline in pipe demand and its negative impact on prices is now faster than the decline in prices for the input materials hot-rolled coils, plates and round billets. This challenges some pipe producers since they face margin losses. As a representative example Figure 5, shows the price development for two representative tube types since June 2022:

- P110 OCTG O.D. 5,5” alloyed casing pipes

- S235 non alloyed structural pipe.

The OCTG pipe price for P110, after its hight in October 2022 (ab. 3.900 USD/ton) suffered a price decline of ab. 25% until April 2023 (ab. 2.900 USD/ton). The structural pipe S235 although on a much lower price level almost maintained its price value at ab. 800 USD/ton. The world tube and pipe production after a slight recovery in 2021 of +5%, was shrinking by -3,1% in 2022. Anyhow substantial regional differences are reported. Whereas CIS (-32,6%) and China (-4,8%) suffer from less production of tube and pipes, the USA (+23,4%) and India (+18,6%) report major growth of production, driven by a strong OCTG and construction market (Figure 7 and 8).

If we look at the European pipe market, before the Russian invasion, about 14% of pipe imports into the EU have been served by Russia. These volumes need to be supplied by other tube and pipe producers. Russian shipments to the EU in 2022 compared to 2020 have been decreased by 75% on-year to 78 million tonnes, ESTA reports (Figure 9).

Therefore, major structural supply modifications were introduced since the Russian invasion into the Ukraine. European, Chinese and Indian suppliers filled most of the gap. This end of the year 2023, Vallourec will shut down major European production, whose capacities need to be replaced as well.

For international trade most of the supply chain bottlenecks disappeared and the freight rates normalized. Inflation seems to have passed its maximum and shall further decline until 2024. The affords of the central banks, especially these of the US FED, has stopped the galloping inflation and reversed the trend. Due to the high indebtedness of the central banks, however, it must be feared that the target inflation of 2% will not be reached for some time yet.

Besides the inflation rate, the producer price index is another important parameter for the economical efficiency, as it reflects the costs of the manufacturing industry. As Figure 10 shows, these costs vary greatly from region to region. Europe brings up the rear due to the sharp rise in energy costs. The USA has compared to Europe a significant advantage of more than 16% due to cheaper local energy. China’s cost situation is particularly advantageous with an advantage versus Europe of about 48% and the US of about 32%. Japan as well has an advantageous situation. Unless Europe finds again sustainable reasonable energy supplies, this cost disadvantage can hardly be bridged in a short time. The major driver of the tube and pipe industry is the OCTG market representing about 51% of the world tube and pipe production. The consumption of OCTG tubes directly relates with the oil price (see previous tube market reviews).

The geopolitical sanctions against Russia in 2022 created a massive contraction of Russian oil production causing speculative price increases until mid-2022 (Figure 11). To sacrifice the supply shortage and to limit the inflationary consequences of the energy supply gap exploration companies initiated massive drilling activities. OPEC-plus boomed its crude oil production in only 2 months starting in February 2022 from 37 Mio. Bbl./day to 38 Mio Bbl./day. The USA to soften the inflation and to sacrifice the crude oil demand enlarged its crude oil production almost linear from 11 Mio. Bbl./day in February 2022 to 12,4 Mio. Bbl./day in February 2023 (+13%) by increasing the number of drilling rigs. The number of drilling rigs was enlarged from 531 in May 2021 to about 800 end of November 2022 (Figure 12).

Of these 800 rigs, 637 are dedicated for the extraction of oil and 163 for gas. The growth pattern has slightly calmed down, anyhow demand stays on high level. The oil producing countries should compensate the anticipated reduced Russian Oil production in a range of 1-2 Mio. Bbl./day (Figure 13). Since June 2022 anyhow, the market calmed down and the oil price stabilized since September 2022 at a price span of about 75 to 85 USD/Bbl. Only this month the price weakened again.

Although OPEC-Plus controls only less than 50% of the total world oil production volume, the oil price is greatly triggered by the OPEC-Plus oil production volumes. In September 2022 OPEC-Plus reduced its production volumes (from 38,7 to 38 Mio. Bbl./day) (Figure 14), with the consequence that the oil price stabilized. Anyhow when in January 2023 the production volume was enlarged to 38,3 Mio. Bbl./day, the oil price weakened immediately. Now in March 2023 the OPEC-Plus, mainly Saudi Arabia, decided, due to further weakening oil prices below 70 USD/Bbl., to reduce its oil production by about 0,7 Mio. Bbl./day to a total of 37,6 Mio. Bbl./day. So far, the effect of this last reduction of production volume did not show the expected strengthening of the oil price. This reducing of the crude oil production is heavily criticised by the US and EU officials, as they fear that inflation and industrial growth will be negatively affected by raising oil prices. The energy industry is booming, Aramco, the world’s largest producer of fossil fuels, has become the world’s most valuable company in 2022. Exxon Mobile even extends its footprint in gas exploration planning to acquire the largest US based shale gas producer. Shell intends to widen its footprint in oil and gas as well. Anyhow currently, there is no evidence that the international oil and gas producers are increasing supply to capture market prices.

Efforts to reduce dependence on fossil fuels can hardly be successful in the short term and can only contribute to decoupling in the medium term. For our pipe industry, however, this means that high energy prices can be expected in the future as well - prices around 80-90 USD/Bbl. are most probable. The investments to secure the energy supply will keep the demand and prices for tubular products high.

Another driving factor is the record high global LNG export rate. Figure 15 shows for the US and Australia how record high LNG production became. Consequently the demand for OCTG products remain high and it eases the energy crisis especially in Europe to compensate the stopped Russian pipeline gas supplies.

In addition to exploration activities, the need to build new pipeline routes has also increased since the ban on Russian pipelines to Europe and the strategy towards hydrogen to replace natural gas. In the wake of the attacks on the Northstream pipelines, which released very large quantities of methane as an environmental load, it can be expected that the safety standards for pipelines will become even more demanding. This development offers the manufacturers of large-diameter pipes > 406 mm OD opportunities for interesting business. Globally a large quantity of pipelines is planned or announced to be built in the coming years up to 2027 (Figure 16).

In this context it is remarkable that most of the contractors building the worldwide pipeline projects are headquartered in China or India. The global construction market with about 5% of the global tube market presents another opportunity for pipe manufacturers with growth potential. The market penetration is quite unevenly distributed in the world and the growth pattern is greatly dependent on the regional GDP growth (Figure 17).

North America and parts of Asia are widely using tubular products for structural buildings. Europe on the other hand still designs mostly with standard concrete or steel structures. A recent study published by Global Construction Perspective and Oxford Economics, entitled “Global Construction 2030”, forecasts an 85% growth in global construction output to 15.5 trillion by 2030, with three countries, China, USA and India, leading the way and accounting for 57% of global growth alone. Europe, on the other hand, will reduce its pace of investment. There is room for additional production capacity for structural tubes, especially in India, to follow the market trend. The tube industry needs to further promote the benefits of tube applications and showcase the architectural perspectives (Figure 18).

Tubular profiles are an ideal choice when visible structures are desired due to their varied shapes and closed cross-sections combined with smooth sides. Best mechanical properties and the possibility to bridge large spans are further highlights of tube profiles. Besides round shaped structural tubes, rectangular profiles are dominating architectural applications. Such profiles are normally cold rolled and formed in so-called turks-heads. In this process great attention must be given to the metallurgical properties of the edges. Normally unalloyed steel is applied, anyhow alloyed steels with its improved material properties should also be considered.

The automotive market representing about 15% of the global tube market is a quite steady and reliable market. The car registration level in 2020, which fell due to the Corona crisis, could only be slightly increased to around 77.2 million light vehicles worldwide in 2021 and 2022 due to various challenges in the supply chain (Figure 19). According to IHS, the recovery process will take longer in the volume markets of Europe and North America. Future growth will take place primarily in Asia, especially in China. However, China could increasingly become a sales problem for the western automotive industry due to the American decoupling tendencies and strengthening local car industry in China.However, the tendency to further reduce the weight of vehicles supports the trend towards the use of tubular products. The transition towards electromobility may also support the application of tubular components since the additional weight of the batteries need to be compensated to the extend possible. The automotive industry offers a lot of attractive tubular applications.

The greatest potential for the use of tubular products (Figure 20) is seen in vehicle frames, followed by chassis and powertrains. Tube manufacturers shall endeavour to enter new vehicle series with larger volumes to further expand their presence in the light vehicle industry.

Overall, the automotive industry is challenged by the transition towards electromobility and how to keep on serving such markets where electromobility cannot be introduced due to restrictions regarding availability of electrical energy. Therefore, automotive producers will need to follow all drive technologies to prevent losing large market potentials. Environmentally friendly combustion technologies will still have its position. Political institutions such as in Europe on the other hand, set time limits to ban combustion technologies. In this field of tension, the automotive industry including its suppliers of tubular products need to find appropriate business approaches.

The mechanical engineering market segment, which accounts for around 9% of world pipe production, has developed well in line with global GDP in recent years (Figure 21). During the financial- and corona crisis, the market was characterised by higher volatility with sharper declines and quick recoveries. In 2022, the current further recovery was slowed down by geopolitical circumstances. Asia, and China in particular, although increasingly reaching self-sufficiency are still the largest markets for machinery purchases. It remains noteworthy that the Chinese industry has taken the global lead in machinery sales since the Corona crisis.

Here, the decoupling intentions of the USA must be observed since this may become a game changer for the worldwide mechanical engineering industry. The USA and Europe continue to be significant sales regions as well. This market segment certainly has the greatest variety of tube products. Cylinder-, ball bearing- and turned part tubes, to name just a few prominent representatives of this market segment, certainly show good prospects for tube producers.

Most pipe and steel producers were able to report strongly improved economic figures in 2022 in the wake of the price increases. However, for European pipe producers, the persistently higher energy cost and the additional CO2 levies agreed to be imposed by the European Community represent major challenges. Confidence in being able to compete on the world market in the future with these additional costs is dwindling among some tube producers. Some tube producers even reduce their engagement in Europe as a consequence hereto.

In general, there is enough production capacity to serve even the increased demand for tubes and pipes for all market segments. Raw material prices for the steel as well as the tube and pipe industry would seem to have peaked early 2023. Still markets are nervous with potential for further volatility.

Further challenge may be imposed, if political measures to prevent climate change are not introduced in a balanced way, with possible consequences being the migration of high energy consuming industries to lower-cost regions. Nonetheless, if the balance of supply and demand within the tubes and pipes industry is restored, price volatility can be expected to calm down.

Tube plant infrastructure with respect to tube mills and finishing lines as well as applied quality assurance systems also plays a significant role. The transition towards environmentally friendly tube production to produce carbon reduced tubes and pipes became increasingly a major task for the industry. Tube and pipe producers who have used the corona pandemic to improve their productivity, flexibility and customer service, like introducing “Industry 4.0” measures, will benefit from such measures.

With an eye to the return to something like normal, it should be noted that plant builders and technology suppliers alike find interesting business opportunities in this new and innovative market segment. Some technology suppliers have already reacted and enhanced their product portfolio with the addition of environmentally friendly and digital solutions.

The ITA organizes this May 11th and 12th an international hybrid conference in Düsseldorf under the title “Opportunities for the Tube Industry in Turbulent Times” offering an excellent platform to discuss sustainable solutions for the tube and pipe industry. The tour on 12th of May to the Benteler Dinslaken plant under the title “Sustainable Tube Production in a High-Cost Environment” is an interesting practical example hereto. The conference is a great opportunity to meet and exchange with tube producers as well as technology suppliers to the tube and pipe industry.