Market Overview

Have a look ...World Tube & Pipe Market: Factors influencing the current situation

Dr. Gunther Voswinckel – Update as per March 2022

Welcome to ITA’s and VOSCO´s regular presentation of the main worldwide economic factors influencing the tube and pipe industry.

In this article we discuss several economic consequences for the tube and pipe industry. In many regions of the world, the 4th wave, Omicron, of corona pandemic is striking the communities. Due to intensive vaccinating, worst consequences seem to be brought partly under control. In the latter months of 2021, we witnessed an impressive restart of the industry. The demand for energy is booming whereas the supply chains are still seriously disrupted. International expenditure programs, established to counteract the economic consequences of the pandemic, flooded the markets with money. And so, after a long period of financial stability, we now see signs of upcoming inflation. In consequence national banks start to cut back their expenditure programmes.

On February 24th, 2022, the Russian army started the invasion against its sovereign neighbour Ukraine. The invasion ordered by Russian President Vladimir Putin represents an escalation of the Russian-Ukrainian war that has been simmering since 2014 by extending it to the entire territory of Ukraine. As countermeasure hard sanctions were imposed on Russia. In consequence the prices for energy, gas and oil, ballooned to unknown hights with significant effect to our industry. The entire Ukrainian tube industry was shut down and some tube mills in other territories were also suspended due to the unaffordable energy costs. So far, the world economic system and structures were based on relatively free trade and the idea that economic networks prevent from warlike activities. This worldview is being put to the test with unforeseen consequences for global free trade. However, the reconsideration of the world oil and gas supplies will not only provide new challenges to our industry but also possible chances for future business.

After a disastrous 2020, characterized by shrinking market demand, some tube and pipe producers closed their production facilities. By contrast, 2021 has been defined by increased demand, followed by an enormous price and cost rally combined with deficits in the supply chains. The price and cost surges peaked in fall 2021, although supply chains and energy costs still present challenges. However, the market in principle provides enough tube and pipe producing capacity to serve the demand, and so will likely calm down as soon as demand and supply can be balanced again.

Still, energy costs will remain challenging for high energy consuming industries like the steel tube and pipe industry. Possible consequence may be the migration of high energy consuming industries to lower cost regions. Producers with unique production advantages may counter such trend. Strategic measures for our industry are consequently quite demanding. Lean and agile organizations with flexible, customer-orientated production facilities as well as adequate agile purchasing strategies are the best answer to demanding and volatile market requirements. Agile digital solutions in the spirit of “Industry 4.0” offer further opportunities to stay successful.

The International Tube Association organized several well attended webinars in 2020 and 2021 as well as the virtual fair “ITA netForum” to substitute the cancelled TUBE Düsseldorf 2020 to keep the exchange of our industry ongoing. This August 2021 new technologies for the application of pipelines for hydrogen were successfully presented at a webinar organized by the ITA Indian chapter. The event was well attended by many colleagues from the tube and pipe industry.We are now looking forward for great exchange of our industry at our world largest tube and pipe show “Tube Düsseldorf 2022” which takes place from June 20th to 24th 2022.

The overall economic recovery in 2021 had also positive effects on our tube and pipe industry. Interestingly the collapse of many supply chains supported the trend towards local supplies. After 2020, a disastrous year for the tube and pipe industry, 2021 showed a slight recovery of the tube and pipe market of + 5% (Fig.1). USA (+10%) and Japan (+10%) had the best recovery. (It must be mentioned that the tube production figures 2021 were partially estimated, since not all regions were providing their official data.)

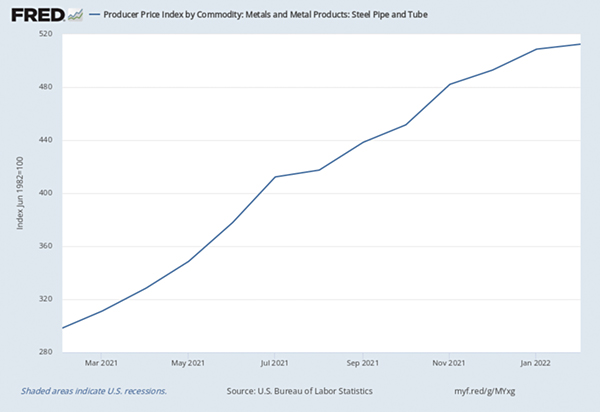

The increased demand on one hand, and the fact, that some production facilities were put idle, led to a significant price increase for tubes and pipes on the spot market (Fig 2).

The pipe price index inclined by about 80% since January 2021. Anyhow long-term pipe contracts could not benefit from such pipe price increases on the spot market. By contrast to this, most pipe produces were suffering from the fact, that they were not able to pass on price increases for their production cost (e.g., increased energy and material prices). In the major 3 tube and pipe production segments, the following production volumes were reported. The seamless market recovered by about + 6%. The most significant incline was reported for seamless pipes in the USA (+22%) and Japan (+15%). Welded pipes >16” OD (>406mm), with losses of up to 27% in 2020, the market recovered by about 8% in 2021. Japan reported the best recovery (+23%). Just Europe still had a major production decline (– 15%) in 2021 (Fig. 3).

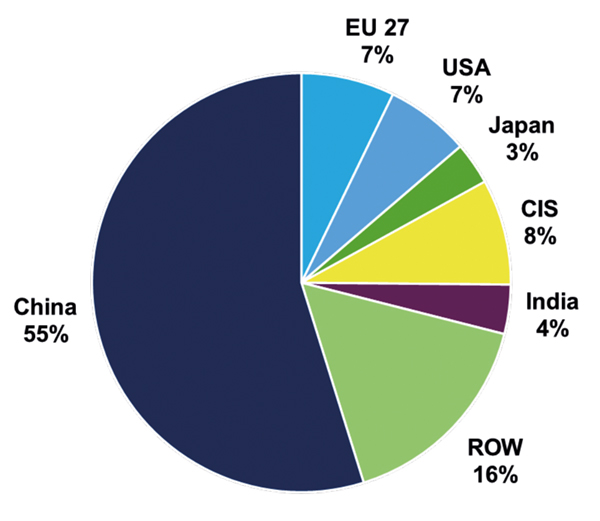

Welded Pipes (more then 406 mm), by far the largest market segment reported a world production increase of 4%. Here Europe (+10%) and USA (+8%) were reporting the largest increases, The world tube and pipe production 2021 is dominated by China with a proportion of 55% of the entire world production (Fig. 4)!

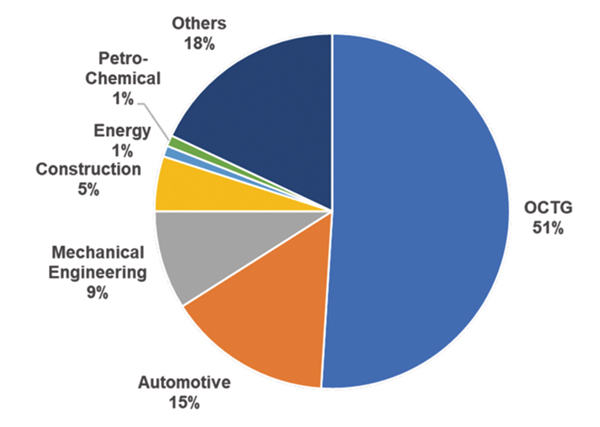

Considering the trends of the major tube and pipe market segments (Fig 5), we will briefly discuss the segments OCTG, automotive, mechanical engineering and civil construction.

The industry in 2021 had an impressive restart, led by China, and followed by other regions, particularly the USA and Europe. Consequently, the need for energy supplies such as oil and gas ballooned, with direct implications for energy prices and the demand for OCTG tubes and pipes (51% of the total market).

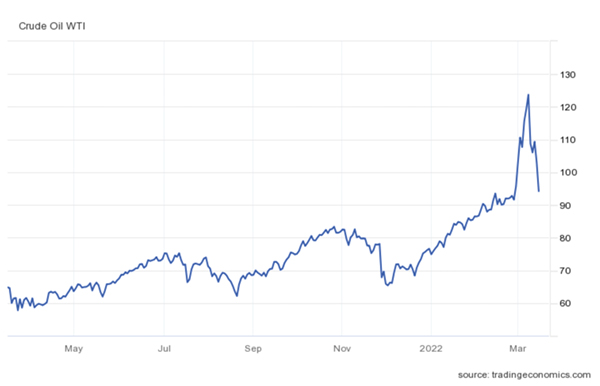

The Western Texas Immediate (WTI) crude oil price boomed from January 2021, 55 US$/Bbl, by 160%, climbing to 88 US$/Bbl on 3rd of February 2022(Fig. 6). On February 24th, 2022, the Russian army started the invasion against its sovereign neighbour Ukraine. The invasion ordered by Russian President Vladimir Putin represents an escalation of the Russian-Ukrainian war that has been simmering since 2014 by extending it to the entire territory of Ukraine. As countermeasure hard sanctions were imposed on Russia. In consequence the prices for energy, gas and oil ballooned to unknown hights of almost 130 US$/Bbl (Fig. 6) on March 8th ,2022. The envisaged shortage of oil and gas supplies let the US and European governments restart talks with the former sanctioned oil producing countries Venezuela and Iran to possibly replace the Russian oil supplies. Somehow the world is suffering from some political leaders of the oil and gas producing countries. These perspectives and the reappearance of corona in some major Chinese cities released some of the oil price pressure to an oil price of about 95 US$/Bbl these days.

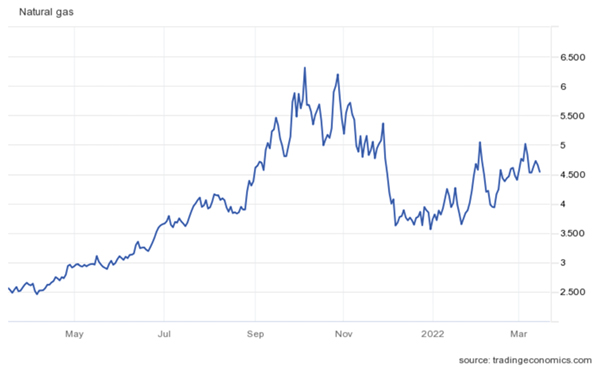

Increased demand from Asia and speculations about the availability of the pipeline Northstream 2 causing relative empty gas reservoirs in Europe, has also created a boom in gas prices in 4th quarter 2021, who slowed down by the yearend. Now, since the conflict between Russia and Ukraine has broken out, the gas price is raising again (Fig. 7).

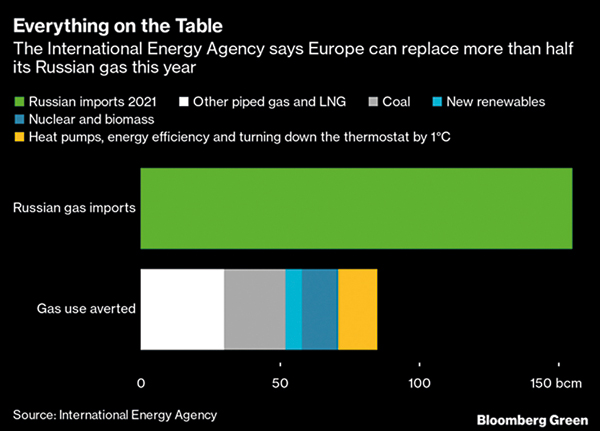

The Asian demand for Liquified Natural Gas (LNG) especially from the USA is enormous. Since April 2021 the Gas price had a rally from 2.5 to 6.3 US$/MMBtu (+250%), calming down to 3.8 US$ in January 2022 (Fig. 7). When the Russian Invasion started on 24th of February, the gas price went up again to 5 US$/MMBtu. Especially European countries like Germany depend significantly on Russian oil and gas supplies. Due to the Russian invasion into the Ukraine, Europe is looking how to substitute the gas supplies. First action taken was the suspension of the Northstream 2 pipeline. The international Energy Agency highlighted a possible alternative to replace about half of the Russian supplies. Anyhow still a growing appetite for gas consumption is enormous, the March flows of gas has averaged about 30% higher than February 2022.

So far, the world economic system and structures were based on relatively free trade and the philosophy that economic networks prevent from warlike activities. This worldview is being put to the test with still unforeseeable consequences for global free trade. However, the reconsideration of the world oil and gas supplies will not only provide new challenges to our industry but also possible chances for future business.

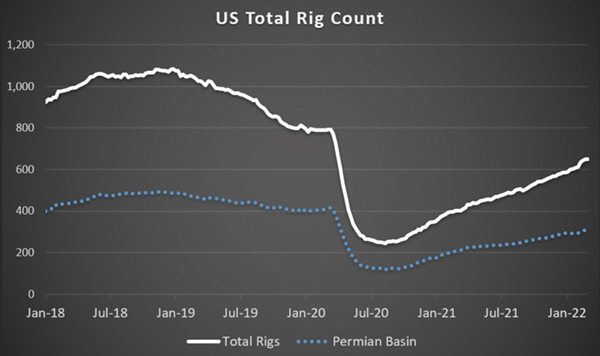

The price rally of oil and gas have had a considerable effect on the number of oil and gas rigs in operation. Since the number of new oil and gas rigs itself is directly linked to the price of oil and gas, the recent price boom caused that the number of oil and gas rigs has significantly increased since October 2020 (Fig.9).

In the US, the rig count after a height of 1050 in 2018, declined, following the oil price, down to a minimum of 220 in July 2020. Since then, when the oils and gas prices started their price rally, the number of rigs inclined again to 650 dominated by the Permian Basin with about 310 as per 4th of March 2022. Other regions in the world showed similar trends.

The consumption of OCTG tubes and pipes with a diameter more then 16” is, as shown in our previous articles, dependant on the number of rigs, as well as the depth of drilling and the capacity of the rigs. Therefore, the demand for OCTG tubes and pipes is booming as well, leading to significant price increases for our industry (Fig.2).

The essential question right now is how sustainable are these high oil and gas prices and the associated high consumption of OCTG tubes and pipes? We should bear in mind that, besides the revitalisation of the industry across the world, effects such as political aggressions and intervention as well as speculation are currently driving prices. This includes, for example, supply shortages by OPEC and other oil- and gas-producing countries and political risks. In addition, we can see market speculations and possible preparations for the raid on Ukraine, which led to almost empty gas reserves in Europe since importers were speculating on falling gas producer prices. Either way, it’s to be assumed that as soon as the supply and demand ecosystem regains its balance, prices will calm down again, with consequences for the OCTG tube and pipe demand.

The consumption of pipes > 16” OD depends to a major extend on the pipeline kilometres built. This market segment is project based and very much depending on political strategies and availability of financial resources in the relevant regions of the world. The ownership of pipelines is dominated by state-owned enterprises and such companies may be somewhat insulated from the market forces that are impacting the publicly traded oil majors. The global pipeline expansion has slowed down in the past years and some projects were delayed due to the covid pandemic (Fig. 10).

Overall, however the pipeline expansion curve has been bent rather than broken, with pipelines continuing enjoying both political and financial support by governments and major financial institutions. Anyhow pipelines are losing their social license. Intense opposition from landowners, climate activists and sometimes indigenous groups are causing the cancellation or delay of high-profile pipelines. This to an extend is also changing perceptions of pipelines as a safe investment. A prominent example is the cancellation of the US Keystone XL pipeline.

A planned 212.000 km expansion in the global system of oil and gas transmission pipelines, amounting to US$ 1trillion in capital expenditures, is on a collision course with commitments by most large economies about transition to carbon neutrality by mid-century. China, Europe, Japan and Korea have committed to achieve net zero emission within the lifespan of pipeline infrastructure currently being processed. This raises the possibility that such planned projects, if built, may be permanently retired. Even though the recent political developments may become a game changer and set entire new priorities. The following table shows the present situation regarding pipeline projects around the world. On one side we can see the dominance of gas projects (ab. 83%), on the other side a quite inhomogeneous spread of projects around the world. Asia Pacific, dominated by China and North America are the centres of pipeline project activities. Russia as one of the main oil and gas producing countries seems to reduce its supply dependence from Europe in favour of Asia by building oil and gas pipelines to the Asian destinations.

Considering, that the overall utilisation of pipe production plants for pipeline pipes > 16” is around 30% only, it can be assumed, that such plants without unique locations or technologies are critical regarding their future prospects (Fig 11). The second largest market segment for tubes and pipes is the automotive market with about 15% market share.

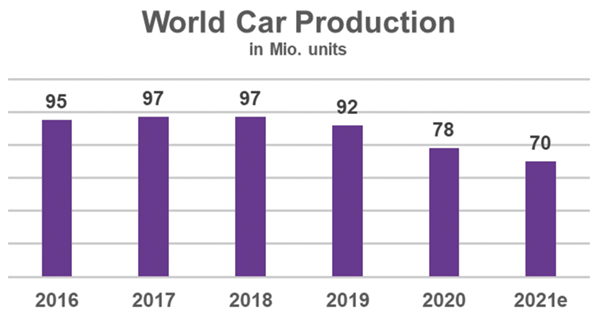

The automotive production in 2020 was heavily hit by the corona pandemic. Many OEM´s and their suppliers production plants had to face temporary shutdowns with the consequence that the automotive deliveries declined by about 15% (Fig.12). In 2021, when the industry restarted, it was expected, that the automotive industry would restart with the same pace as well. The market demand was recovering, anyhow the automobile industry could not manage their supply chains to serve the increasing demand from the market. Mainly IT parts, such as microprocessors created a serious bottleneck for the industry. Consequently, the automotive production declined by another 10% in 2021. The tube and pipe industry was very hardly hit by this supply volume decline in combination with the significant cost increases for energy and raw material. If we look at hot rolled coil prices, we see a major challenge for ERW pipes. Since September 2020 the prices have gone up by about 340%, from 450 US$/ton to a peak of about 1500 US$/ton in November 2021. Since than the prices for hot rolled coils had a moderate decline on high level. Now the prices raise again. The OEM´s on the other side could compensate their production volumes by concentrating on premium segment vehicles maintaining good commercial results. Anyhow we assume that despite the present turbulences, the automotive industry will remain an attractive market segment, since the market demand will maintain high levels and the automotive production will recover as soon as the supply chains are in order again.

Other relevant markets for tubes and pipes are currently not experiencing such spectacular volatility but are nonetheless displaying positive trends.

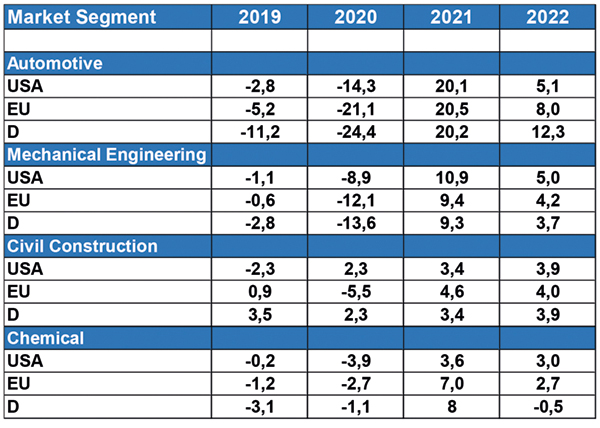

The market segment mechanical engineering, representing about 9% of the total tube and pipe market, lost about 12% of its volume in 2020. 2021 so far has not been able to compensate for such losses, and it’s expected that pre-pandemic levels will only be reached again in 2022 (Fig.13). Some investments in mechanical engineering products are still delayed due to uncertainties within consequences due to the corona pandemic.

Another attractive market for tube and pipe producers is the civil construction market, representing about 5% of the world tube production. The impact of the pandemic on this market segment was much less severe in 2020. Some regions, such as the USA, managed to avoid negative growth altogether. The construction market is steadily growing along with GDP growth, and it’s expected that 2021 and 2022 will see expansion continue at a moderate level of 3-4%.

All market segments nonetheless still suffer from supply chain challenges and rising costs. The problems in supply chains, especially from remote Far East sources, have prompted businesses and industries to buy local. Shipping costs are booming as well, and containers represent a serious bottle neck. The USA in consequence forecast an increase in local supply of about 10-12% (approx. 443 billion US$).

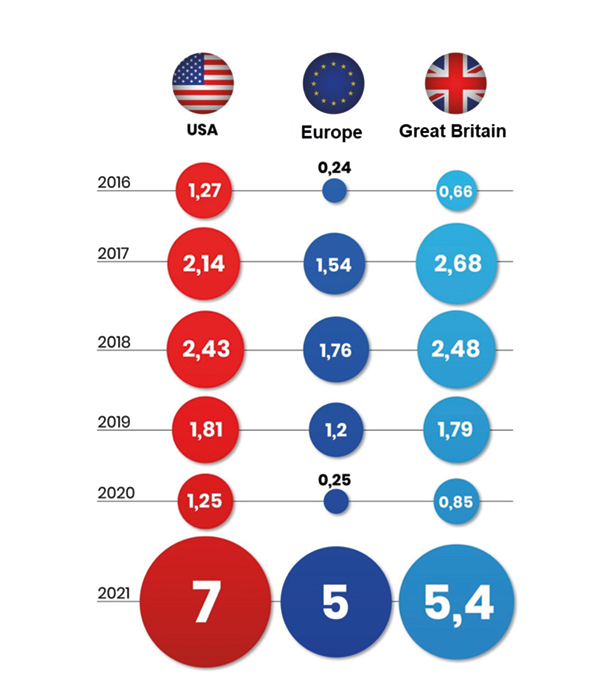

Driven by the prices for energy, cars and raw materials, inflation is on the rise (Fig. 14). In the USA this year the inflation rate reached 7% (target 2%). This is the biggest increase since June 1992. The US central bank is now planning to restrict its loose monetary policy.

Even in Europe inflation rate has reached 5% by the end of 2021. Great Britain reached some 5,4% by 2021. Since the inflation seems not to calm down as the 2022 figures show, countermeasures need to be taken by central banks to prompt such galloping inflation.

In general, there is enough production capacity to serve even the increased demand for tubes and pipes for all market segments. Raw material prices for the steel as well as the tube and pipe industry would seem to have peaked by the end of 2021. Energy costs, however, remain high and climb even further since market interventions (e.g. OPEC plus) and warlike actions call free world trade into question. Further challenge may be imposed, if political measures to prevent climate change are not introduced in a balanced way. These effects may also push inflation rates still higher, with possible consequences being the migration of high energy consuming industries to lower-cost regions. Nonetheless, if the balance of supply and demand within the tubes and pipes industry can be restored, price volatility can be expected to calm down.

Tube plant infrastructure with respect to tube mills and finishing lines as well as applied quality assurance systems also plays a significant role. Growing importance can be attributed to agile management strategies regarding customer benefit, process and product quality enhancement as well as purchasing processes by applying “Industry 4.0” measures.

With an eye to the return to something like normal, it should be noted that plant builders and technology suppliers alike may find interesting business opportunities in this new market segment. Some technology suppliers have already reacted and enhanced their product portfolio with the addition of digital solutions. The International Tube Association organized several well attended webinars in 2020 and 2021 to keep the exchange within our industry ongoing. Some interesting applications of “Industry 4.0” in the tube and pipe industry were presented by various companies at the ITA netForum which was organized to substitute the cancelled TUBE 2020 in Düsseldorf. August 2021 new technologies for the application of pipelines for hydrogen were successfully presented at the webinar organized by the ITA Indian chapter. The event was well attended by many colleagues from the tube and pipe industry.

It is good to realize, that besides the virtual exchange in our industry, such as the webinars organized by the International Tube Association (ITA) now again hybrid or even personal events for industrial exchange take place.

We are looking forward meeting tube producers as well as suppliers to the tube and pipe industry at our world largest tube and pipe show “Tube Düsseldorf 2022” which takes place from June 20th to 24th 2022.

Dr. Gunther Voswinckel

In this article we discuss several economic consequences for the tube and pipe industry. In many regions of the world, the 4th wave, Omicron, of corona pandemic is striking the communities. Due to intensive vaccinating, worst consequences seem to be brought partly under control. In the latter months of 2021, we witnessed an impressive restart of the industry. The demand for energy is booming whereas the supply chains are still seriously disrupted. International expenditure programs, established to counteract the economic consequences of the pandemic, flooded the markets with money. And so, after a long period of financial stability, we now see signs of upcoming inflation. In consequence national banks start to cut back their expenditure programmes.

On February 24th, 2022, the Russian army started the invasion against its sovereign neighbour Ukraine. The invasion ordered by Russian President Vladimir Putin represents an escalation of the Russian-Ukrainian war that has been simmering since 2014 by extending it to the entire territory of Ukraine. As countermeasure hard sanctions were imposed on Russia. In consequence the prices for energy, gas and oil, ballooned to unknown hights with significant effect to our industry. The entire Ukrainian tube industry was shut down and some tube mills in other territories were also suspended due to the unaffordable energy costs. So far, the world economic system and structures were based on relatively free trade and the idea that economic networks prevent from warlike activities. This worldview is being put to the test with unforeseen consequences for global free trade. However, the reconsideration of the world oil and gas supplies will not only provide new challenges to our industry but also possible chances for future business.

After a disastrous 2020, characterized by shrinking market demand, some tube and pipe producers closed their production facilities. By contrast, 2021 has been defined by increased demand, followed by an enormous price and cost rally combined with deficits in the supply chains. The price and cost surges peaked in fall 2021, although supply chains and energy costs still present challenges. However, the market in principle provides enough tube and pipe producing capacity to serve the demand, and so will likely calm down as soon as demand and supply can be balanced again.

Still, energy costs will remain challenging for high energy consuming industries like the steel tube and pipe industry. Possible consequence may be the migration of high energy consuming industries to lower cost regions. Producers with unique production advantages may counter such trend. Strategic measures for our industry are consequently quite demanding. Lean and agile organizations with flexible, customer-orientated production facilities as well as adequate agile purchasing strategies are the best answer to demanding and volatile market requirements. Agile digital solutions in the spirit of “Industry 4.0” offer further opportunities to stay successful.

The International Tube Association organized several well attended webinars in 2020 and 2021 as well as the virtual fair “ITA netForum” to substitute the cancelled TUBE Düsseldorf 2020 to keep the exchange of our industry ongoing. This August 2021 new technologies for the application of pipelines for hydrogen were successfully presented at a webinar organized by the ITA Indian chapter. The event was well attended by many colleagues from the tube and pipe industry.We are now looking forward for great exchange of our industry at our world largest tube and pipe show “Tube Düsseldorf 2022” which takes place from June 20th to 24th 2022.

The overall economic recovery in 2021 had also positive effects on our tube and pipe industry. Interestingly the collapse of many supply chains supported the trend towards local supplies. After 2020, a disastrous year for the tube and pipe industry, 2021 showed a slight recovery of the tube and pipe market of + 5% (Fig.1). USA (+10%) and Japan (+10%) had the best recovery. (It must be mentioned that the tube production figures 2021 were partially estimated, since not all regions were providing their official data.)

The increased demand on one hand, and the fact, that some production facilities were put idle, led to a significant price increase for tubes and pipes on the spot market (Fig 2).

The pipe price index inclined by about 80% since January 2021. Anyhow long-term pipe contracts could not benefit from such pipe price increases on the spot market. By contrast to this, most pipe produces were suffering from the fact, that they were not able to pass on price increases for their production cost (e.g., increased energy and material prices). In the major 3 tube and pipe production segments, the following production volumes were reported. The seamless market recovered by about + 6%. The most significant incline was reported for seamless pipes in the USA (+22%) and Japan (+15%). Welded pipes >16” OD (>406mm), with losses of up to 27% in 2020, the market recovered by about 8% in 2021. Japan reported the best recovery (+23%). Just Europe still had a major production decline (– 15%) in 2021 (Fig. 3).

Welded Pipes (more then 406 mm), by far the largest market segment reported a world production increase of 4%. Here Europe (+10%) and USA (+8%) were reporting the largest increases, The world tube and pipe production 2021 is dominated by China with a proportion of 55% of the entire world production (Fig. 4)!

Considering the trends of the major tube and pipe market segments (Fig 5), we will briefly discuss the segments OCTG, automotive, mechanical engineering and civil construction.

The industry in 2021 had an impressive restart, led by China, and followed by other regions, particularly the USA and Europe. Consequently, the need for energy supplies such as oil and gas ballooned, with direct implications for energy prices and the demand for OCTG tubes and pipes (51% of the total market).

The Western Texas Immediate (WTI) crude oil price boomed from January 2021, 55 US$/Bbl, by 160%, climbing to 88 US$/Bbl on 3rd of February 2022(Fig. 6). On February 24th, 2022, the Russian army started the invasion against its sovereign neighbour Ukraine. The invasion ordered by Russian President Vladimir Putin represents an escalation of the Russian-Ukrainian war that has been simmering since 2014 by extending it to the entire territory of Ukraine. As countermeasure hard sanctions were imposed on Russia. In consequence the prices for energy, gas and oil ballooned to unknown hights of almost 130 US$/Bbl (Fig. 6) on March 8th ,2022. The envisaged shortage of oil and gas supplies let the US and European governments restart talks with the former sanctioned oil producing countries Venezuela and Iran to possibly replace the Russian oil supplies. Somehow the world is suffering from some political leaders of the oil and gas producing countries. These perspectives and the reappearance of corona in some major Chinese cities released some of the oil price pressure to an oil price of about 95 US$/Bbl these days.

Increased demand from Asia and speculations about the availability of the pipeline Northstream 2 causing relative empty gas reservoirs in Europe, has also created a boom in gas prices in 4th quarter 2021, who slowed down by the yearend. Now, since the conflict between Russia and Ukraine has broken out, the gas price is raising again (Fig. 7).

The Asian demand for Liquified Natural Gas (LNG) especially from the USA is enormous. Since April 2021 the Gas price had a rally from 2.5 to 6.3 US$/MMBtu (+250%), calming down to 3.8 US$ in January 2022 (Fig. 7). When the Russian Invasion started on 24th of February, the gas price went up again to 5 US$/MMBtu. Especially European countries like Germany depend significantly on Russian oil and gas supplies. Due to the Russian invasion into the Ukraine, Europe is looking how to substitute the gas supplies. First action taken was the suspension of the Northstream 2 pipeline. The international Energy Agency highlighted a possible alternative to replace about half of the Russian supplies. Anyhow still a growing appetite for gas consumption is enormous, the March flows of gas has averaged about 30% higher than February 2022.

So far, the world economic system and structures were based on relatively free trade and the philosophy that economic networks prevent from warlike activities. This worldview is being put to the test with still unforeseeable consequences for global free trade. However, the reconsideration of the world oil and gas supplies will not only provide new challenges to our industry but also possible chances for future business.

The price rally of oil and gas have had a considerable effect on the number of oil and gas rigs in operation. Since the number of new oil and gas rigs itself is directly linked to the price of oil and gas, the recent price boom caused that the number of oil and gas rigs has significantly increased since October 2020 (Fig.9).

In the US, the rig count after a height of 1050 in 2018, declined, following the oil price, down to a minimum of 220 in July 2020. Since then, when the oils and gas prices started their price rally, the number of rigs inclined again to 650 dominated by the Permian Basin with about 310 as per 4th of March 2022. Other regions in the world showed similar trends.

The consumption of OCTG tubes and pipes with a diameter more then 16” is, as shown in our previous articles, dependant on the number of rigs, as well as the depth of drilling and the capacity of the rigs. Therefore, the demand for OCTG tubes and pipes is booming as well, leading to significant price increases for our industry (Fig.2).

The essential question right now is how sustainable are these high oil and gas prices and the associated high consumption of OCTG tubes and pipes? We should bear in mind that, besides the revitalisation of the industry across the world, effects such as political aggressions and intervention as well as speculation are currently driving prices. This includes, for example, supply shortages by OPEC and other oil- and gas-producing countries and political risks. In addition, we can see market speculations and possible preparations for the raid on Ukraine, which led to almost empty gas reserves in Europe since importers were speculating on falling gas producer prices. Either way, it’s to be assumed that as soon as the supply and demand ecosystem regains its balance, prices will calm down again, with consequences for the OCTG tube and pipe demand.

The consumption of pipes > 16” OD depends to a major extend on the pipeline kilometres built. This market segment is project based and very much depending on political strategies and availability of financial resources in the relevant regions of the world. The ownership of pipelines is dominated by state-owned enterprises and such companies may be somewhat insulated from the market forces that are impacting the publicly traded oil majors. The global pipeline expansion has slowed down in the past years and some projects were delayed due to the covid pandemic (Fig. 10).

Overall, however the pipeline expansion curve has been bent rather than broken, with pipelines continuing enjoying both political and financial support by governments and major financial institutions. Anyhow pipelines are losing their social license. Intense opposition from landowners, climate activists and sometimes indigenous groups are causing the cancellation or delay of high-profile pipelines. This to an extend is also changing perceptions of pipelines as a safe investment. A prominent example is the cancellation of the US Keystone XL pipeline.

A planned 212.000 km expansion in the global system of oil and gas transmission pipelines, amounting to US$ 1trillion in capital expenditures, is on a collision course with commitments by most large economies about transition to carbon neutrality by mid-century. China, Europe, Japan and Korea have committed to achieve net zero emission within the lifespan of pipeline infrastructure currently being processed. This raises the possibility that such planned projects, if built, may be permanently retired. Even though the recent political developments may become a game changer and set entire new priorities. The following table shows the present situation regarding pipeline projects around the world. On one side we can see the dominance of gas projects (ab. 83%), on the other side a quite inhomogeneous spread of projects around the world. Asia Pacific, dominated by China and North America are the centres of pipeline project activities. Russia as one of the main oil and gas producing countries seems to reduce its supply dependence from Europe in favour of Asia by building oil and gas pipelines to the Asian destinations.

Considering, that the overall utilisation of pipe production plants for pipeline pipes > 16” is around 30% only, it can be assumed, that such plants without unique locations or technologies are critical regarding their future prospects (Fig 11). The second largest market segment for tubes and pipes is the automotive market with about 15% market share.

The automotive production in 2020 was heavily hit by the corona pandemic. Many OEM´s and their suppliers production plants had to face temporary shutdowns with the consequence that the automotive deliveries declined by about 15% (Fig.12). In 2021, when the industry restarted, it was expected, that the automotive industry would restart with the same pace as well. The market demand was recovering, anyhow the automobile industry could not manage their supply chains to serve the increasing demand from the market. Mainly IT parts, such as microprocessors created a serious bottleneck for the industry. Consequently, the automotive production declined by another 10% in 2021. The tube and pipe industry was very hardly hit by this supply volume decline in combination with the significant cost increases for energy and raw material. If we look at hot rolled coil prices, we see a major challenge for ERW pipes. Since September 2020 the prices have gone up by about 340%, from 450 US$/ton to a peak of about 1500 US$/ton in November 2021. Since than the prices for hot rolled coils had a moderate decline on high level. Now the prices raise again. The OEM´s on the other side could compensate their production volumes by concentrating on premium segment vehicles maintaining good commercial results. Anyhow we assume that despite the present turbulences, the automotive industry will remain an attractive market segment, since the market demand will maintain high levels and the automotive production will recover as soon as the supply chains are in order again.

Other relevant markets for tubes and pipes are currently not experiencing such spectacular volatility but are nonetheless displaying positive trends.

The market segment mechanical engineering, representing about 9% of the total tube and pipe market, lost about 12% of its volume in 2020. 2021 so far has not been able to compensate for such losses, and it’s expected that pre-pandemic levels will only be reached again in 2022 (Fig.13). Some investments in mechanical engineering products are still delayed due to uncertainties within consequences due to the corona pandemic.

Another attractive market for tube and pipe producers is the civil construction market, representing about 5% of the world tube production. The impact of the pandemic on this market segment was much less severe in 2020. Some regions, such as the USA, managed to avoid negative growth altogether. The construction market is steadily growing along with GDP growth, and it’s expected that 2021 and 2022 will see expansion continue at a moderate level of 3-4%.

All market segments nonetheless still suffer from supply chain challenges and rising costs. The problems in supply chains, especially from remote Far East sources, have prompted businesses and industries to buy local. Shipping costs are booming as well, and containers represent a serious bottle neck. The USA in consequence forecast an increase in local supply of about 10-12% (approx. 443 billion US$).

Driven by the prices for energy, cars and raw materials, inflation is on the rise (Fig. 14). In the USA this year the inflation rate reached 7% (target 2%). This is the biggest increase since June 1992. The US central bank is now planning to restrict its loose monetary policy.

Even in Europe inflation rate has reached 5% by the end of 2021. Great Britain reached some 5,4% by 2021. Since the inflation seems not to calm down as the 2022 figures show, countermeasures need to be taken by central banks to prompt such galloping inflation.

In general, there is enough production capacity to serve even the increased demand for tubes and pipes for all market segments. Raw material prices for the steel as well as the tube and pipe industry would seem to have peaked by the end of 2021. Energy costs, however, remain high and climb even further since market interventions (e.g. OPEC plus) and warlike actions call free world trade into question. Further challenge may be imposed, if political measures to prevent climate change are not introduced in a balanced way. These effects may also push inflation rates still higher, with possible consequences being the migration of high energy consuming industries to lower-cost regions. Nonetheless, if the balance of supply and demand within the tubes and pipes industry can be restored, price volatility can be expected to calm down.

Tube plant infrastructure with respect to tube mills and finishing lines as well as applied quality assurance systems also plays a significant role. Growing importance can be attributed to agile management strategies regarding customer benefit, process and product quality enhancement as well as purchasing processes by applying “Industry 4.0” measures.

With an eye to the return to something like normal, it should be noted that plant builders and technology suppliers alike may find interesting business opportunities in this new market segment. Some technology suppliers have already reacted and enhanced their product portfolio with the addition of digital solutions. The International Tube Association organized several well attended webinars in 2020 and 2021 to keep the exchange within our industry ongoing. Some interesting applications of “Industry 4.0” in the tube and pipe industry were presented by various companies at the ITA netForum which was organized to substitute the cancelled TUBE 2020 in Düsseldorf. August 2021 new technologies for the application of pipelines for hydrogen were successfully presented at the webinar organized by the ITA Indian chapter. The event was well attended by many colleagues from the tube and pipe industry.

It is good to realize, that besides the virtual exchange in our industry, such as the webinars organized by the International Tube Association (ITA) now again hybrid or even personal events for industrial exchange take place.

We are looking forward meeting tube producers as well as suppliers to the tube and pipe industry at our world largest tube and pipe show “Tube Düsseldorf 2022” which takes place from June 20th to 24th 2022.

Dr. Gunther Voswinckel