Market Overview

Have a look ...World Tube & Pipe Market: Factors influencing the current situation

Dr. Gunther Voswinckel – Update as per april 2024

Welcome to ITA’s and VOSCO´s regular presentation of the main worldwide economic factors influencing the tube and pipe industry.

The Russian invasion into the Ukraine in 2022 and its consequences are still creating challenges for the industry. The war between Hamas and Israel recently started October 2023 is another conflict threatening the world. So far, no consequences on the energy prices are to be seen since all involved parties manage to keep this conflict local without interference to other middle east countries. Increasing tension between the US and China officials create further clouds for free international trade. Political interventions and regulations are increasingly influencing industrial strategies and actions.

The necessary transition to environmentally friendly and carbon reduced production became a central mission of the industry. The consequences on the cost increases are unevenly distributed across the world. Europe is challenged by persistently high energy prices and levies on carbon intensive industries. Regions such as the USA, India, Turkey and China are benefiting from lower energy cost. The high level of public debt caused by the expensive measures taken to overcome the various crisis in recent years give rise to fears that the central banks’ effectiveness in combating inflation will be limited and that the target value of 2% can therefore not be expected in short term. All these unexpected challenges are difficult to manage.

Many tube and pipe producers were able to report improved profits in 2023, but in Europe high energy prices and CO2 levies are weighing on tube and pipe producers. Due to the dynamics of these developments, it is usually very difficult for the producers to react appropriately. Some manufacturers are losing confidence to compete on the global market with these additional costs and consequently even reduce their involvement in Europe. As a result, some countries/regions are looking for suitable political countermeasures to compensate for their cost disadvantages.

Whereas previously only quality, delivery time and costs were decisive, now geopolitical and logistical risk considerations as well as current and future energy costs are increasingly taking centre stage. All sources of supply are being critically scrutinised, and one can only hope and warn that international trade will not suffer too much as a result. In particular, the regional differences in energy prices will have an impact on the current landscape of the energy-intensive steel as well as tube and pipe industry.

However, disruptive times also always create new opportunities for economic success. New markets such as carbon capture utilisation and storage (CCUS), new networks for hydrogen transportation, electromobility and productivity improvements at production sites as part of the transformation towards more environmentally friendly plants offer opportunities that should be seized.

Availability of economical energy is a decisive factor for the industry. Geopolitical turbulences and political regulations have changed the regional balance with increasing challenges for the industry in regions with higher energy cost. This may change the industrial landscape of the energy intensive industry with significant future consequences.

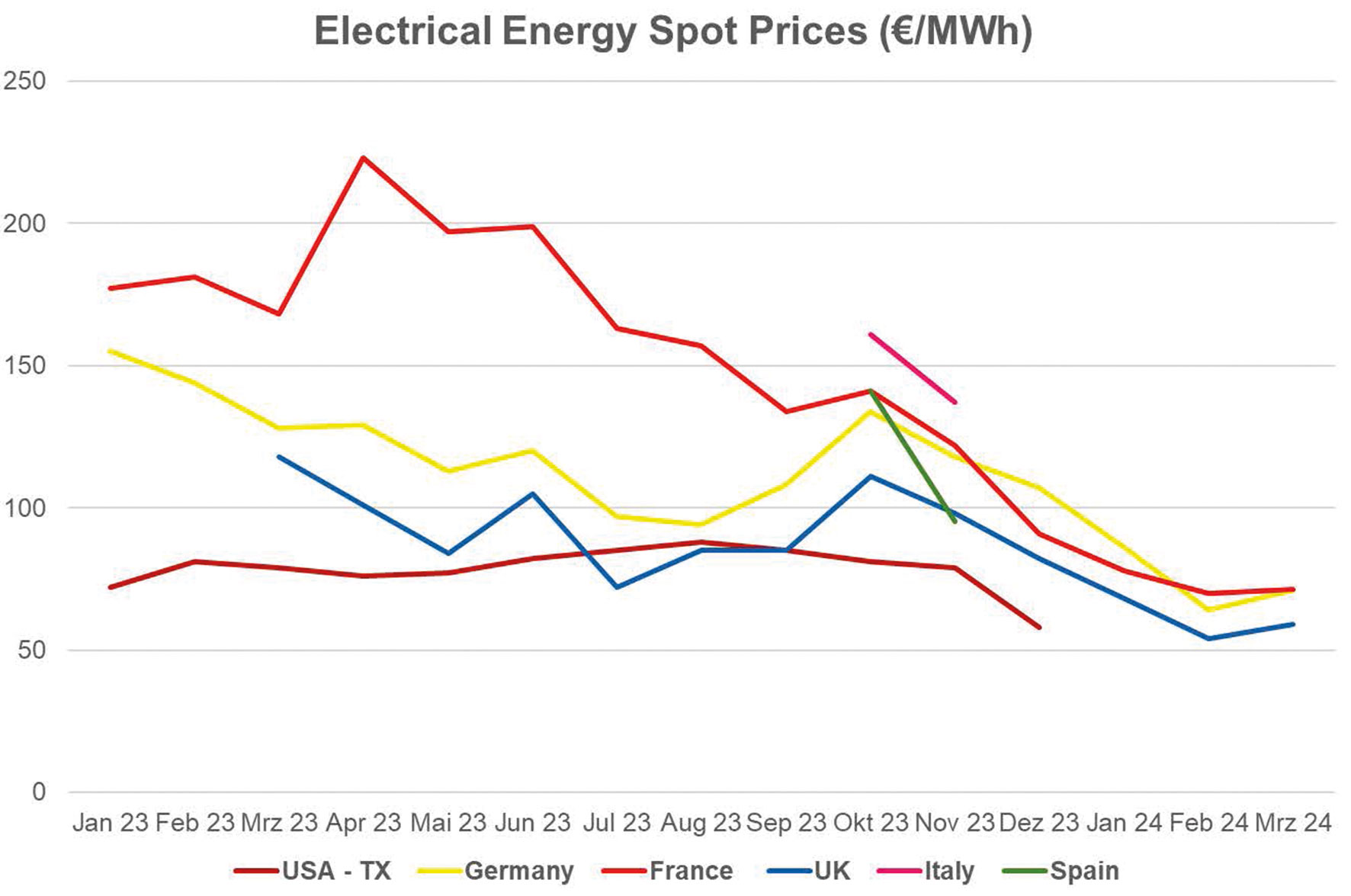

The prices for electrical energy in Europe, after turbulent periods, is now reported at a level of about 70 €/MWh with remarkable volatility (Figure 1). Considering significant lower price levels in other parts of the world, e.g. USA about 20-30 €/MWh less, it is obvious that the environmental driven trend towards electrical energy in Europe is loaded by cost burdens. Measures to improve production efficiency need to be introduced to prompt such disadvantages.

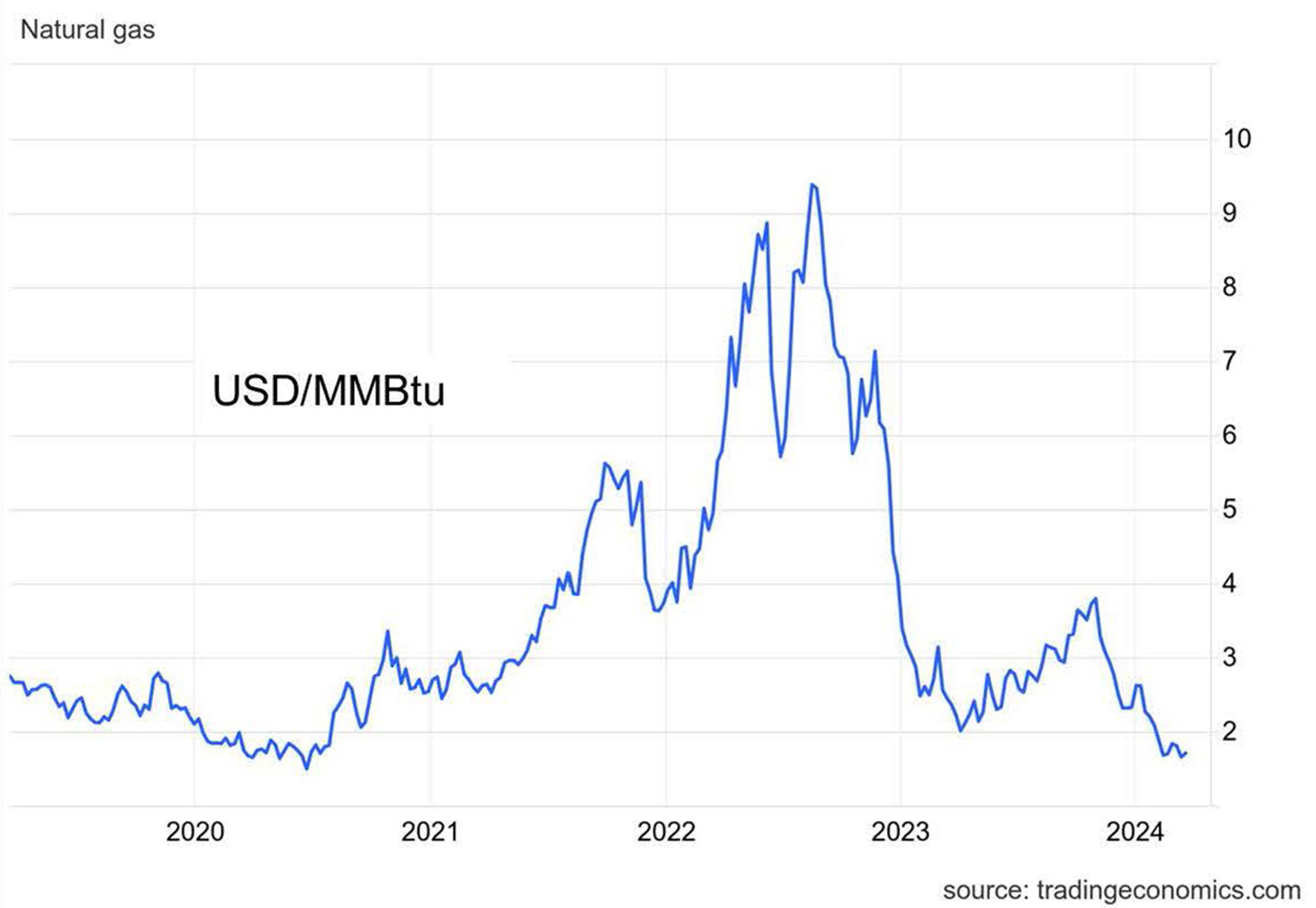

Cost of natural gas, after turbulent times climbing in 2022 up to levels higher than 9 USD/MMBtu and another sharp increase in 2023 up to 4 USD/MMBtu, has now calmed down to a level of about 1,7 USD/MMBtu, which is the same price range as early 2020 (Figure 2). This is good news for gas intensive industries and gas power plants. Europe anyhow, originally being supplied by Russian gas via pipelines at good values, now sources its gas needs to a great extend as LNG. Just Austria and Poland still source their natural gas via Jamal pipeline from Russia.

The conflict in middle east, the war between Hamas and Israel, still does not have measurable impact on the gas prices. The involved parties seem to succeed in limiting the conflict local without being spread out to other middle east countries. The original concerns of analysts about possible upcoming consequences like in earlier conflicts in the middle east seem so far under control.

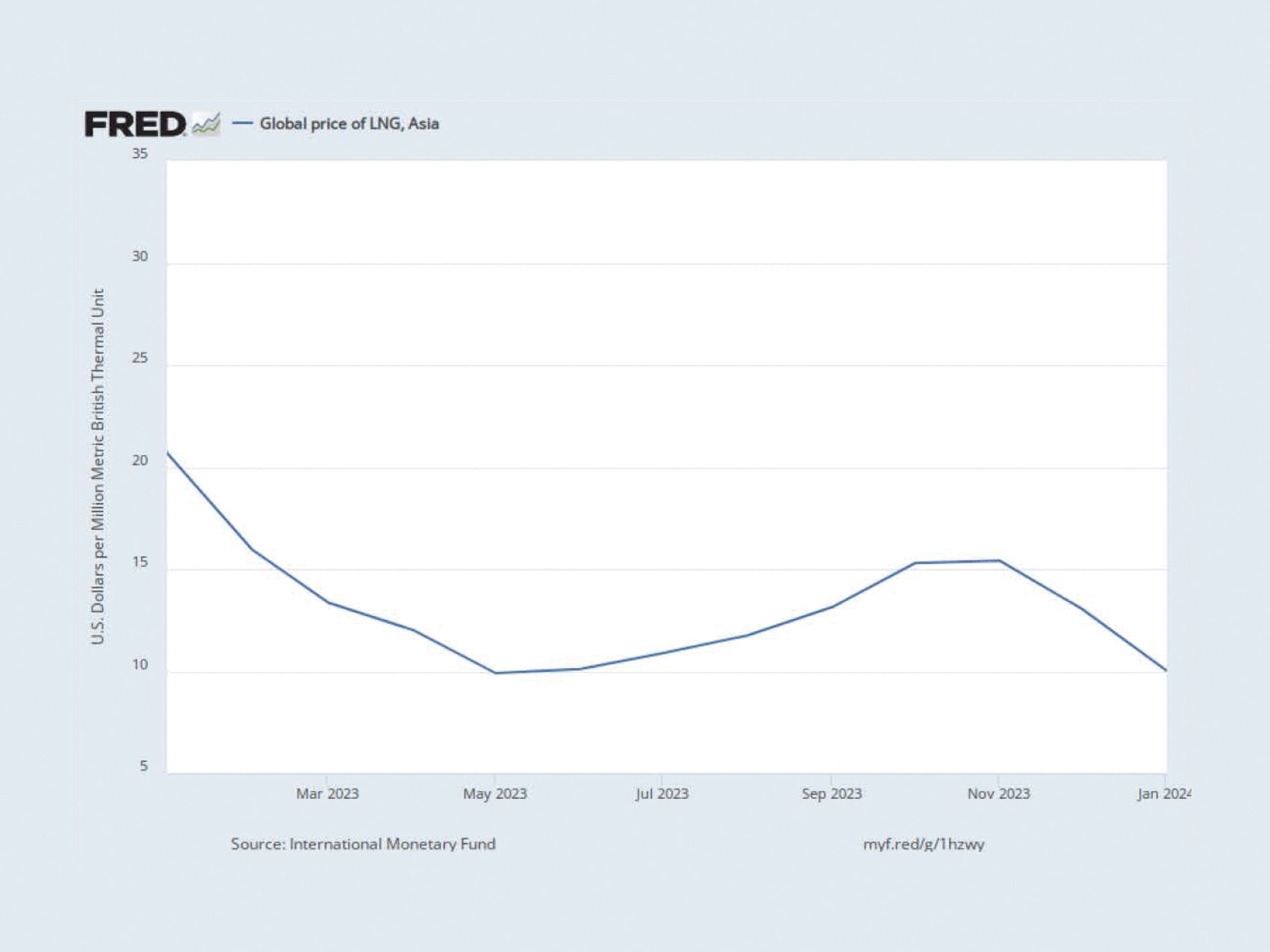

The European industry nowadays depends largely on imported LNG (Liquified Natural Gas). LNG on the other hand is by far more expensive than natural gas. Figure 3 displays the development of the global price for LNG. Since November 2023 the LNG-price for 1MMBtu was reduced significantly from 15 to 10 USD, anyhow this price is still more than 8 USD or 550% higher than the price of natural gas. These remarkable additional costs are applicable to such regions without sufficient natural gas supply. Europe is one of such regions with additional cost burdens. Europe is buying LNG from USA, Kuwait and also from Russia via third countries. Possible measures to overcome the price disadvantage of LNG are hardly to be seen. Extended European local gas exploration or shale gas exploration are politically banned. Therefore, hardly any short- or mid-term measures are visible to overcome cost disadvantages European high energy consuming industries are confronted with.

The long-term strategy to shift towards green hydrogen to replace fossil energy sources such as natural gas, are also questioned by some specialists. Hydrogen production via electrolysis in an industrial scale requires not only masses of clean water, but also a lot of electrical energy. About 55 MW/ton of Hydrogen must be considered. Furthermore, the chemical process, the electrolysis, requires permanent electrical energy 24 hours over 7 days per week with limited power network variations. The lifetime of the electrolyse stacks is significantly reduced in case of larger power supply volatility. Therefore, green hydrogen production seems to be feasible in regions with steady sun and wind. In most parts of Europe such constant power supply at reasonable cost is still hardly to be realized by the green energy sources wind and sun. Some European countries therefore consider nuclear power as the green solution hereto.

Europe has established the ETS (Emission Trading System), to reduce CO2 emission by introducing levies on each tonne of emitted CO2. In addition, the CBAM (Carbon Border Adjustment Mechanism), was introduced as compensating levies on CO2 intensive goods imported from third countries outside of Europe. This system, characterised by punitive tariffs, ensures a certain equalisation of costs within Europe, local European producer however do not get any further protection. However, as it raises the overall cost level for goods in Europe, it is leading to cost disadvantages for products which are exported outside of Europe.

In contrast, USA has introduced an instrument with the introduction of the IRA (Inflation Reduction Act), which provides financial incentives for low-carbon investments. A climate protection package of 369 billion US dollars is providing tax credits for climate saving investments. The US IRA has created a boost of investments, whereas the European levies system did create irritations amongst investors and economic recession.

Therefore, the European energy intensive industry is confronted by a significant cost disadvantage. If no cheaper energy supply sources become available, this disadvantage remain as a major thread for the European energy intensive steel and tubular industry.

It is to be seen, to what extend measures to increase energy effectiveness and productivity can help European producers to compensate such cost disadvantages and the flood of additional administrative measures required by regulations such as ETS and CBAM. Lean and competitive production is somehow in danger to come out of sight.

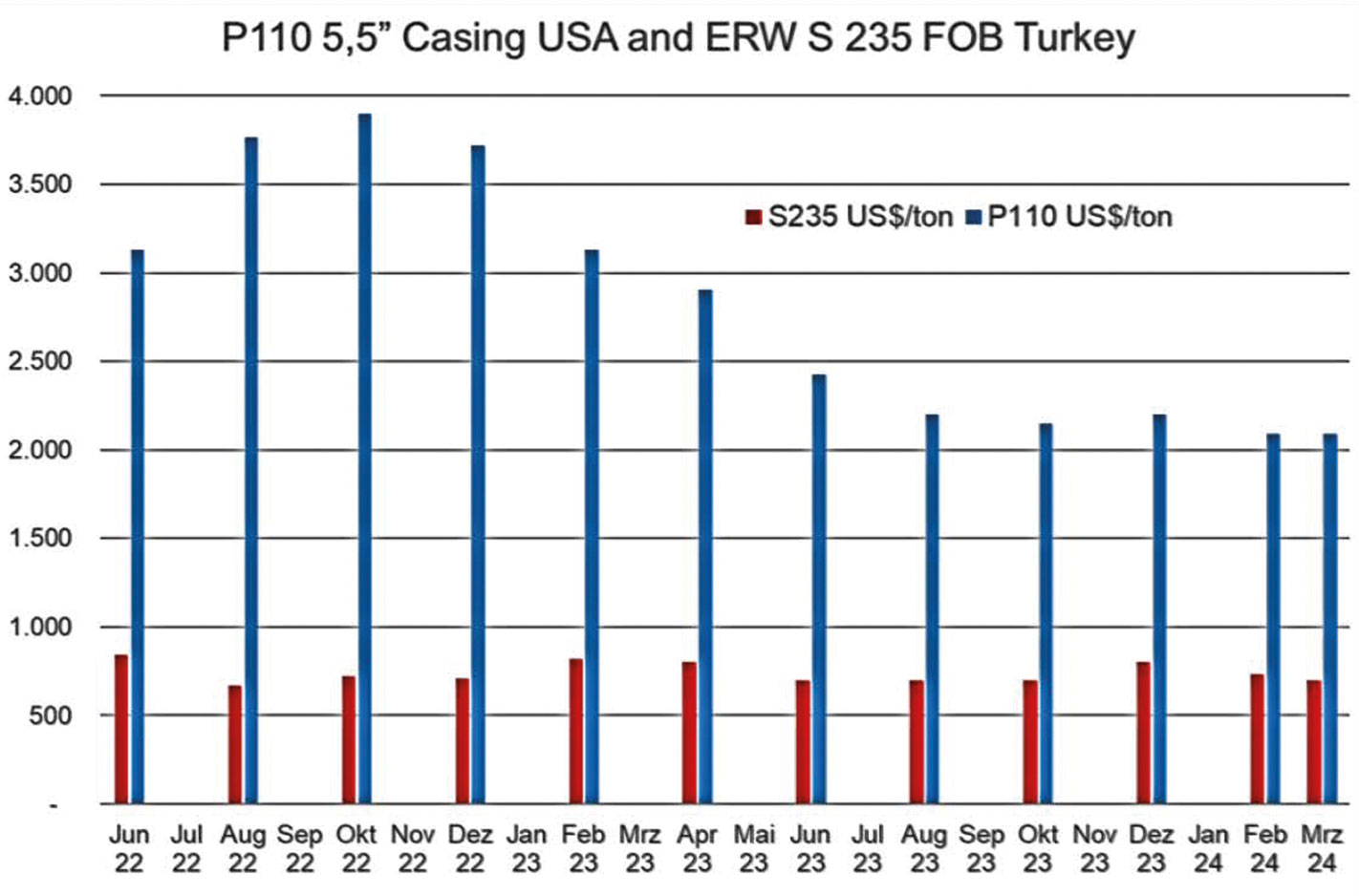

Tube and Pipe manufacturers buy hot-rolled coils, round billets, or plates as input material for their production lines. More than 70 % of the total world pipe production, i.e. about 110 million tonnes/year, are welded tubes and pipes. Welded tube producers are highly dependent on attractive hot rolled coil prices and large OD pipe (pipeline) producers, on plate prices. Average prices for hot-rolled coils came down from September 2021 (ab. 2000 USD/ton) to September 2023 (ab. 700 USD/ton). Since then, the HRC prices strengthened again to prices of about 1120 USD/ton. Mid of March 2024 the price is at 880 USD/Ton (Figure 4). Furthermore, tube producers suffer from shortages in the availability of special tube material specifications. Special alloyed HRC as applied e.g. OCTG tubes and pipes, are traded at significant higher prices.

Comparing the price difference between HRC and finished structural tubes and pipes type S 235 (Figure 5), it becomes obvious how small the margins for tube producers of such products are. There were even time periods, with negative margins.

Some tube and pipe producers even stopped their welding operations temporary and fed seamless pipes into their finishing lines to overcome such margin losses. Steel plates are traded according Kallanish on 19th March 2024 for low grade plates at about 650 USD/ton.

Billet prices, used for seamless tubes are traded for an average of around 500 USD/ton.

In 2024 almost all prices for tubular pre-materials were quite volatile. It remains a challenge to predict the pre-material price developments.

Figure 5, shows the price development for two representative tube grades since June 2022:

- P110 OCTG O.D. 5,5” alloyed casing pipe.

- S235 non alloyed structural pipe.

The OCTG pipe price for P110, after its hight in October 2022 (ab. 3.900 USD/ton) suffered a price decline of ab. 46% until October 2023 (ab. 2.100 USD/ton) - however, since then, it seems the price has bottomed out.

The structural pipe S235 although on a much lower price niveau, characterized by much less volatility almost maintained its price level at ab. 700-800 USD/ton.

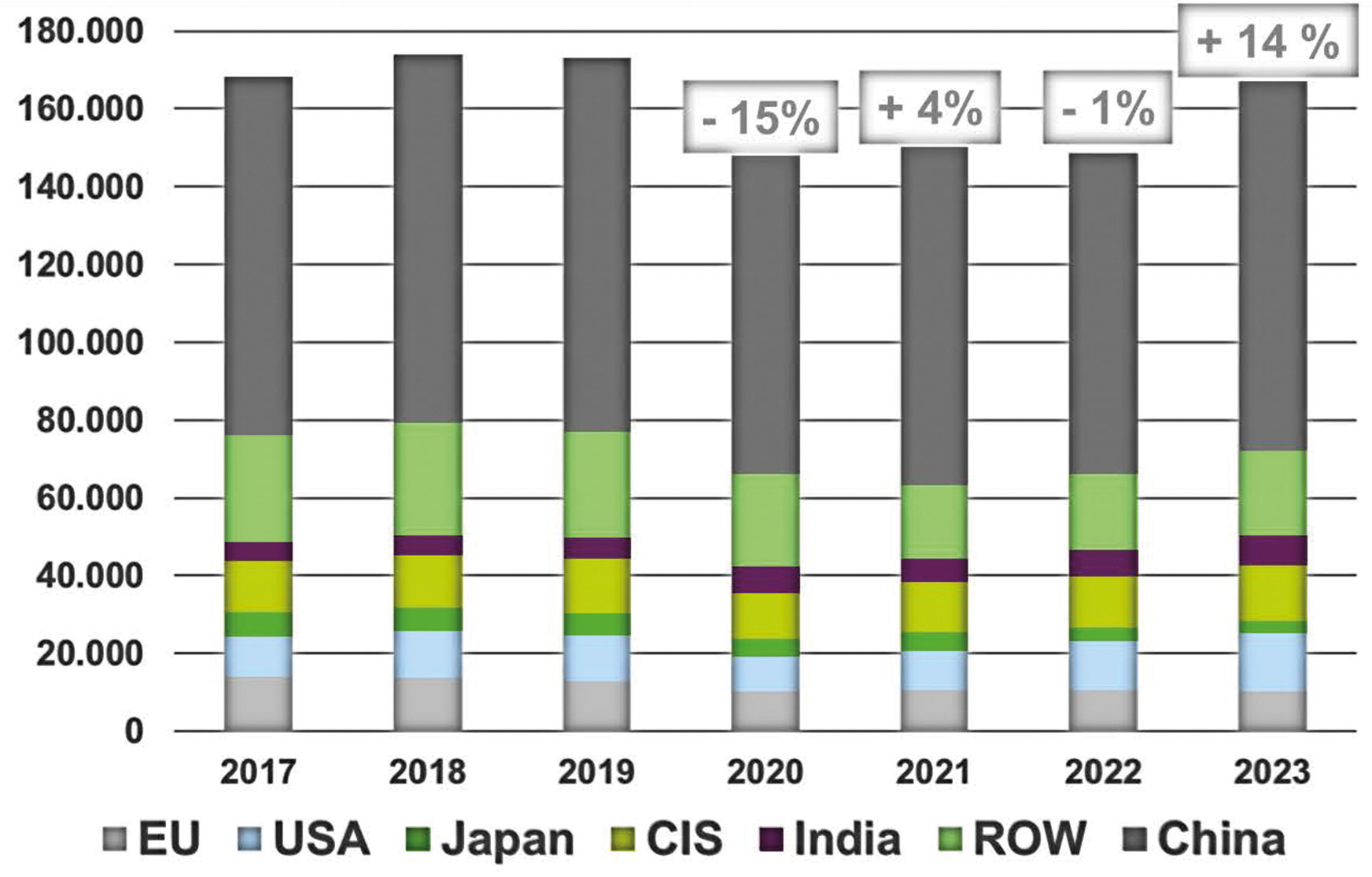

The world tube and pipe production after a slight downturn in 2022 of -1%, had an impressive recovery in 2023 of +14% (Figure 6).

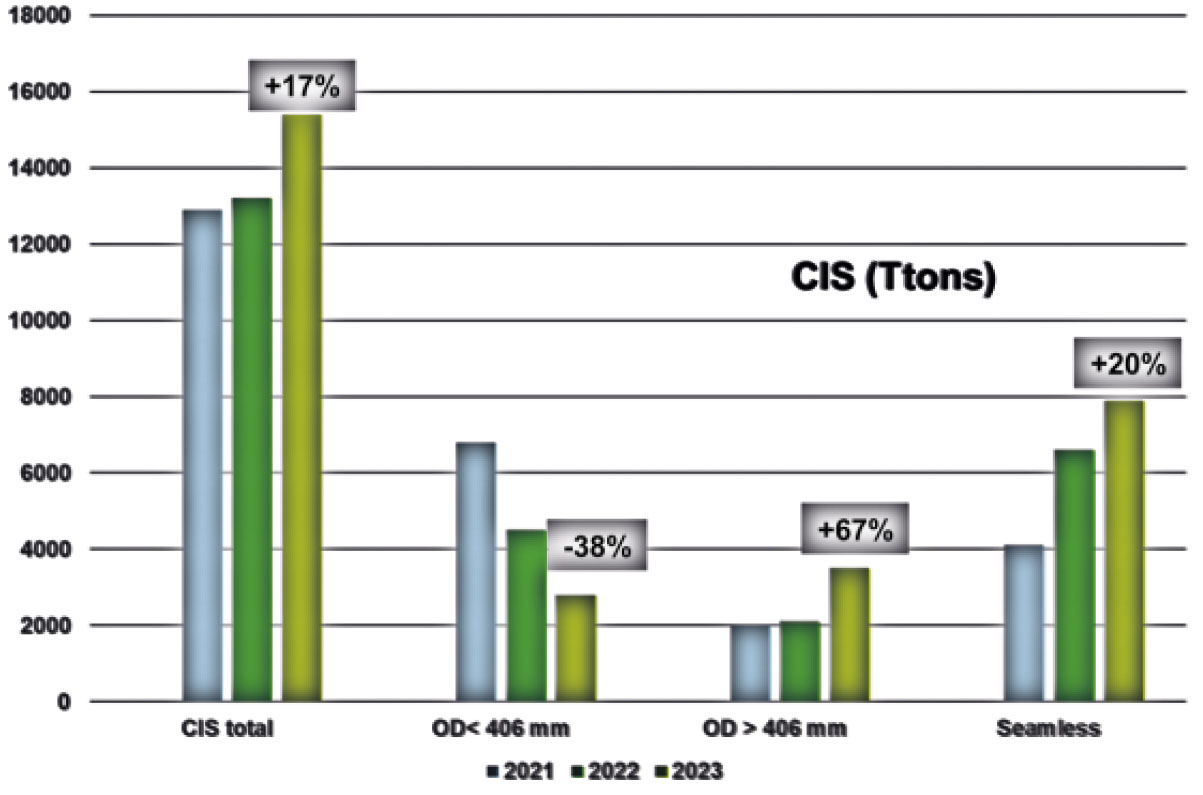

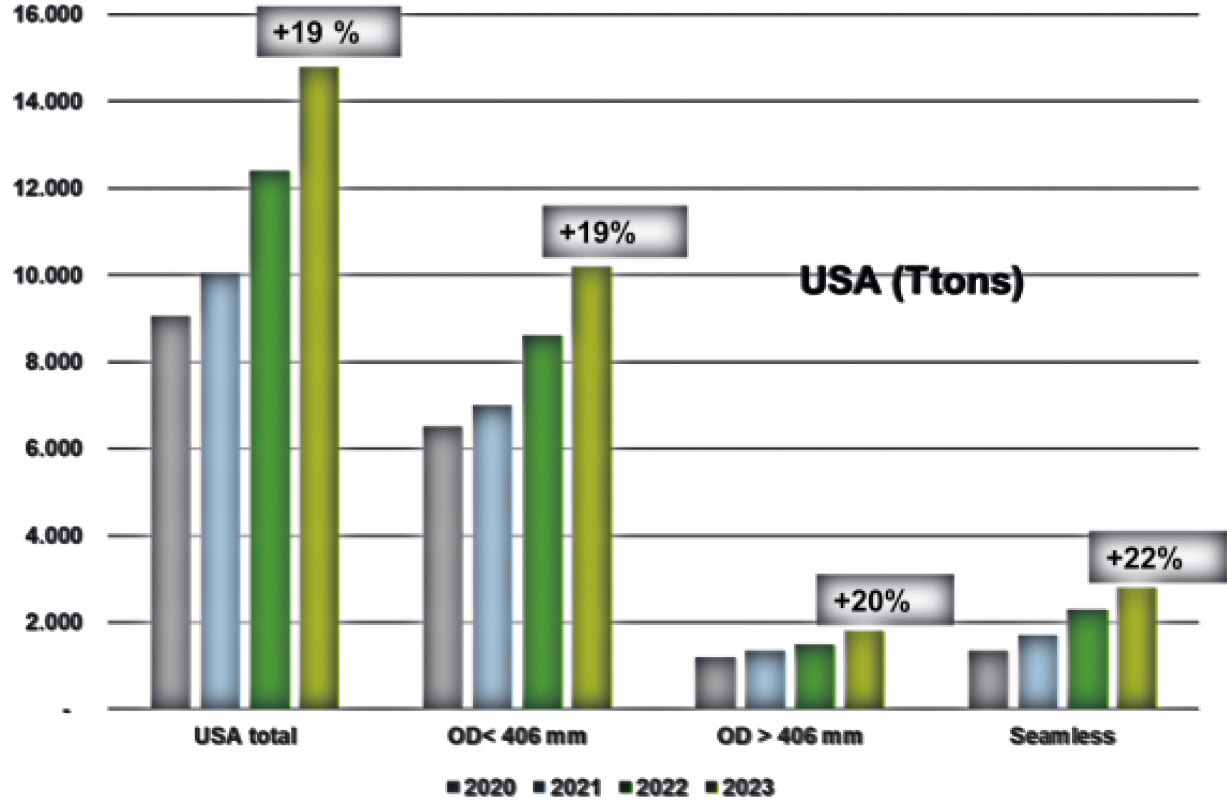

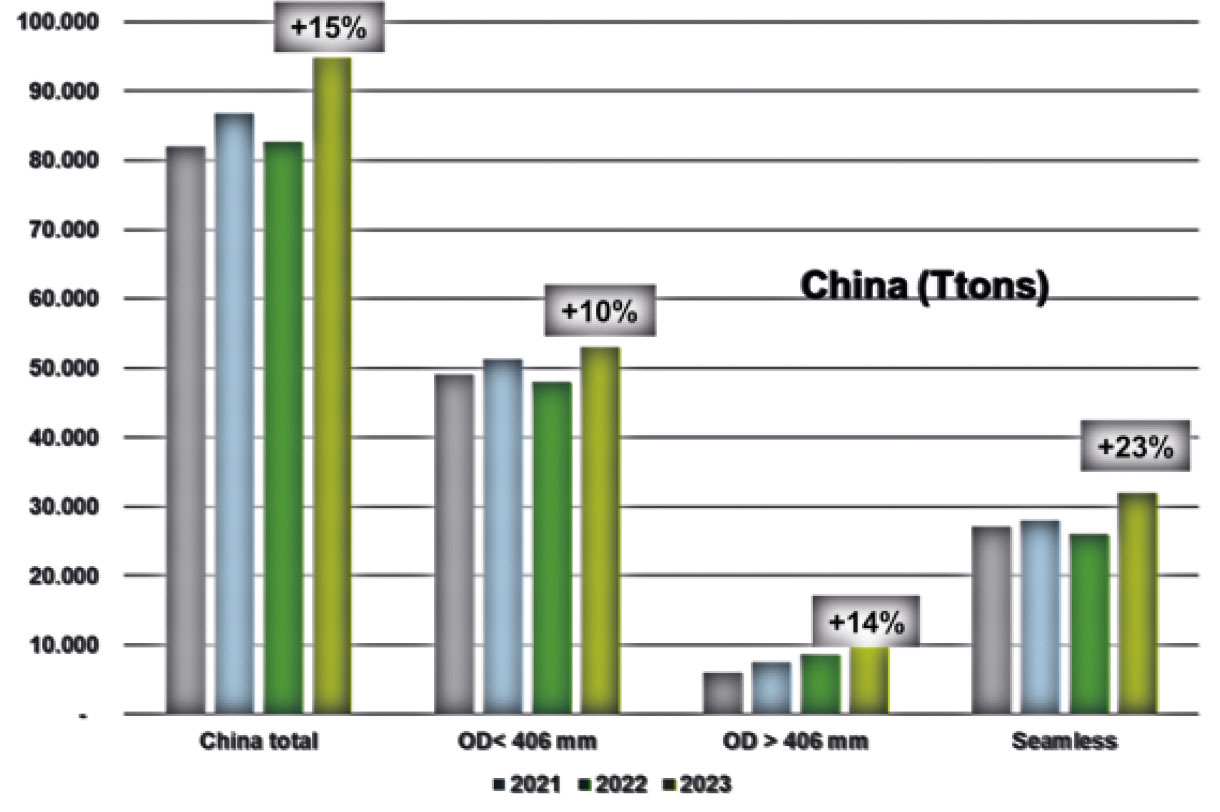

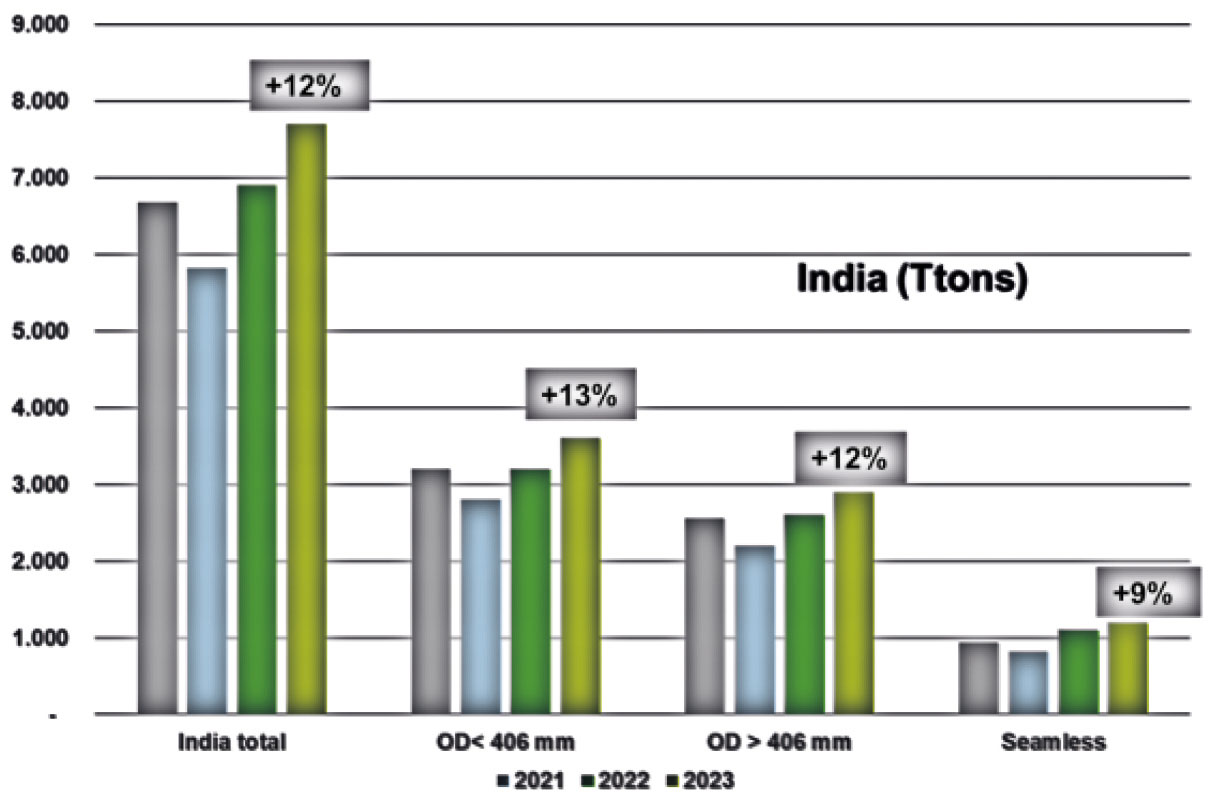

Anyhow substantial regional differences are reported. CIS (+17%), the strong growth most likely due to compensation of imported pipes by local production (Figure 7). Remarkable is that contrary to the trend, the production of welded tubes < 406 mm OD was suffering by – 38%, whereas the segment of pipeline pipes > 406 mm OD was growing by 67% (Figure 7). This trend seems to be fired by the need to build new pipelines to redirect the gas originally send to Europe. USA (+19%) with strong growth in all dimensional segments driven by the strong economic situation and the strong oil and gas demand (Figure 8). China representing more than 50% of the world tube production had a further gain of 15%, which is by far more than the overall economic growth in China. Particularly the seamless tube segment reported a remarkable increase of +23% (Figure 9). India after a week 1st half year

2023 reported a booming 2nd half year ending up at a full year 2023 increase of +12% (Figure 10). This positive development was already expected at our last report and was covering all tube and pipe segments. In essence the tube and pipe producers it these four countries are benefitting the most from the present geopolitical turbulences. Japan and Europe on the other hand are suffering and do not participate in the general growth trend reported for 2023 in the range of +14%!

Europe has lost a significant amount of its production capacities second half of 2023 due to Vallourec´ s shut down of their major European production facilities, whose capacities need to be replaced by others as far as technically possible. Some tube customers do have problems for adequate replacement.

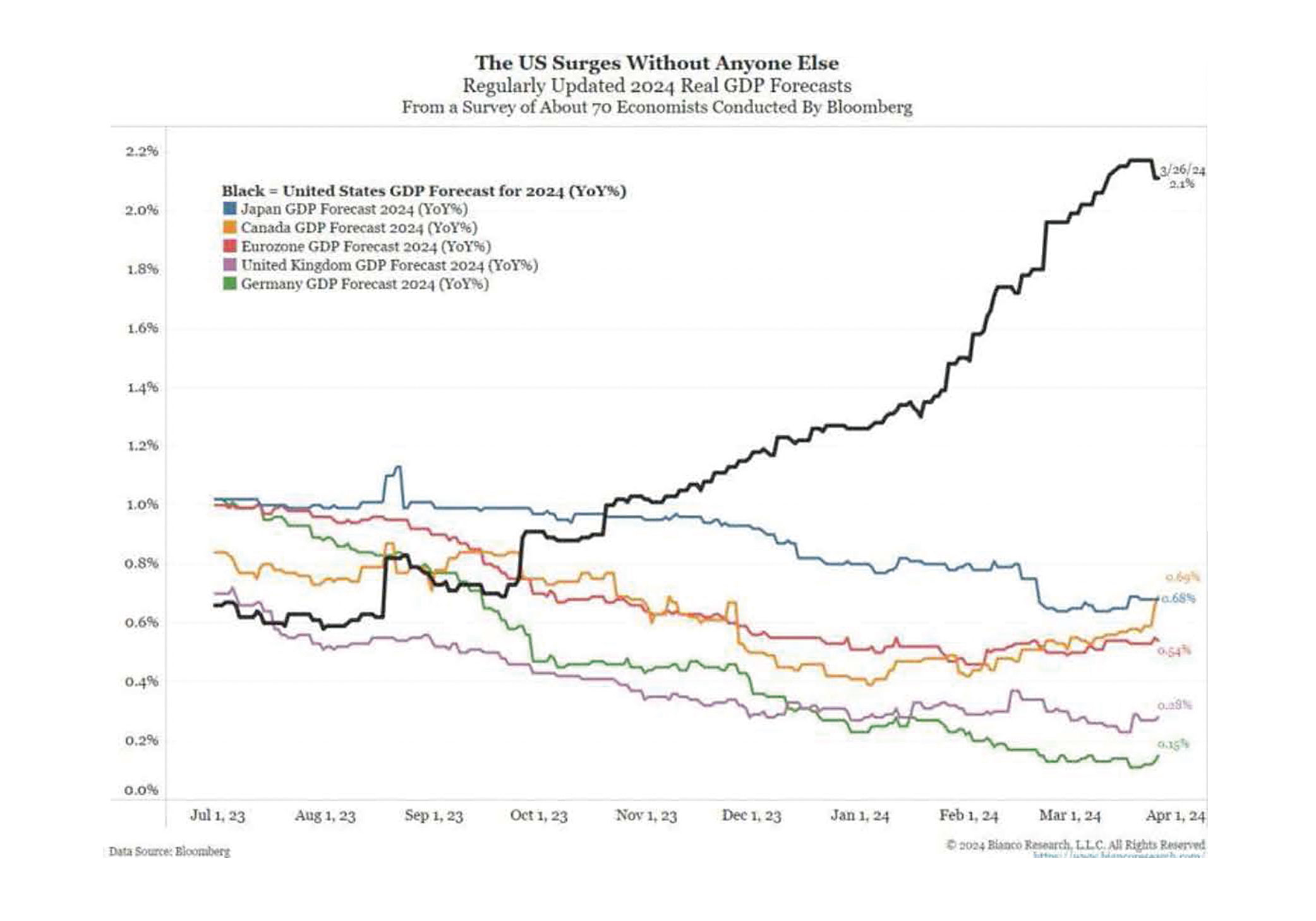

Inflation rate, which was considered as a major thread to economic growth seems to calm down in most parts of the world. The efforts of the central banks, especially these of the US FED, has stopped the galloping inflation and reversed the trend. Due to the high indebtedness of the central banks, however, it must be feared that the target inflation of 2% will not be reached for some time yet (Figure 11).

Besides the inflation rate, the producer price index is another important parameter for the economic efficiency, as it reflects the costs of the manufacturing industry. As Figure 12 shows, these costs vary greatly from region to region. Europe and the USA have aligned to a similar level due to the falling energy costs in Europe. China’s cost situation is still particularly advantageous with an advantage versus Europe and the USA of about 25%. Japan as well has an advantageous situation in comparison to the USA and Europe of about 16%. Labour unions in the USA and Europe are currently concluding their wage rounds with significant wage increases, meaning that further increases in producer prices are expected. In Europe, the high energy prices must also be considered if these cannot be significantly reduced in the short term.

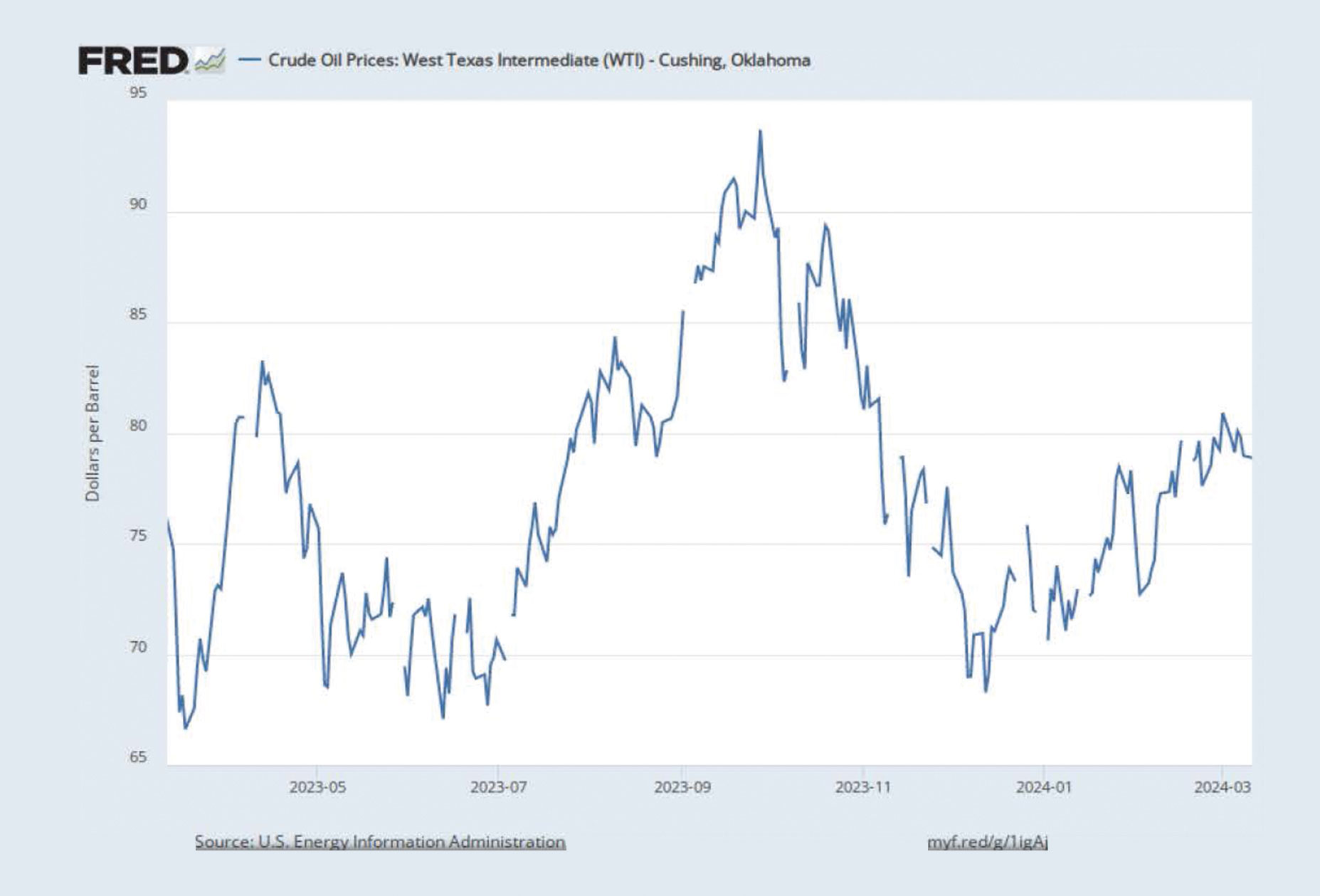

The major driver of the tube and pipe industry is the OCTG market representing about 51% of the world tube and pipe production. The consumption of OCTG tubes directly relates with the oil price (see previous tube market reviews). OPEC+ during the past months have tried to keep the oil price at a minimum level of 90 USD/Bbl. by voluntary supply cuts. The USA on the other hand tried to balance the possible supply shortages by additional own supplies. These measures kept the Oil price mostly in a range of 70 to 90 USD/Bbl. (Figure 13). Therefore, under normal conditions, the World bank projects the oil price to stay at 80 USD/Bbl. in 2024. This projection certainly only applies if the war between Israel and Hamas remains local.

World Bank on the other hand sees significant influence on the oil price if the Hamas-Israel war would escalate into a Middle East wide conflict disrupting the oil supplies.

Since it seems that all involved parties are trying to keep the conflict local and avoid any escalation, it can be assumed that the oil price stays at present level. Frightening scenarios like that in 1973 with disruptive impacts on the global economy a sudden four-fold increase in crude oil prices ushering in the higher inflation and rising unemployment that ended the long post-war boom in the global economy, as displayed by some world bank specialists’ forecasts seems to be out of sight.

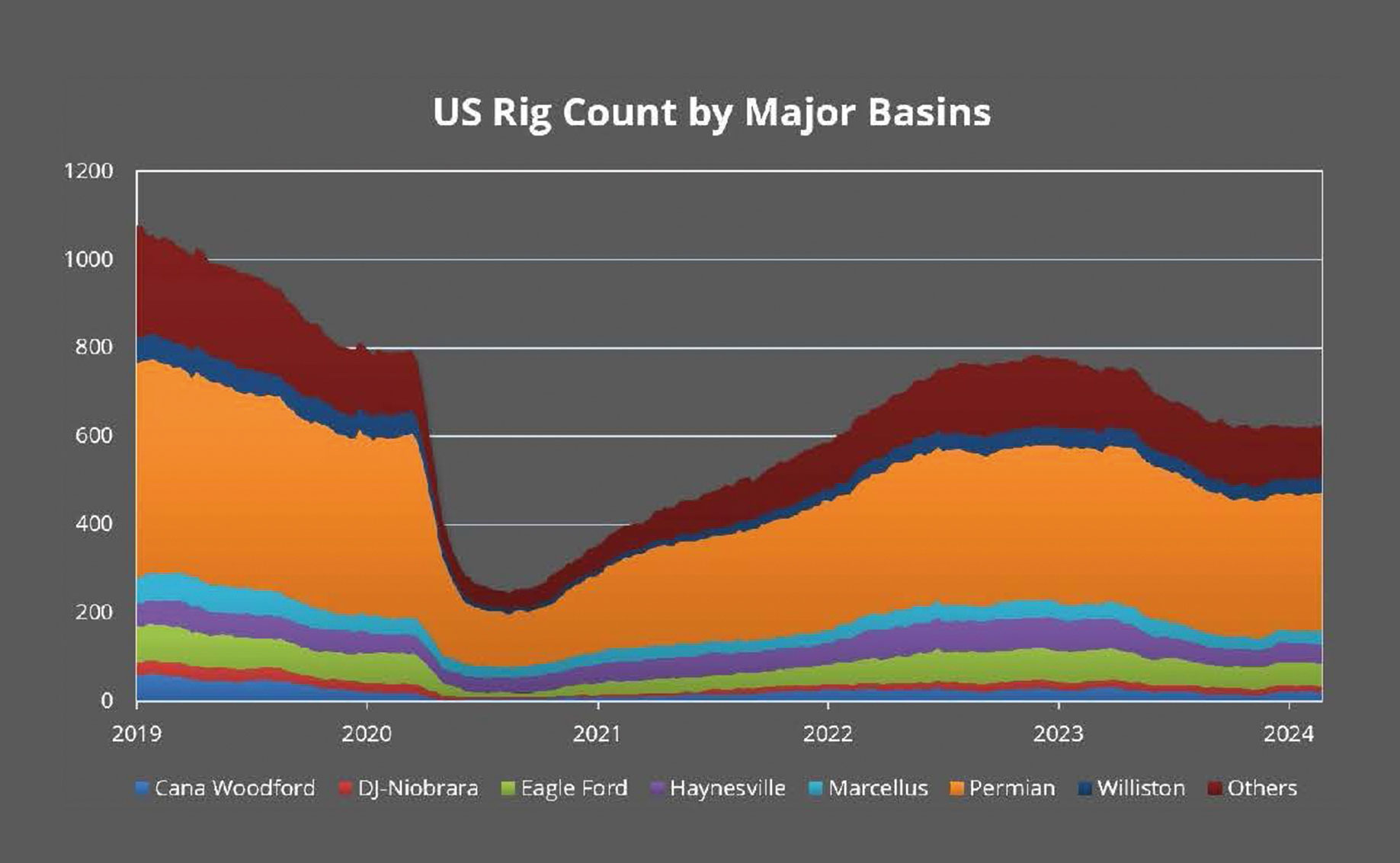

The USA to soften the inflation and to sacrifice the crude oil demand enlarged its crude oil production almost linear from 12 Mio. Bbl./day in September 2023 to 13,3 Mio. Bbl./day in March 2024 (+ 11%) by increasing the number of drilling rigs and their productivity (Figure 14).

The number of US drilling rigs was enlarged to about 800 by December 2022 (Figure 15). In 2023 due to declining oil prices, the number of rigs was reduced again to 618 rigs. Of these 618 rigs, 496 are dedicated for the extraction of oil and 118 for gas. Furthermore, the USA has relieved some of the oil export sanctions on Venezuela. Nevertheless, the US oil exports have reached a new all-time high with about 5,5 million Bbl./day.

Efforts to reduce dependence on fossil fuels can hardly be successful in the short term and can only contribute in the medium term. For our pipe industry, however, this means that crude oil prices can be expected this year at around 80-90 USD/Bbl. The investments to secure the world energy supply will keep the demand for tubular products high. Another driving factor is the record high global LNG production. Katar, USA and Australia have record high LNG production. Consequently, the demand for OCTG products remain high. The LNG supplies ease the energy crisis especially in Europe to compensate the stopped Russian pipeline gas supplies.

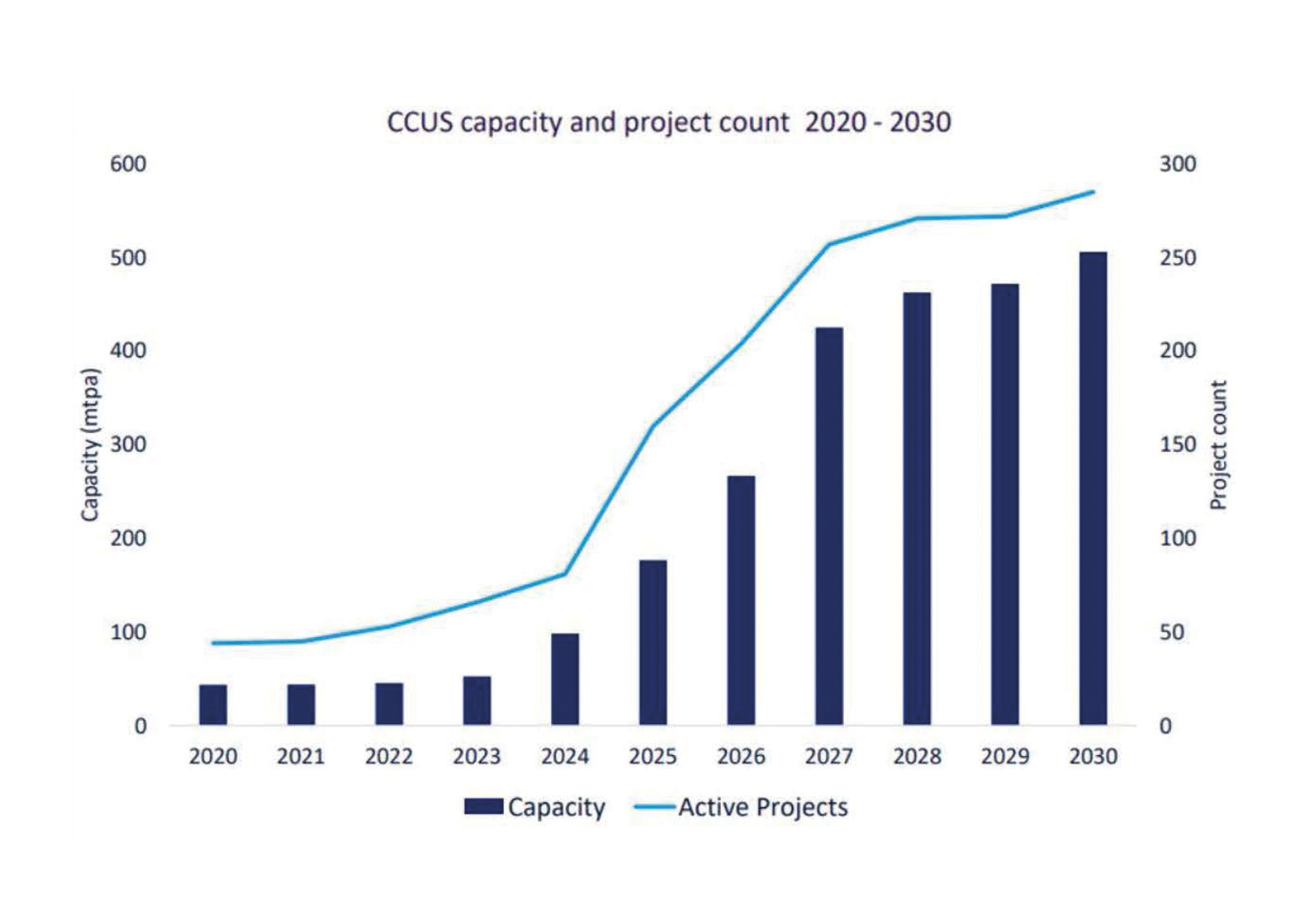

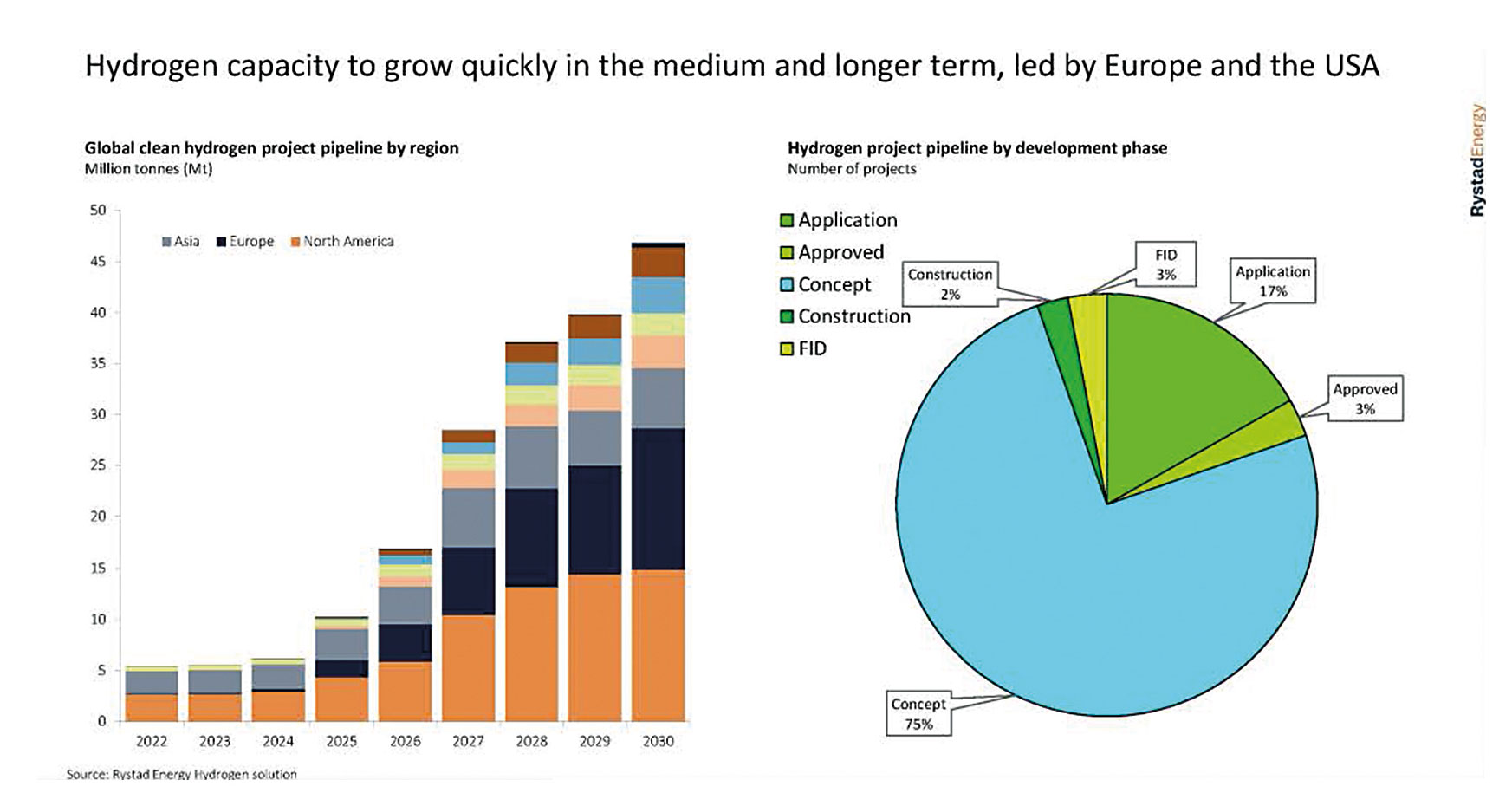

Carbon Capture Utilisation and Storage (CCUS) is an upcoming interesting market for higher alloyed tubes. In CO2 capture and sequestration, carbon dioxide is separated from combustion gases and then stored indefinitely in deep underground layers of rock without a container. For deep drilling and transportation of CO2 into these deep underground layers of rock, increasing volumes of tubes and pipes are required. USA, China and Middle East are the centres for development following this technology. The project volumes of CCUS will achieve considerable volumes 2026 and the following years (Figure 16). CCUS refers to a suite of technologies that can play an important and diverse role in meeting global energy and climate goals. In addition to exploration activities, the need to build new pipeline routes has also increased since the ban on Russian pipelines to Europe and the strategy towards replacing natural gas by hydrogen. Globally a large quantity of pipelines is planned or announced to be built in the coming years up to 2027. A new market for hydrogen pipelines is upcoming (Figure 17). Particularly the US and Europe expect major growth in this segment. This development offers pipeline manufacturers of large-diameter pipes > 406 mm OD opportunities for interesting future business.

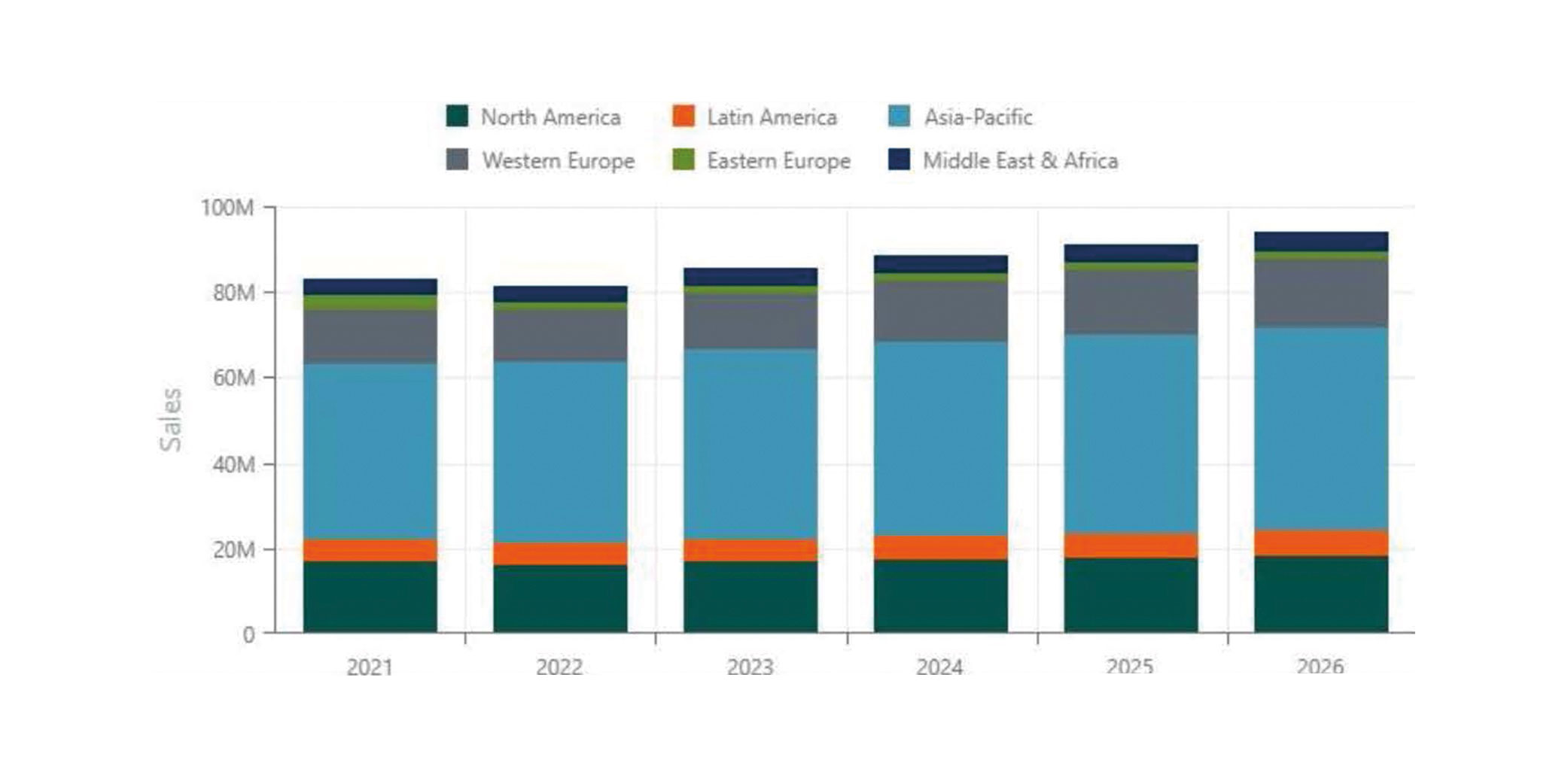

The automotive market, accounts for around 15% of the global tube and pipe market. With most car manufacturers and many of their suppliers now reporting that their production capacity is either no longer constrained by semiconductor shortages, overall car sales figures are rising - with global deliveries expected to reach 85.5 million units by the end of the year. As the macroeconomic outlook for the automotive industry deteriorates, a modest return to growth in new car sales of private and commercial vehicles is expected over the next two years. ABI Research forecasts global vehicle sales growth of 3.6% in 2024. Furthermore, car manufacturers can expect sales to exceed the 90 million units’ level again in 2025 (Figure 18). In terms of regional growth in vehicle sales, the following chart summarises these findings. According to IHS, the recovery process in the volume markets of Europe and North America anyhow will take longer. Future growth will primarily take place in Asia, particularly in China. However, China could increasingly become a sales problem for the western automotive industry due to the American decoupling tendencies and the strengthening local car industry in China. However, the tendency to further reduce the weight of vehicles supports the trend towards the use of tubular products. The transition to electromobility can also support the use of tubular components, as the additional weight of the batteries must be compensated as far as possible. The automotive industry offers many attractive applications for tubular products.

The greatest potential for the use of tubular products is seen in the vehicle frame, followed by the chassis and powertrain. Tube manufacturers will endeavour to enter new vehicle series with larger quantities in order to further expand their presence in the light vehicle industry.

Overall, the automotive industry faces the challenge of the transition to electromobility and the question how they can continue to serve markets in which electromobility cannot be introduced due to restrictions in the availability of electrical energy. Car manufacturers must therefore pursue all drive technologies to avoid losing major market potential. Environmentally friendly combustion technologies will continue to have their place. Political institutions, such as those in Europe, on the other hand, are setting deadlines to ban combustion technologies including green fuels. Present discussions may be understood that this paradigm may be opened again in favour of combustion engines with green fuel. In this area of conflict, the automotive industry, including its suppliers of tube products, must find suitable business approaches.

The mechanical engineering market segment, which accounts for around 9% of world tube and pipe production, has developed well in line with global GDP in recent years. During the financial- and corona crisis, the market was characterised by higher volatility with sharper declines and quick recoveries. In 2022, the current further recovery was slowed down by geopolitical circumstances. Asia, and China in particular, although increasingly reaching self-sufficiency are still the largest markets for machinery purchases. It remains noteworthy that the Chinese industry has taken the global lead in machinery sales since the Corona crisis.

Here, the decoupling intentions of the USA must be observed since this may become a game changer for the worldwide mechanical engineering industry. The USA and Europe continue to be significant sales regions as well. This market segment certainly has the greatest variety of tube products. Cylinder-, ball bearing- and turned part tubes, to name just a few prominent representatives of this market segment, certainly show interesting prospects for tube and pipe producers.

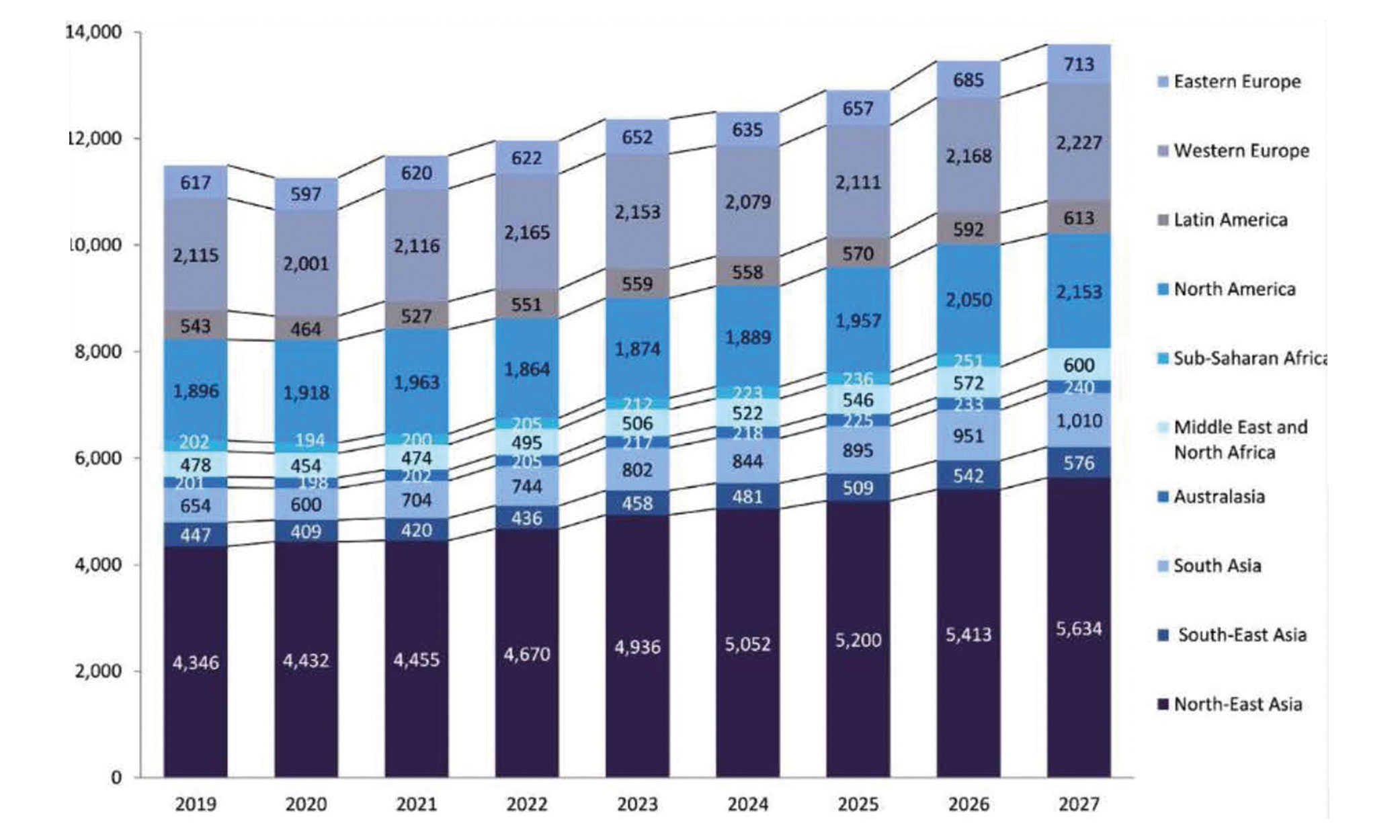

The construction market with about 5% of the global tube market presents another opportunity for pipe manufacturers with growth potential. Despite the challenging macroeconomic and geopolitical backdrop, the global construction industry managed to continue to generate growth momentum in 2023, with output rising by 3.4% in real terms (Figure 19). Much of this was owed to China’s surprisingly strong performance despite the prolonged real estate crisis there, which has significantly impacted investment in building activity. Construction in the US also picked up in the second half of 2023, which pushed global construction industry output growth excluding China to 2.0% in 2023. With interest rates remaining at a high level, new investment in the residential buildings sector has fallen sharply. This has particularly been the case across North America and Europe, where residential building permits have plummeted. The infrastructure, energy & utilities, and industrial sectors will be key drivers of construction output activity. There are also high levels of spending across areas related to the energy transition, with investment in renewable energy projects and in manufacturing plants to produce electric vehicles and components. The market penetration of structural tubes, as shown is quite unevenly distributed in the world and the growth pattern is greatly dependent on the regional GDP growth (Figure 20). European countries face week GDP growth, this in combination with cost increases for construction work, result in slow building activities. India and the USA on the other hand, based on their stronger GDP growth, report much more active building investments. China, one of the leading countries for construction works, presently is slowed down due to major real estate turbulences. Anyhow once these turbulences are under control again the potential for construction remains high.

In mid-term anyhow this market segment will offer again interesting opportunities also for Europe. North America and parts of Asia are widely using tubular products for structural buildings. Europe on the other hand still designs mostly with standard concrete or steel structures. The tube industry needs to further promote the benefits of tube applications and showcase the architectural perspectives. Tubular profiles are an ideal choice when visible structures are desired due to their varied shapes and closed cross-sections combined with smooth sides. Best mechanical properties and the possibility to bridge large spans are further highlights of tube profiles. Besides round shaped structural tubes, rectangular profiles are dominating architectural applications. Such profiles are normally cold rolled and formed in so-called turks-heads. In this process great attention must be given to the metallurgical properties of the edges. Normally unalloyed steel is applied, anyhow alloyed steels with its improved material properties should also be considered. Regarding the CO2 -footprint tubular profiles are of great advantage, since the applied steel can be produced from metal scrab in electric arc furnaces driven by green electrical energy. A recent study published by Global Construction Perspective and Oxford Economics, entitled “Global Construction 2030”, forecasts an 85% growth in global construction output to 15.5 trillion by 2030, with three countries, China, USA and India, leading the way and accounting for 57% of global growth alone. Europe, on the other hand, will reduce its pace of investment. There is room for additional production capacity for structural tubes, especially in India, to follow the market trend.

Most tube and pipe producers were able to report strongly improved economic figures in 2023. However, for European pipe producers, the persistently higher energy cost and the additional CO2 levies agreed to be imposed by the European Community represent major challenges. Confidence in being able to compete on the world market in the future with these additional costs is dwindling among some tube producers. Some tube producers even reduce their engagement in Europe as a consequence hereto.

New upcoming market segments such as carbon capture utilization and storage as well as hydrogen pipelines will start requiring larger tonnages of alloyed tubes and pipes in 2025 and thereafter. In general, there is enough production capacity to serve even the increased demand for tubes and pipes for all market segments. Anyhow the trend to produce close to the customers will have ongoing impact on the tube producer´s landscape. Raw material prices for the steel as well as the tube and pipe industry would seem to have peaked early 2023. Still markets are nervous with potential for further volatility.

Further challenge may be imposed, if political measures to prevent climate change are not introduced in a balanced way, with possible consequences being the migration of high energy consuming industries to lower-cost regions. Nonetheless, if the balance of supply and demand within the tubes and pipes industry is restored, price volatility can be expected to calm down.

The transition towards environmentally friendly tube production to produce carbon reduced tubes and pipes became increasingly a major task for the industry. Tube and pipe producers are converting their production facilities from gas to electricity. Simultaneously they improve their productivity, flexibility, and customer service. Innovative instruments such as Artificial Intelligence (AI) and Industry 4.0 are introduced in this context. So far AI has only been applied to analyse the enormous amount of data available to the industry, but self-learning AI solutions will further revolutionize the tubular industry.

Many technology suppliers have already reacted and enhanced their product portfolio with the addition of environmentally friendly and digital solutions.

The Russian invasion into the Ukraine in 2022 and its consequences are still creating challenges for the industry. The war between Hamas and Israel recently started October 2023 is another conflict threatening the world. So far, no consequences on the energy prices are to be seen since all involved parties manage to keep this conflict local without interference to other middle east countries. Increasing tension between the US and China officials create further clouds for free international trade. Political interventions and regulations are increasingly influencing industrial strategies and actions.

The necessary transition to environmentally friendly and carbon reduced production became a central mission of the industry. The consequences on the cost increases are unevenly distributed across the world. Europe is challenged by persistently high energy prices and levies on carbon intensive industries. Regions such as the USA, India, Turkey and China are benefiting from lower energy cost. The high level of public debt caused by the expensive measures taken to overcome the various crisis in recent years give rise to fears that the central banks’ effectiveness in combating inflation will be limited and that the target value of 2% can therefore not be expected in short term. All these unexpected challenges are difficult to manage.

Many tube and pipe producers were able to report improved profits in 2023, but in Europe high energy prices and CO2 levies are weighing on tube and pipe producers. Due to the dynamics of these developments, it is usually very difficult for the producers to react appropriately. Some manufacturers are losing confidence to compete on the global market with these additional costs and consequently even reduce their involvement in Europe. As a result, some countries/regions are looking for suitable political countermeasures to compensate for their cost disadvantages.

Whereas previously only quality, delivery time and costs were decisive, now geopolitical and logistical risk considerations as well as current and future energy costs are increasingly taking centre stage. All sources of supply are being critically scrutinised, and one can only hope and warn that international trade will not suffer too much as a result. In particular, the regional differences in energy prices will have an impact on the current landscape of the energy-intensive steel as well as tube and pipe industry.

However, disruptive times also always create new opportunities for economic success. New markets such as carbon capture utilisation and storage (CCUS), new networks for hydrogen transportation, electromobility and productivity improvements at production sites as part of the transformation towards more environmentally friendly plants offer opportunities that should be seized.

Availability of economical energy is a decisive factor for the industry. Geopolitical turbulences and political regulations have changed the regional balance with increasing challenges for the industry in regions with higher energy cost. This may change the industrial landscape of the energy intensive industry with significant future consequences.

The prices for electrical energy in Europe, after turbulent periods, is now reported at a level of about 70 €/MWh with remarkable volatility (Figure 1). Considering significant lower price levels in other parts of the world, e.g. USA about 20-30 €/MWh less, it is obvious that the environmental driven trend towards electrical energy in Europe is loaded by cost burdens. Measures to improve production efficiency need to be introduced to prompt such disadvantages.

Cost of natural gas, after turbulent times climbing in 2022 up to levels higher than 9 USD/MMBtu and another sharp increase in 2023 up to 4 USD/MMBtu, has now calmed down to a level of about 1,7 USD/MMBtu, which is the same price range as early 2020 (Figure 2). This is good news for gas intensive industries and gas power plants. Europe anyhow, originally being supplied by Russian gas via pipelines at good values, now sources its gas needs to a great extend as LNG. Just Austria and Poland still source their natural gas via Jamal pipeline from Russia.

The conflict in middle east, the war between Hamas and Israel, still does not have measurable impact on the gas prices. The involved parties seem to succeed in limiting the conflict local without being spread out to other middle east countries. The original concerns of analysts about possible upcoming consequences like in earlier conflicts in the middle east seem so far under control.

The European industry nowadays depends largely on imported LNG (Liquified Natural Gas). LNG on the other hand is by far more expensive than natural gas. Figure 3 displays the development of the global price for LNG. Since November 2023 the LNG-price for 1MMBtu was reduced significantly from 15 to 10 USD, anyhow this price is still more than 8 USD or 550% higher than the price of natural gas. These remarkable additional costs are applicable to such regions without sufficient natural gas supply. Europe is one of such regions with additional cost burdens. Europe is buying LNG from USA, Kuwait and also from Russia via third countries. Possible measures to overcome the price disadvantage of LNG are hardly to be seen. Extended European local gas exploration or shale gas exploration are politically banned. Therefore, hardly any short- or mid-term measures are visible to overcome cost disadvantages European high energy consuming industries are confronted with.

The long-term strategy to shift towards green hydrogen to replace fossil energy sources such as natural gas, are also questioned by some specialists. Hydrogen production via electrolysis in an industrial scale requires not only masses of clean water, but also a lot of electrical energy. About 55 MW/ton of Hydrogen must be considered. Furthermore, the chemical process, the electrolysis, requires permanent electrical energy 24 hours over 7 days per week with limited power network variations. The lifetime of the electrolyse stacks is significantly reduced in case of larger power supply volatility. Therefore, green hydrogen production seems to be feasible in regions with steady sun and wind. In most parts of Europe such constant power supply at reasonable cost is still hardly to be realized by the green energy sources wind and sun. Some European countries therefore consider nuclear power as the green solution hereto.

Europe has established the ETS (Emission Trading System), to reduce CO2 emission by introducing levies on each tonne of emitted CO2. In addition, the CBAM (Carbon Border Adjustment Mechanism), was introduced as compensating levies on CO2 intensive goods imported from third countries outside of Europe. This system, characterised by punitive tariffs, ensures a certain equalisation of costs within Europe, local European producer however do not get any further protection. However, as it raises the overall cost level for goods in Europe, it is leading to cost disadvantages for products which are exported outside of Europe.

In contrast, USA has introduced an instrument with the introduction of the IRA (Inflation Reduction Act), which provides financial incentives for low-carbon investments. A climate protection package of 369 billion US dollars is providing tax credits for climate saving investments. The US IRA has created a boost of investments, whereas the European levies system did create irritations amongst investors and economic recession.

Therefore, the European energy intensive industry is confronted by a significant cost disadvantage. If no cheaper energy supply sources become available, this disadvantage remain as a major thread for the European energy intensive steel and tubular industry.

It is to be seen, to what extend measures to increase energy effectiveness and productivity can help European producers to compensate such cost disadvantages and the flood of additional administrative measures required by regulations such as ETS and CBAM. Lean and competitive production is somehow in danger to come out of sight.

Tube and Pipe manufacturers buy hot-rolled coils, round billets, or plates as input material for their production lines. More than 70 % of the total world pipe production, i.e. about 110 million tonnes/year, are welded tubes and pipes. Welded tube producers are highly dependent on attractive hot rolled coil prices and large OD pipe (pipeline) producers, on plate prices. Average prices for hot-rolled coils came down from September 2021 (ab. 2000 USD/ton) to September 2023 (ab. 700 USD/ton). Since then, the HRC prices strengthened again to prices of about 1120 USD/ton. Mid of March 2024 the price is at 880 USD/Ton (Figure 4). Furthermore, tube producers suffer from shortages in the availability of special tube material specifications. Special alloyed HRC as applied e.g. OCTG tubes and pipes, are traded at significant higher prices.

Comparing the price difference between HRC and finished structural tubes and pipes type S 235 (Figure 5), it becomes obvious how small the margins for tube producers of such products are. There were even time periods, with negative margins.

Some tube and pipe producers even stopped their welding operations temporary and fed seamless pipes into their finishing lines to overcome such margin losses. Steel plates are traded according Kallanish on 19th March 2024 for low grade plates at about 650 USD/ton.

Billet prices, used for seamless tubes are traded for an average of around 500 USD/ton.

In 2024 almost all prices for tubular pre-materials were quite volatile. It remains a challenge to predict the pre-material price developments.

Figure 5, shows the price development for two representative tube grades since June 2022:

- P110 OCTG O.D. 5,5” alloyed casing pipe.

- S235 non alloyed structural pipe.

The OCTG pipe price for P110, after its hight in October 2022 (ab. 3.900 USD/ton) suffered a price decline of ab. 46% until October 2023 (ab. 2.100 USD/ton) - however, since then, it seems the price has bottomed out.

The structural pipe S235 although on a much lower price niveau, characterized by much less volatility almost maintained its price level at ab. 700-800 USD/ton.

The world tube and pipe production after a slight downturn in 2022 of -1%, had an impressive recovery in 2023 of +14% (Figure 6).

Anyhow substantial regional differences are reported. CIS (+17%), the strong growth most likely due to compensation of imported pipes by local production (Figure 7). Remarkable is that contrary to the trend, the production of welded tubes < 406 mm OD was suffering by – 38%, whereas the segment of pipeline pipes > 406 mm OD was growing by 67% (Figure 7). This trend seems to be fired by the need to build new pipelines to redirect the gas originally send to Europe. USA (+19%) with strong growth in all dimensional segments driven by the strong economic situation and the strong oil and gas demand (Figure 8). China representing more than 50% of the world tube production had a further gain of 15%, which is by far more than the overall economic growth in China. Particularly the seamless tube segment reported a remarkable increase of +23% (Figure 9). India after a week 1st half year

2023 reported a booming 2nd half year ending up at a full year 2023 increase of +12% (Figure 10). This positive development was already expected at our last report and was covering all tube and pipe segments. In essence the tube and pipe producers it these four countries are benefitting the most from the present geopolitical turbulences. Japan and Europe on the other hand are suffering and do not participate in the general growth trend reported for 2023 in the range of +14%!

Europe has lost a significant amount of its production capacities second half of 2023 due to Vallourec´ s shut down of their major European production facilities, whose capacities need to be replaced by others as far as technically possible. Some tube customers do have problems for adequate replacement.

Inflation rate, which was considered as a major thread to economic growth seems to calm down in most parts of the world. The efforts of the central banks, especially these of the US FED, has stopped the galloping inflation and reversed the trend. Due to the high indebtedness of the central banks, however, it must be feared that the target inflation of 2% will not be reached for some time yet (Figure 11).

Besides the inflation rate, the producer price index is another important parameter for the economic efficiency, as it reflects the costs of the manufacturing industry. As Figure 12 shows, these costs vary greatly from region to region. Europe and the USA have aligned to a similar level due to the falling energy costs in Europe. China’s cost situation is still particularly advantageous with an advantage versus Europe and the USA of about 25%. Japan as well has an advantageous situation in comparison to the USA and Europe of about 16%. Labour unions in the USA and Europe are currently concluding their wage rounds with significant wage increases, meaning that further increases in producer prices are expected. In Europe, the high energy prices must also be considered if these cannot be significantly reduced in the short term.

The major driver of the tube and pipe industry is the OCTG market representing about 51% of the world tube and pipe production. The consumption of OCTG tubes directly relates with the oil price (see previous tube market reviews). OPEC+ during the past months have tried to keep the oil price at a minimum level of 90 USD/Bbl. by voluntary supply cuts. The USA on the other hand tried to balance the possible supply shortages by additional own supplies. These measures kept the Oil price mostly in a range of 70 to 90 USD/Bbl. (Figure 13). Therefore, under normal conditions, the World bank projects the oil price to stay at 80 USD/Bbl. in 2024. This projection certainly only applies if the war between Israel and Hamas remains local.

World Bank on the other hand sees significant influence on the oil price if the Hamas-Israel war would escalate into a Middle East wide conflict disrupting the oil supplies.

Since it seems that all involved parties are trying to keep the conflict local and avoid any escalation, it can be assumed that the oil price stays at present level. Frightening scenarios like that in 1973 with disruptive impacts on the global economy a sudden four-fold increase in crude oil prices ushering in the higher inflation and rising unemployment that ended the long post-war boom in the global economy, as displayed by some world bank specialists’ forecasts seems to be out of sight.

The USA to soften the inflation and to sacrifice the crude oil demand enlarged its crude oil production almost linear from 12 Mio. Bbl./day in September 2023 to 13,3 Mio. Bbl./day in March 2024 (+ 11%) by increasing the number of drilling rigs and their productivity (Figure 14).

The number of US drilling rigs was enlarged to about 800 by December 2022 (Figure 15). In 2023 due to declining oil prices, the number of rigs was reduced again to 618 rigs. Of these 618 rigs, 496 are dedicated for the extraction of oil and 118 for gas. Furthermore, the USA has relieved some of the oil export sanctions on Venezuela. Nevertheless, the US oil exports have reached a new all-time high with about 5,5 million Bbl./day.

Efforts to reduce dependence on fossil fuels can hardly be successful in the short term and can only contribute in the medium term. For our pipe industry, however, this means that crude oil prices can be expected this year at around 80-90 USD/Bbl. The investments to secure the world energy supply will keep the demand for tubular products high. Another driving factor is the record high global LNG production. Katar, USA and Australia have record high LNG production. Consequently, the demand for OCTG products remain high. The LNG supplies ease the energy crisis especially in Europe to compensate the stopped Russian pipeline gas supplies.

Carbon Capture Utilisation and Storage (CCUS) is an upcoming interesting market for higher alloyed tubes. In CO2 capture and sequestration, carbon dioxide is separated from combustion gases and then stored indefinitely in deep underground layers of rock without a container. For deep drilling and transportation of CO2 into these deep underground layers of rock, increasing volumes of tubes and pipes are required. USA, China and Middle East are the centres for development following this technology. The project volumes of CCUS will achieve considerable volumes 2026 and the following years (Figure 16). CCUS refers to a suite of technologies that can play an important and diverse role in meeting global energy and climate goals. In addition to exploration activities, the need to build new pipeline routes has also increased since the ban on Russian pipelines to Europe and the strategy towards replacing natural gas by hydrogen. Globally a large quantity of pipelines is planned or announced to be built in the coming years up to 2027. A new market for hydrogen pipelines is upcoming (Figure 17). Particularly the US and Europe expect major growth in this segment. This development offers pipeline manufacturers of large-diameter pipes > 406 mm OD opportunities for interesting future business.

The automotive market, accounts for around 15% of the global tube and pipe market. With most car manufacturers and many of their suppliers now reporting that their production capacity is either no longer constrained by semiconductor shortages, overall car sales figures are rising - with global deliveries expected to reach 85.5 million units by the end of the year. As the macroeconomic outlook for the automotive industry deteriorates, a modest return to growth in new car sales of private and commercial vehicles is expected over the next two years. ABI Research forecasts global vehicle sales growth of 3.6% in 2024. Furthermore, car manufacturers can expect sales to exceed the 90 million units’ level again in 2025 (Figure 18). In terms of regional growth in vehicle sales, the following chart summarises these findings. According to IHS, the recovery process in the volume markets of Europe and North America anyhow will take longer. Future growth will primarily take place in Asia, particularly in China. However, China could increasingly become a sales problem for the western automotive industry due to the American decoupling tendencies and the strengthening local car industry in China. However, the tendency to further reduce the weight of vehicles supports the trend towards the use of tubular products. The transition to electromobility can also support the use of tubular components, as the additional weight of the batteries must be compensated as far as possible. The automotive industry offers many attractive applications for tubular products.

The greatest potential for the use of tubular products is seen in the vehicle frame, followed by the chassis and powertrain. Tube manufacturers will endeavour to enter new vehicle series with larger quantities in order to further expand their presence in the light vehicle industry.

Overall, the automotive industry faces the challenge of the transition to electromobility and the question how they can continue to serve markets in which electromobility cannot be introduced due to restrictions in the availability of electrical energy. Car manufacturers must therefore pursue all drive technologies to avoid losing major market potential. Environmentally friendly combustion technologies will continue to have their place. Political institutions, such as those in Europe, on the other hand, are setting deadlines to ban combustion technologies including green fuels. Present discussions may be understood that this paradigm may be opened again in favour of combustion engines with green fuel. In this area of conflict, the automotive industry, including its suppliers of tube products, must find suitable business approaches.

The mechanical engineering market segment, which accounts for around 9% of world tube and pipe production, has developed well in line with global GDP in recent years. During the financial- and corona crisis, the market was characterised by higher volatility with sharper declines and quick recoveries. In 2022, the current further recovery was slowed down by geopolitical circumstances. Asia, and China in particular, although increasingly reaching self-sufficiency are still the largest markets for machinery purchases. It remains noteworthy that the Chinese industry has taken the global lead in machinery sales since the Corona crisis.

Here, the decoupling intentions of the USA must be observed since this may become a game changer for the worldwide mechanical engineering industry. The USA and Europe continue to be significant sales regions as well. This market segment certainly has the greatest variety of tube products. Cylinder-, ball bearing- and turned part tubes, to name just a few prominent representatives of this market segment, certainly show interesting prospects for tube and pipe producers.

The construction market with about 5% of the global tube market presents another opportunity for pipe manufacturers with growth potential. Despite the challenging macroeconomic and geopolitical backdrop, the global construction industry managed to continue to generate growth momentum in 2023, with output rising by 3.4% in real terms (Figure 19). Much of this was owed to China’s surprisingly strong performance despite the prolonged real estate crisis there, which has significantly impacted investment in building activity. Construction in the US also picked up in the second half of 2023, which pushed global construction industry output growth excluding China to 2.0% in 2023. With interest rates remaining at a high level, new investment in the residential buildings sector has fallen sharply. This has particularly been the case across North America and Europe, where residential building permits have plummeted. The infrastructure, energy & utilities, and industrial sectors will be key drivers of construction output activity. There are also high levels of spending across areas related to the energy transition, with investment in renewable energy projects and in manufacturing plants to produce electric vehicles and components. The market penetration of structural tubes, as shown is quite unevenly distributed in the world and the growth pattern is greatly dependent on the regional GDP growth (Figure 20). European countries face week GDP growth, this in combination with cost increases for construction work, result in slow building activities. India and the USA on the other hand, based on their stronger GDP growth, report much more active building investments. China, one of the leading countries for construction works, presently is slowed down due to major real estate turbulences. Anyhow once these turbulences are under control again the potential for construction remains high.

In mid-term anyhow this market segment will offer again interesting opportunities also for Europe. North America and parts of Asia are widely using tubular products for structural buildings. Europe on the other hand still designs mostly with standard concrete or steel structures. The tube industry needs to further promote the benefits of tube applications and showcase the architectural perspectives. Tubular profiles are an ideal choice when visible structures are desired due to their varied shapes and closed cross-sections combined with smooth sides. Best mechanical properties and the possibility to bridge large spans are further highlights of tube profiles. Besides round shaped structural tubes, rectangular profiles are dominating architectural applications. Such profiles are normally cold rolled and formed in so-called turks-heads. In this process great attention must be given to the metallurgical properties of the edges. Normally unalloyed steel is applied, anyhow alloyed steels with its improved material properties should also be considered. Regarding the CO2 -footprint tubular profiles are of great advantage, since the applied steel can be produced from metal scrab in electric arc furnaces driven by green electrical energy. A recent study published by Global Construction Perspective and Oxford Economics, entitled “Global Construction 2030”, forecasts an 85% growth in global construction output to 15.5 trillion by 2030, with three countries, China, USA and India, leading the way and accounting for 57% of global growth alone. Europe, on the other hand, will reduce its pace of investment. There is room for additional production capacity for structural tubes, especially in India, to follow the market trend.

Most tube and pipe producers were able to report strongly improved economic figures in 2023. However, for European pipe producers, the persistently higher energy cost and the additional CO2 levies agreed to be imposed by the European Community represent major challenges. Confidence in being able to compete on the world market in the future with these additional costs is dwindling among some tube producers. Some tube producers even reduce their engagement in Europe as a consequence hereto.

New upcoming market segments such as carbon capture utilization and storage as well as hydrogen pipelines will start requiring larger tonnages of alloyed tubes and pipes in 2025 and thereafter. In general, there is enough production capacity to serve even the increased demand for tubes and pipes for all market segments. Anyhow the trend to produce close to the customers will have ongoing impact on the tube producer´s landscape. Raw material prices for the steel as well as the tube and pipe industry would seem to have peaked early 2023. Still markets are nervous with potential for further volatility.

Further challenge may be imposed, if political measures to prevent climate change are not introduced in a balanced way, with possible consequences being the migration of high energy consuming industries to lower-cost regions. Nonetheless, if the balance of supply and demand within the tubes and pipes industry is restored, price volatility can be expected to calm down.

The transition towards environmentally friendly tube production to produce carbon reduced tubes and pipes became increasingly a major task for the industry. Tube and pipe producers are converting their production facilities from gas to electricity. Simultaneously they improve their productivity, flexibility, and customer service. Innovative instruments such as Artificial Intelligence (AI) and Industry 4.0 are introduced in this context. So far AI has only been applied to analyse the enormous amount of data available to the industry, but self-learning AI solutions will further revolutionize the tubular industry.

Many technology suppliers have already reacted and enhanced their product portfolio with the addition of environmentally friendly and digital solutions.