Page 11 - ITAtube Journal 3 2024

P. 11

Market information

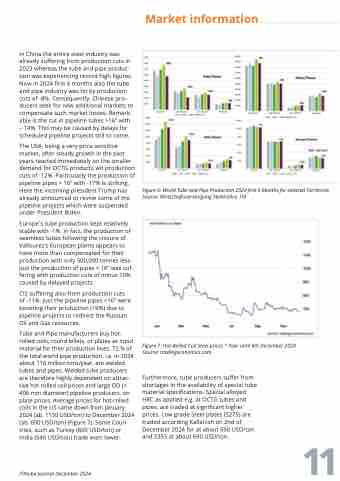

Figure 6: World Tube and Pipe Production 2024 first 6 Months for selected Territories

Source: Wirtschaftsvereinigung Stahlrohre, ITA

In China the entire steel industry was

already suffering from production cuts in

2023 whereas the tube and pipe produc-

tion was experiencing record high figures.

Now in 2024 first 6 months also the tube

and pipe industry was hit by production

cuts of -8%. Consequently, Chinese pro-

ducers seek for new additional markets to

compensate such market losses. Remark-

able is the cut in pipeline tubes >16” with

– 14%. This may be caused by delays for

scheduled pipeline projects still to come.

The USA, being a very price sensitive

market, after steady growth in the past

years reacted immediately on the smaller

demand for OCTG products wit production

cuts of -12%. Particularly the production of

pipeline pipes > 16” with -17% is striking.

Here the incoming president Trump has

already announced to revive some of the

pipeline projects which were suspended

under President Biden.

Europe´s tube production kept relatively

stable with -1%. In fact, the production of

seamless tubes following the closure of

Vallourec’s European plants appears to

have more than compensated for their

production with only 500,000 tonnes less.

Just the production of pipes > 16” was suf-

fering with production cuts of minus 10%

caused by delayed projects.

CIS suffering also from production cuts

of -11%. Just the pipeline pipes >16” were

boosting their production (+9%) due to

pipeline projects to redirect the Russian

Oil and Gas resources.

Tube and Pipe manufacturers buy hot-

rolled coils, round billets, or plates as input

material for their production lines. 72 % of

the total world pipe production, i.e. in 2024

about 116 million tons/year, are welded

tubes and pipes. Welded tube producers

are therefore highly dependent on attrac-

tive hot rolled coil prices and large OD (>

406 mm diameter) pipeline producers, on

plate prices. Average prices for hot-rolled

coils in the US came down from January

2024 (ab. 1130 USD/ton) to December 2024

(ab. 690 USD/ton) (Figure 7). Some Coun-

tries, such as Turkey (600 USD/ton) or

India (540 USD/ton) trade even lower.

Figure 7: Hot-Rolled Coil Steel prices 1 Year until 6th December 2024

Source: tradingeconomics.com

Furthermore, tube producers suffer from

shortages in the availability of special tube

material specifications. Special alloyed

HRC as applied e.g. at OCTG tubes and

pipes, are traded at significant higher

prices. Low grade Steel plates (S275) are

traded according Kallanish on 2nd of

December 2024 for at about 650 USD/ton

and S355 at about 690 USD/ton.

ITAtube Journal December 2024 11