Page 13 - ITAtube Journal 32022

P. 13

Market information

Figure 11: Growth rate of the producer price index in selected countries since 2018 (%),

Source: DJE, Refinitiv, The Pioneer

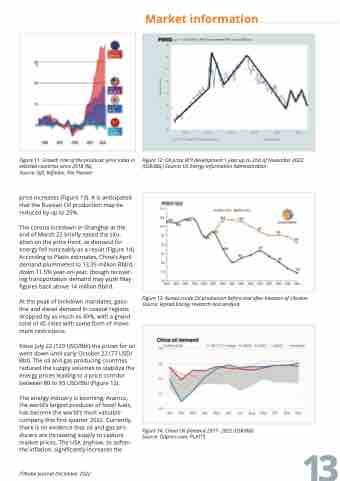

price increases (Figure 13). It is anticipated that the Russian Oil production may be reduced by up to 25%.

The corona lockdown in Shanghai at the end of March 22 briefly eased the situ- ation on the price front, as demand for energy fell noticeably as a result (Figure 14). According to Platts estimates, China’s April demand plummeted to 13.35 million Bbl/d, down 11.5% year-on-year, though recover- ing transportation demand may push May figures back above 14 million Bbl/d.

At the peak of lockdown mandates, gaso- line and diesel demand in coastal regions dropped by as much as 40%, with a grand total of 45 cities with some form of move- ment restrictions.

Since July 22 (120 USD/Bbl) the prices for oil went down until early October 22 (77 USD/ Bbl). The oil and gas producing countries reduced the supply volumes to stabilize the energy prices leading to a price corridor between 80 to 93 USD/Bbl (Figure 12).

The energy industry is booming, Aramco, the world’s largest producer of fossil fuels, has become the world’s most valuable company this first quarter 2022. Currently, there is no evidence that oil and gas pro- ducers are increasing supply to capture market prices. The USA anyhow, to soften the inflation, significantly increases the

ITAtube Journal December 2022

Figure 12: Oil price WTI development 1 year up to 21st of November 2022 (US$/Bbl,) Source: US Energy Information Administration

Figure 13: Russia crude Oil production before and after Invasion of Ukraine Source: Rystad Energy research and analysis

Figure 14: China Oil Demand 2017- 2022 (US$/Bbl) Source: Oilprice.com, PLATTS

13