Page 9 - ITAtube Journal 1 2024

P. 9

Market information

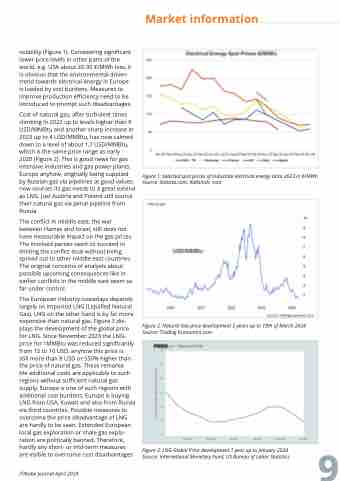

volatility (Figure 1). Considering significant lower price levels in other parts of the world, e.g. USA about 20-30 €/MWh less, it is obvious that the environmental driven trend towards electrical energy in Europe is loaded by cost burdens. Measures to improve production efficiency need to be introduced to prompt such disadvantages.

Cost of natural gas, after turbulent times climbing in 2022 up to levels higher than 9 USD/MMBtu and another sharp increase in 2023 up to 4 USD/MMBtu, has now calmed down to a level of about 1,7 USD/MMBtu, which is the same price range as early

2020 (Figure 2). This is good news for gas intensive industries and gas power plants. Europe anyhow, originally being supplied by Russian gas via pipelines at good values, now sources its gas needs to a great extend as LNG. Just Austria and Poland still source their natural gas via Jamal pipeline from Russia.

The conflict in middle east, the war between Hamas and Israel, still does not have measurable impact on the gas prices. The involved parties seem to succeed in limiting the conflict local without being spread out to other middle east countries. The original concerns of analysts about possible upcoming consequences like in earlier conflicts in the middle east seem so far under control.

The European industry nowadays depends largely on imported LNG (Liquified Natural Gas). LNG on the other hand is by far more expensive than natural gas. Figure 3 dis- plays the development of the global price for LNG. Since November 2023 the LNG- price for 1MMBtu was reduced significantly from 15 to 10 USD, anyhow this price is

still more than 8 USD or 550% higher than the price of natural gas. These remarka-

ble additional costs are applicable to such regions without sufficient natural gas supply. Europe is one of such regions with additional cost burdens. Europe is buying LNG from USA, Kuwait and also from Russia via third countries. Possible measures to overcome the price disadvantage of LNG are hardly to be seen. Extended European local gas exploration or shale gas explo- ration are politically banned. Therefore, hardly any short- or mid-term measures are visible to overcome cost disadvantages

ITAtube Journal April 2024

Figure 1: Selected spot prices of industrial electrical energy since 2023 in €/MWh Source: Statista.com, Kallanish, com

Figure 2: Natural Gas price development 5 years up to 19th of March 2024 Source: Trading Economics.com

Figure 3: LNG Global Price development 1 year up to January 2024 9 Source: International Monetary Fund, US Bureau of Labor Statistics